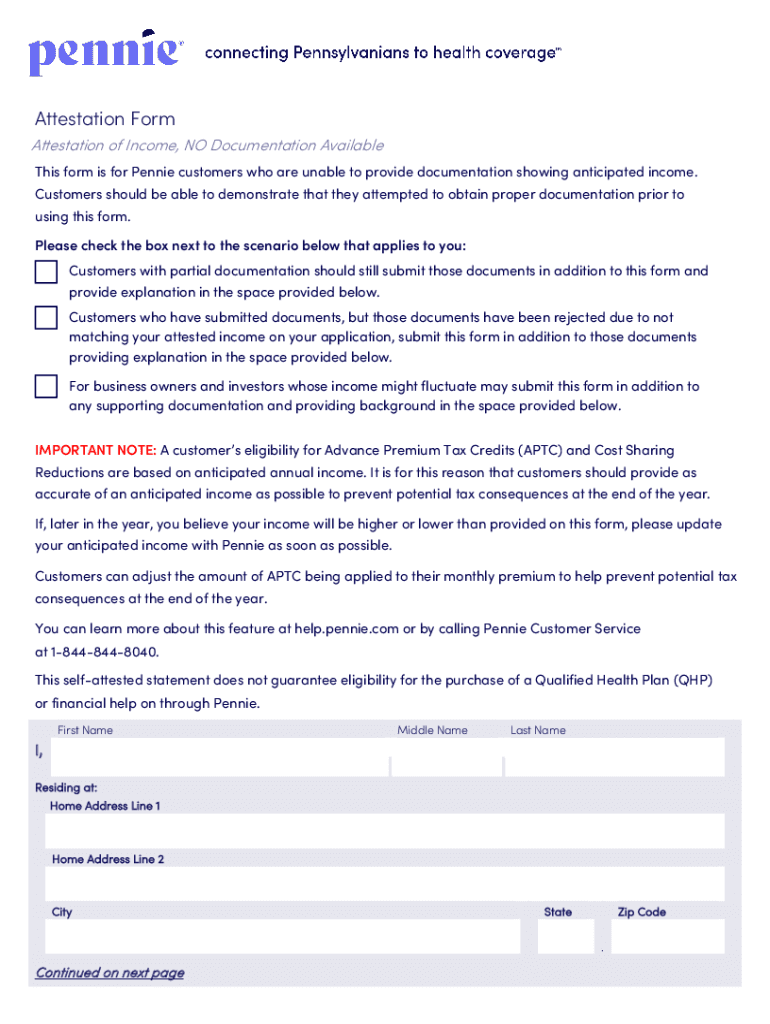

Definition & Purpose of the Pennie Self-Attestation Form

The Pennie Self-Attestation Form is a crucial document for individuals in Pennsylvania who may be unable to provide traditional documentation of their anticipated income. This form allows an individual to declare their income based on their personal estimation, a process known as self-attestation. It is designed to streamline access to health insurance options through the Pennie marketplace, ensuring that applicants can verify their income eligibility without the typical paper-based proof.

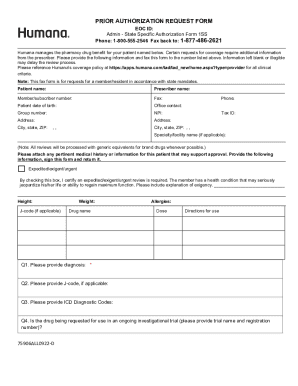

Components of the Form

- Applicant Information: Basic details such as name, address, and contact information.

- Income Declaration: Estimated total annual income and sources, such as wages, benefits, or freelance work.

- Attestation Statement: A legally binding statement affirming the accuracy of the declared information.

How to Obtain the Pennie Self-Attestation Form

Obtaining the Pennie Self-Attestation Form is a straightforward process. The form is typically accessible through the official Pennie website or can be requested from customer service via phone. Often, a downloadable PDF version is available for convenience. Additionally, applicants may receive the form directly if they initiate their health insurance application through Pennie and are identified as needing to complete self-attestation.

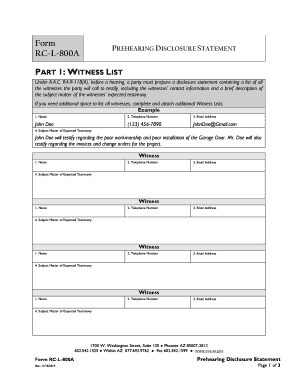

Steps to Complete the Pennie Self-Attestation Form

Completing the Pennie Self-Attestation Form involves several key steps:

- Download the Form: Access the form through Pennie’s online portal or request it from customer service.

- Fill Out Personal Information: Provide accurate personal details, including your address and contact information.

- Estimate Your Income: Carefully estimate and declare your expected annual income, providing the sources of this income.

- Review and Sign: Read the attestation statement carefully, then sign and date the form to certify its accuracy.

- Submit the Form: Submit the completed form to Pennie, either by uploading it through the online portal or mailing it to the address provided.

Common Mistakes to Avoid

- Misestimating income can lead a discrepancy in the final eligibility assessment.

- Omitting important contact information which can delay processing.

Why Is the Pennie Self-Attestation Form Important?

The Pennie Self-Attestation Form plays a significant role in opening up access to health insurance for those who may experience difficulties in obtaining traditional income documentation. It affords flexibility and ensures that temporary or non-conventional income scenarios do not impede an individual’s ability to obtain necessary health coverage.

Benefits of Use

- Accessibility: Enables individuals without standard documentation to affirm their eligibility.

- Simplification: Reduces the complexity of documentation requirements, expediting the application process.

Key Elements of the Pennie Self-Attestation Form

Understanding the key elements of the form is essential for successful completion:

- Accuracy in Income Declaration: Critical for determining premiums and potential subsidies.

- Signature and Date: Validates the form and confirms the legal attestation of the information provided.

- Fields for Correction: Includes sections to make necessary corrections easily and transparently.

Legal Implications of the Pennie Self-Attestation Form

Filling out the Pennie Self-Attestation Form accurately is legally binding. Providing false information can lead to severe consequences, including the loss of eligibility for insurance through Pennie and potential legal action.

Consequences of Misreporting

- Suspension of Coverage: Ineligibility for benefits if discrepancies are found upon review.

- Legal Liability: Potential for legal actions based on fraud or misrepresentation.

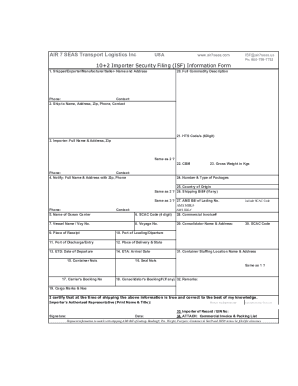

Examples and Real-World Scenarios

Consider individuals who freelance or work in gig jobs with variable income streams. These workers often find it challenging to provide consistent pay stubs or tax documentation. For them, the Pennie Self-Attestation Form represents an important mechanism to honestly represent their income and obtain necessary health benefits accordingly.

Case Study

- Freelancer with Variable Income: A graphic designer, whose earnings fluctuate monthly, uses the form to average out her projected income over a year, ensuring she remains eligible for assistance through Pennie.

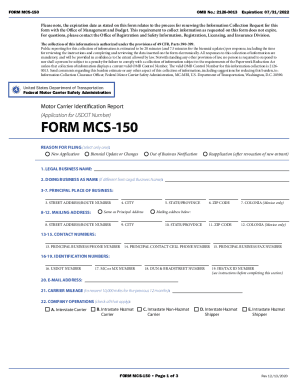

Application Process & Approval Time

Submitting the Pennie Self-Attestation Form is just one component of the broader application process for health insurance through Pennie. Once submitted, the form is reviewed alongside other application materials, and applicants typically receive a decision within a few weeks. This duration may vary based on the completeness and accuracy of the submitted information.

Tips for Fast Approval

- Complete All Sections Thoroughly: Ensure all required fields are filled and information is current.

- Timely Submission: Meeting self-attestation deadlines can significantly expedite processing times.

By taking full advantage of the Pennie Self-Attestation Form, applicants can securely and effectively manage their health insurance eligibility, catering to a diverse array of income situations. This tool not only facilitates smoother application processes but also underscores the flexibility and inclusivity of Pennsylvania’s healthcare marketplace.