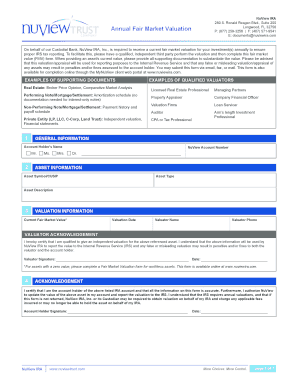

Gain access to ready-made customizable Ira Application Forms templates. Prepare and manage your templates on the go with DocHub adaptable online editor.

Your workflows always benefit when you can find all the forms and files you may need on hand. DocHub delivers a a large collection form templates to alleviate your day-to-day pains. Get hold of Ira Application Forms category and easily discover your document.

Begin working with Ira Application Forms in a few clicks:

Enjoy easy document administration with DocHub. Check out our Ira Application Forms online library and locate your form today!