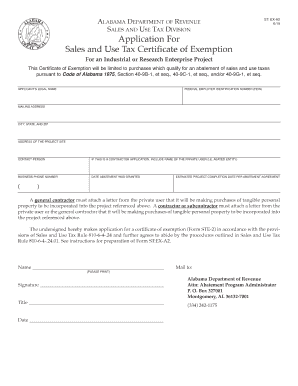

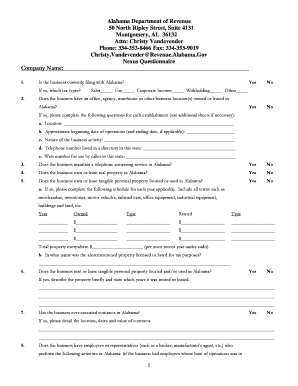

Obtain customizable Alabam tax Business Forms in our extensive online library. Browse for the relevant form, open it, and start adjusting it right away with DocHub free profile.

Your workflows always benefit when you can get all of the forms and documents you require at your fingertips. DocHub offers a huge selection of document templates to ease your everyday pains. Get a hold of Alabam tax Business Forms category and quickly find your document.

Begin working with Alabam tax Business Forms in a few clicks:

Enjoy fast and easy form managing with DocHub. Discover our Alabam tax Business Forms category and locate your form right now!