Definition and Purpose of Form 14

Form 14310, introduced in 2011, is an essential document for individuals interested in joining the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. These programs are initiatives by the IRS designed to help low- to moderate-income taxpayers, individuals with disabilities, and those with limited English proficiency with free tax preparation. The primary aim of Form 14310 is to collect personal information and consent from volunteers who wish to contribute to these community service programs.

Volunteers’ participation in the VITA/TCE initiatives not only supports fellow citizens in understanding tax complexities but also allows them to gain valuable experience in tax preparation and related financial matters.

How to Obtain Form 14

Acquiring Form 14310 is straightforward and can typically be accomplished via multiple channels. The IRS provides access to this form through their official website, allowing individuals to download it directly. Alternatively, those affiliated with VITA/TCE programs, such as program coordinators or IRS partners, may distribute the form during volunteer recruitment drives or training sessions.

Once obtained, ensure the form is the correct version for the 2011 tax season, as forms may undergo periodic updates or changes. Reviewing the version year is crucial to ensuring compliance with the appropriate IRS guidelines.

Steps to Complete Form 14

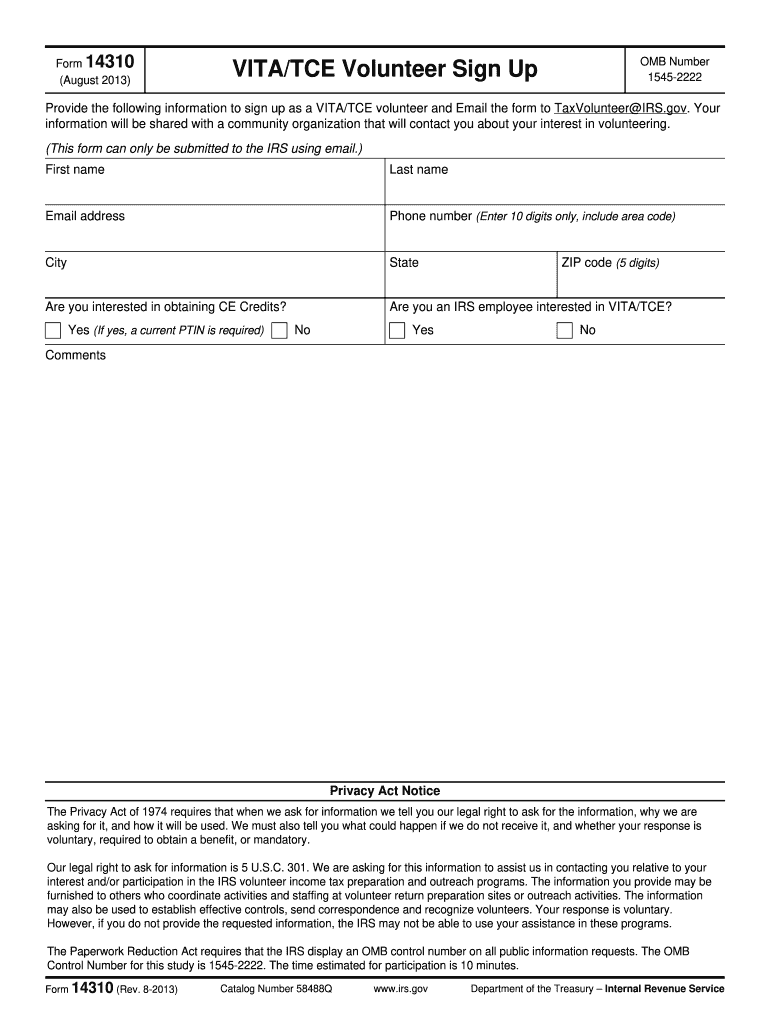

Filling out Form 14310 requires attention to detail. Here’s a step-by-step guide:

-

Personal Information: Start by entering your full name, address, and contact details. Pay attention to accuracy, as this information is crucial for your identification and communication purposes.

-

Experience and Education: Indicate your level of experience with tax preparation and whether you're interested in earning continuing education credits. This section helps align your skills and experiences with appropriate volunteer roles.

-

Availability: Specify your availability and preferences for participating in the program. This may include selecting the days and hours you can commit, ensuring efficient scheduling with program coordinators.

-

Consent and Privacy Notices: Carefully read all the privacy statements regarding the use of your personal information. Consent sections must be signed to participate, reflecting your understanding and agreement to the terms.

-

Submission: Submit the completed form to the designated program contact point, either via mail or electronically. Ensure all sections are filled and signed as required to avoid delays in processing.

Who Typically Uses Form 14

Form 14310 is mainly used by individuals eager to volunteer in tax preparation services under the VITA and TCE programs. These volunteer roles attract a diverse crowd, including college students, retired professionals, financial consultants, and anyone passionate about assisting others with tax-related matters.

The form is also utilized by community service organizations aiming to recruit volunteers to enhance their tax assistance and outreach efforts. By leveraging such diverse backgrounds, the programs aim to foster an inclusive environment for both taxpayers and volunteers.

Key Elements of Form 14

Several critical elements are highlighted within Form 14310 to ensure its optimal utility and compliance:

- Personal Information: Ensures proper identification and contact for further communication.

- Interest in Continuing Education: Appeals to individuals seeking to enhance their tax knowledge through educational credits.

- Privacy Notices: Informs the volunteer about how the IRS uses and protects the data provided.

- Consent: Critical for compliance, as it reflects the volunteer’s informed agreement to participate in the programs under stated terms.

Attention to these elements ensures that all necessary data is systematically collected and processed, benefiting both the volunteer and the administering program.

Legal Use of Form 14

Form 14310 is utilized legally to facilitate participation in IRS-sponsored volunteer programs, preserving the integrity and objectives of the VITA/TCE initiatives. Legal utilization implies:

- Authorization of Personal Data Use: By signing, individuals allow the IRS to use their data per stated privacy terms.

- Commitment to Volunteer Services: Volunteers agree to provide services in line with program standards and IRS regulations.

Legal compliance with the form requires signers to be fully aware of the conditions underpinning their involvement with these tax assistance programs.

IRS Guidelines for Form 14

The IRS provides specific guidelines regarding the use of Form 14310 to ensure effective and lawful implementation in the VITA/TCE programs:

- Eligibility and Inclusion: Volunteers must meet certain criteria, such as age and identification verification, to ensure inclusivity and mitigate unauthorised access.

- Training: Volunteers might be required to undergo IRS-approved training programs to equip them with necessary skills and adherence to standardized processes.

Guidelines also emphasize confidentiality and proper conduct, protecting both volunteer interests and taxpayer data confidentiality.

Filing Deadlines and Important Dates

Volunteering for the VITA/TCE programs aligns with the tax season timeline, compelling awareness of key dates associated with Form 14310:

- Volunteer Recruitment Period: Typically begins months before the tax season starts to ensure ample time for processing applications and training.

- Training and Orientation: Must be completed before the active start of the tax preparation window to ensure competency and readiness.

Understanding these critical timelines ensures smooth administrative flow and ample preparation for volunteers committed to assisting taxpayers effectively.