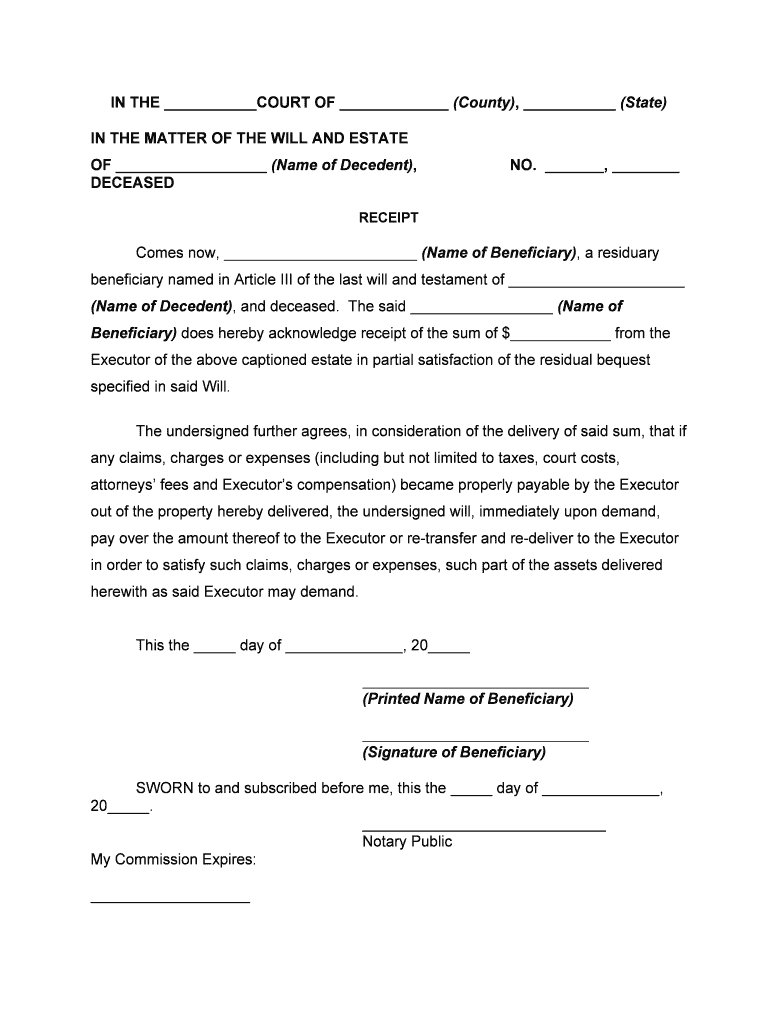

Definition and Meaning of a Receipt

A receipt serves as a written acknowledgment for a payment made. It details the transaction between the buyer and seller, confirming that a specified amount of money has been exchanged for goods or services. In a legal context, such as with estates, a receipt outlines the distribution of assets to beneficiaries, ensuring that all parties involved recognize and document the transaction clearly.

Key Components of a Receipt

- Date of Transaction: Indicates when the transaction occurred.

- Buyer and Seller Information: Contains the names and contact details of both parties.

- Description of Goods or Services: Lists the items or services provided.

- Total Amount Paid: Specifies the payment received.

- Payment Method: Documents how the payment was made (cash, check, credit card, etc.).

Understanding these key components is crucial for ensuring that both parties are on the same page regarding the transaction.

How to Use a Receipt

Using a receipt correctly involves several practical steps to ensure it fulfills its intended purpose, especially in formal or legal contexts.

Steps for Effective Receipt Use

- Create the Receipt: Utilize a template or software tool to generate a receipt that includes all necessary details.

- Provide a Copy: Ensure the buyer receives a copy for their records, which is essential for any future claims or disputes.

- Retain a Record: Keep copies of all receipts for bookkeeping and tax purposes.

This approach helps maintain accurate financial records and serves as proof of transactions for both parties, critical in case of discrepancies.

Key Elements of a Receipt

Understanding the essential elements of a receipt ensures accuracy and completeness in documentation. It not only facilitates smooth transactions but also serves crucial functions in various settings, particularly in legal and tax-related situations.

Essential Elements Explained

- Identification Numbers: Many receipts include serial numbers or transaction IDs for easy tracking.

- Tax Identification Numbers: In legal contexts, tax ID numbers may be necessary for beneficiaries to clarify their tax obligations.

- Signatures: Both parties might need to sign the receipt for validation, especially in formal transactions.

These components contribute significantly to the reliability and enforceability of the receipt.

Important Terms Related to Receipts

Familiarity with relevant terminology associated with receipts can enhance understanding and compliance, particularly in legal situations involving estate distributions.

Common Terms Defined

- Beneficiary: An individual or entity entitled to receive assets from an estate.

- Executor: The person responsible for overseeing the distribution of an estate per the will.

- Distribution Receipt: A document confirming that a beneficiary has received their share of the estate.

- Release and Receipt Forms: Legal documents where a beneficiary acknowledges receipt of their distribution and agrees to certain terms regarding the estate.

Grasping these terms is vital for navigating the legal or tax implications of receiving a payment or asset distribution.

Legal Use of a Receipt

Receipts play an essential role in legal contexts, especially concerning estate management and tax compliance. Their legal standing can affect various aspects of estate administration and beneficiary rights.

Legal Implications of Using a Receipt

- Proof of Payment: A receipt serves as legal evidence that a payment has been made, which can be crucial in disputes.

- Claims Against the Estate: Beneficiaries may need to provide receipts to support claims or to ensure they are not liable for estate debts.

- Tax Requirements: Receipt documentation is often required during tax filings, as it substantiates reported income or distributions.

Receiving and managing receipts correctly is important for beneficiaries to protect their rights and meet their legal obligations.