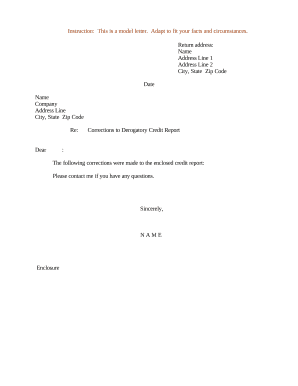

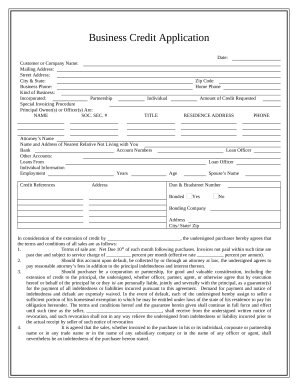

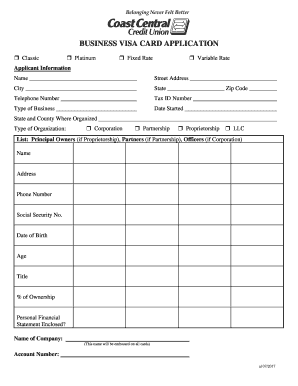

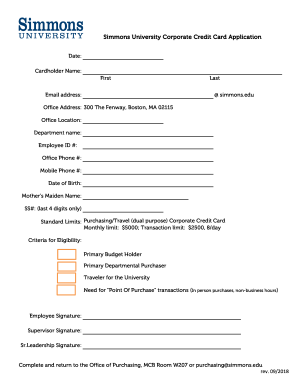

Preview and pick Business credit card Application Forms from our extensive template catalog. Enhance your document submission workflows with DocHub: edit, fill out, and securely store completed documents online.

Your workflows always benefit when you are able to get all of the forms and files you may need at your fingertips. DocHub gives a wide array of documents to ease your everyday pains. Get hold of Business credit card Application Forms category and quickly find your form.

Start working with Business credit card Application Forms in several clicks:

Enjoy easy form management with DocHub. Explore our Business credit card Application Forms collection and locate your form today!