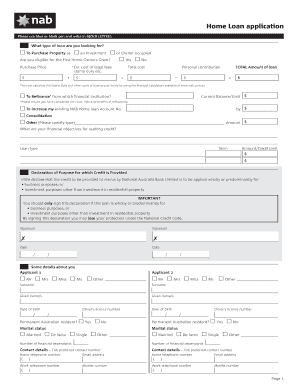

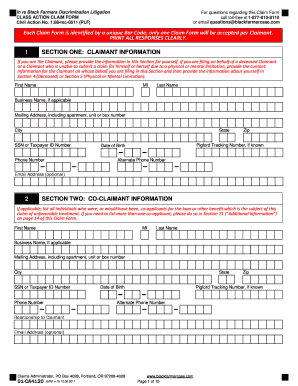

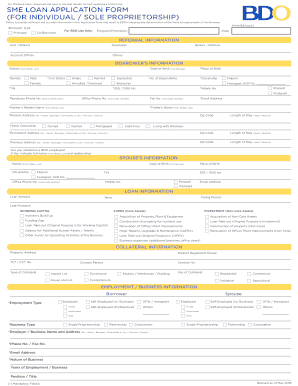

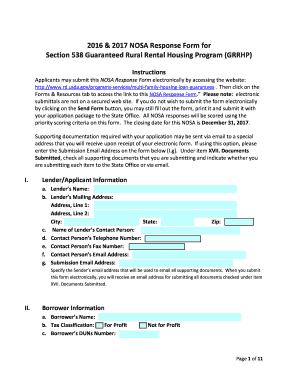

Discover and manage case-specific Agriculture loan Application Forms templates with DocHub. Fill out, handle, and distribute your form without losing any significant details along the way.

Your workflows always benefit when you can discover all the forms and files you will need on hand. DocHub delivers a a huge collection of templates to alleviate your everyday pains. Get a hold of Agriculture loan Application Forms category and easily discover your form.

Start working with Agriculture loan Application Forms in several clicks:

Enjoy fast and easy record administration with DocHub. Check out our Agriculture loan Application Forms online library and look for your form right now!