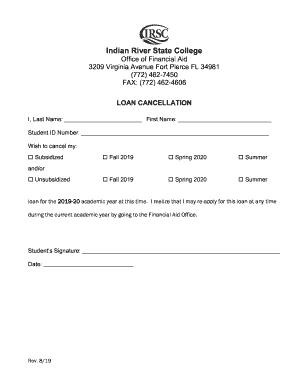

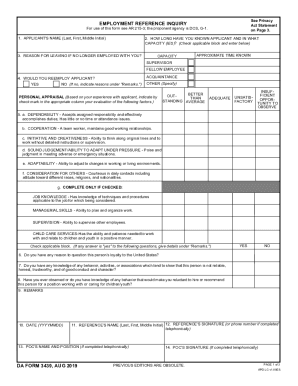

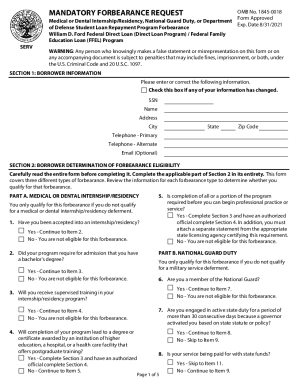

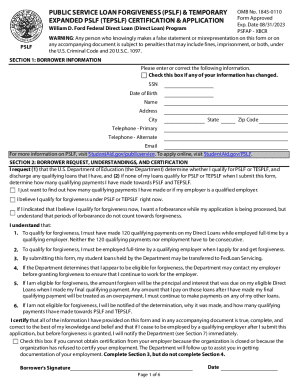

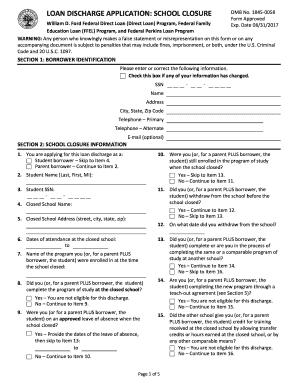

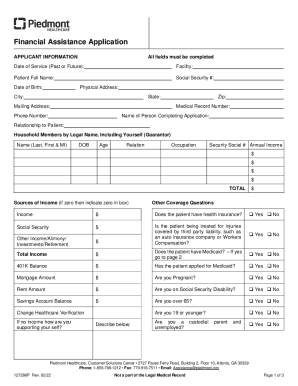

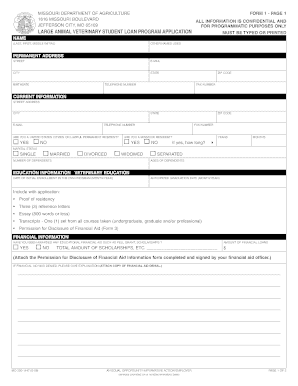

Locate and handle case-specific One time student loan debt relief Application Forms documents with DocHub. Complete, handle, and send your template without losing any relevant details along the way.

Papers managing takes up to half of your office hours. With DocHub, it is simple to reclaim your time and effort and increase your team's efficiency. Access One time student loan debt relief Application Forms category and check out all document templates relevant to your everyday workflows.

The best way to use One time student loan debt relief Application Forms:

Accelerate your everyday file managing with our One time student loan debt relief Application Forms. Get your free DocHub account today to explore all templates.