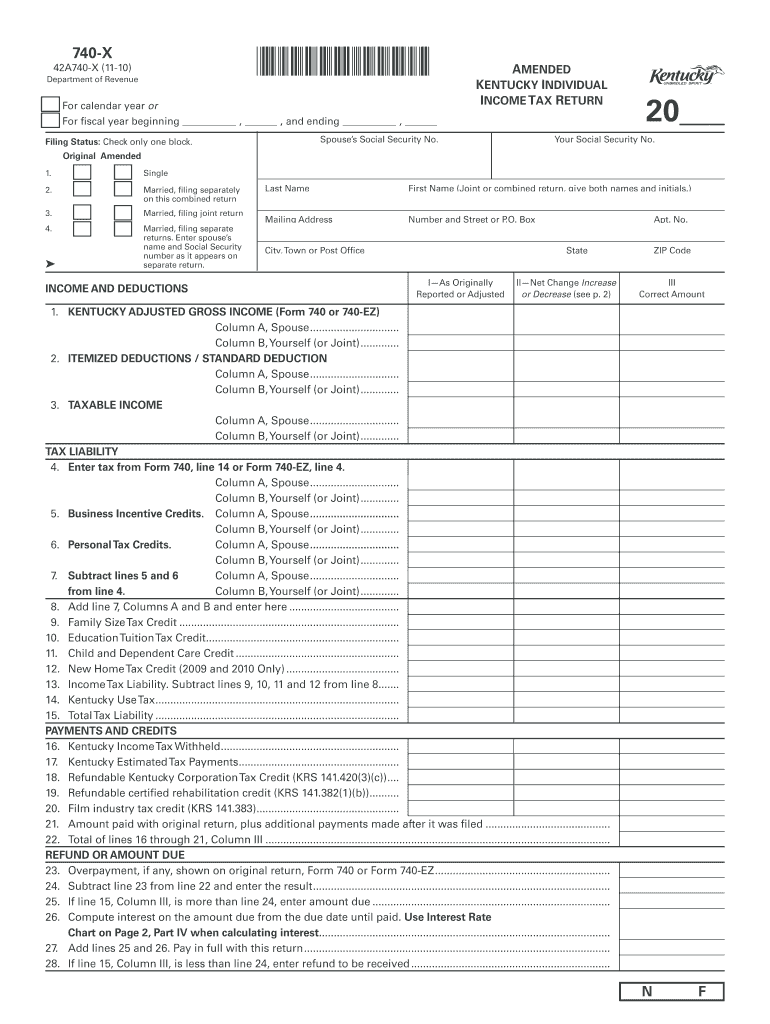

Definition and Meaning of Kentucky Form 740-X 2010

Kentucky Form 740-X for the year 2010 is an amended state individual income tax return. This form is utilized by taxpayers in Kentucky who need to correct or update information on a previously filed Form 740, the standard state tax return. Amendments might be necessary due to errors in the original filing, changes in income, or modifications in tax deductions and credits.

Key Elements of the Kentucky Form 740-X

- Personal Information: Similar to the original Form 740, this section requires entering personal details such as name, address, and Social Security number. It is critical to double-check that all personal information is correct.

- Changes in Income and Deductions: A comprehensive list of adjustments to previously reported income and deductions must be provided. This includes any new sources of income or additional deductions that were not reported in the original filing.

- Tax Liability and Credits: Calculate any changes in tax liability resulting from revised income or deductions. Also, list any additional tax credits for which you are eligible or need to adjust.

- Explanation of Changes: You must provide a detailed explanation for every change made. This narrative supports the numerical adjustments on the form and helps prevent processing delays.

Steps to Complete the Kentucky Form 740-X 2010

- Gather Documentation: Collect all original tax documents, new income statements, deductions, and any additional records that substantiate the changes you intend to make.

- Fill Out Personal Information: Start by entering your personal details as required for identification purposes.

- Report Adjustments: Carefully document any corrections to income, deductions, and credits originally reported. Ensure all figures are accurate and supported by documentation.

- Complete Calculations: Update your tax liability based on the corrected income and deductions. Use the tax tables for 2010 to determine the correct amount.

- Provide Narrative: Offer a clear explanation for each amendment, detailing why the original filing was inaccurate or incomplete.

- Review and Submit: Double-check all figures and narratives for accuracy. Inaccuracies can lead to delays or complications. Submit the completed form via your preferred method.

How to Obtain the Kentucky Form 740-X 2010

- Kentucky Department of Revenue Website: The form can typically be downloaded from the official Kentucky Department of Revenue website. Ensure the form version is for the year 2010.

- Mail Request: If online access is not possible, contact the Kentucky Department of Revenue to request a physical copy of the form be mailed to your address.

- Tax Preparation Software: Many tax software packages include state forms like the 740-X for various years, making them accessible if you use such software for filing.

Who Typically Uses the Kentucky Form 740-X 2010

Taxpayers in Kentucky who discover errors or omissions in their original 2010 Form 740 filing will use Form 740-X to amend their state tax return. This includes individuals who have:

- Found discrepancies in reported income due to missing documents or new information.

- Noticed incorrect deduction claims or missed credits that could reduce taxable income and increase potential refunds.

- Experienced changes in personal circumstances, such as marriage or dependency status changes, affecting tax situation.

Important Terms Related to Kentucky Form 740-X 2010

- Amended Return: A corrected tax return filed to adjust figures reported on a previously submitted return.

- Filing Status: The category that defines the type of tax return form you should use. It affects your tax rates and credits eligibility.

- Tax Liability: The total amount of tax owed to the state tax authorities.

- Tax Credits and Deductions: Financial breaks used to reduce taxable income or tax due. Credits often provide dollar-for-dollar reduction of tax owed.

Legal Use of the Kentucky Form 740-X 2010

Filing an amended return using the Form 740-X 2010 is a legal obligation if a taxpayer identifies that their original return was incorrect. Amending a return promptly can aid in avoiding interest and penalties associated with unpaid taxes due to underreporting or incorrect filings.

Filing Deadlines and Important Dates

Although there's generally no statute of limitations for correcting a state income tax return, it's best practice to file amended returns as soon as errors are identified. However, if a refund is anticipated, the amended return should be filed within two years after you paid the tax or three years from the date the original return was filed.