Understanding the Release Lien: Definition and Importance

A release lien is a legal document that formally acknowledges that a lien has been removed from a property or asset. This document is essential in real estate and construction contexts, where a lien is placed on a property as security for unpaid debts, such as contractor services or material costs. Once the debt is settled, the lienholder issues a lien release letter to signify that the property owner is no longer liable and the property is clear of any claims. This document is critical for protecting property rights and easing any barriers to selling or refinancing the property.

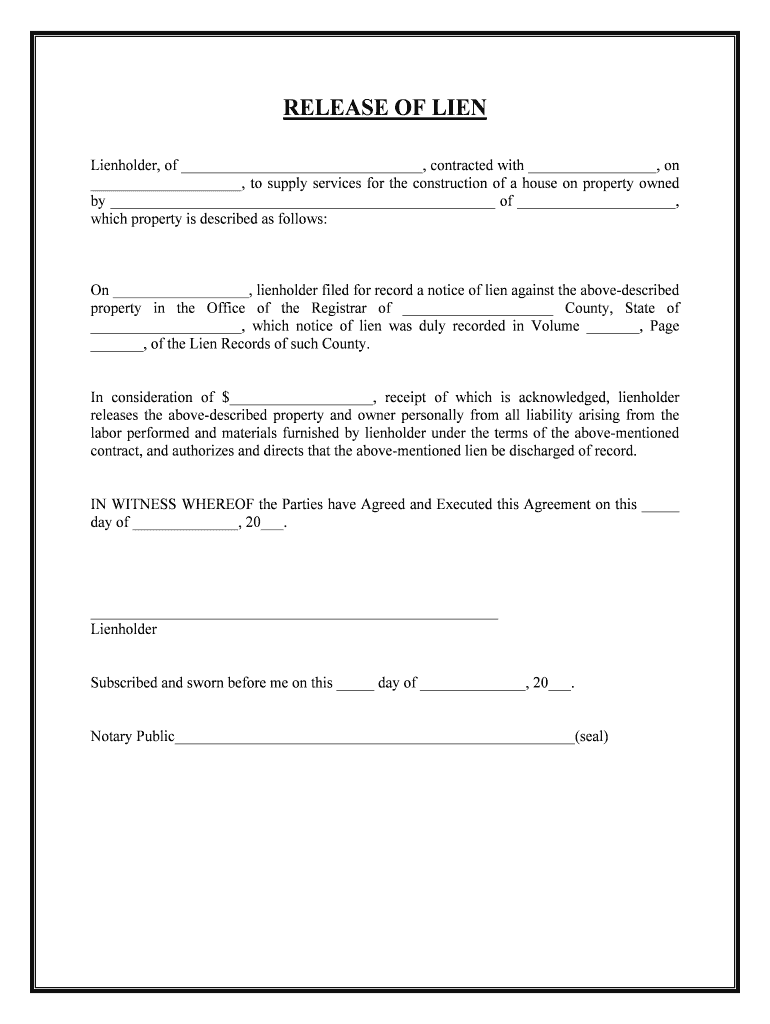

Essential Elements of a Release Lien

A release lien typically includes the following key elements:

- Property Information: Description of the property affected by the lien, including its address and any unique identifiers such as Parcel ID.

- Debtor Information: The name and details of the property owner or debtor responsible for settling the lien.

- Creditor Information: Identification of the lienholder or creditor who initially filed the lien.

- Statement of Release: A clear declaration that the lien is being released and no further claim to the property exists.

- Date of Release: The date on which the lien is formally released.

- Signature of the Lienholder: A signature or acknowledgment from the lienholder that validates the release.

The presence of these elements ensures that the release of lien is legally binding and recognized by relevant authorities.

Procedures for Using a Release Lien

Using a release lien involves a series of straightforward steps that can be completed efficiently with accurate documentation. Below is a structured process to facilitate the use of a release lien:

- Prepare the Necessary Documentation: Gather all essential documents, including the original lien statement, proof of payment or settlement, and any additional paperwork that supports the release process.

- Draft the Release Lien Document: Create the release lien using a template or legal format that includes all required details such as property description, debtor and creditor information, and the statement of release.

- Sign and Notarize: Ensure the lienholder signs the document and that it is notarized to validate the authenticity of the release.

- File the Release Lien: Submit the signed release lien to the appropriate county or state office where the original lien was recorded. This could typically be the county clerk’s office or the land records department.

- Obtain Confirmation: After filing, request a stamped copy of the filed release lien for your records. This confirmation serves as proof that the lien has been officially released.

Completing these steps correctly ensures that the release lien is properly documented and acknowledged, preventing future disputes over property claims.

Benefits of Releasing a Lien

Releasing a lien provides several benefits for property owners. These include:

- Improved Property Marketability: Clear title status enhances the ability to sell or refinance the property, as buyers and lenders prefer properties free of liens.

- Legal Protection: A properly executed release lien protects owners from possible legal claims against their property after the debt has been satisfied.

- Enhanced Cash Flow: Timely release of liens can free up valuable capital for property owners, allowing them to reinvest or utilize funds for new projects.

For contractors and service providers, issuing a lien release can also strengthen business relationships and enhance credibility with clients by demonstrating professionalism in handling financial obligations.

Who Uses the Release Lien

The release lien is commonly used by various parties involved in real estate transactions or construction agreements, including:

- Property Owners: Homeowners or real estate investors who have settled debts related to property improvements or sales.

- Construction Contractors: Builders and service providers who wish to secure payment for their work and formally acknowledge when the payment has been made.

- Mortgage Lenders: Financial institutions that hold security interests in a property and must issue a release upon debt repayment to clear the title for future transactions.

Each of these users must understand the importance of having a well-documented release lien to safeguard their financial and legal interests.

Legal Considerations Surrounding Release Liens

Release liens are governed by state laws that outline their execution, filing, and enforcement. Here are some key legal considerations:

- Compliance with State Laws: Each state may have specific requirements regarding the format, content, and filing procedures for release liens. Familiarity with local regulations ensures enforceability.

- Timeliness of Filing: Some jurisdictions require that liens be released promptly upon payment, while others may specify particular time frames for filing the release after the satisfaction of the debt.

- Potential Penalties for Non-Compliance: Failing to file a release lien can result in legal complications, including ongoing liability for the original lien and possible damage claims against the lienholder.

Understanding and adhering to these legal parameters are crucial for ensuring a smooth financial transition after a lien release.