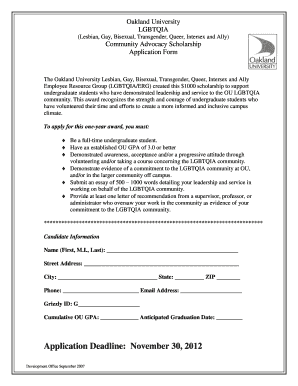

Browse numerous of modifiable and free Ally Application Forms with DocHub. Modify, fill, and invite other contributors to work together on your application forms in real-time.

Your workflows always benefit when you can easily find all of the forms and documents you need at your fingertips. DocHub delivers a vast array of document templates to ease your day-to-day pains. Get a hold of Ally Application Forms category and easily discover your form.

Start working with Ally Application Forms in a few clicks:

Enjoy fast and easy form managing with DocHub. Discover our Ally Application Forms collection and look for your form right now!