Definition and Meaning of Buyer's Information Sheet

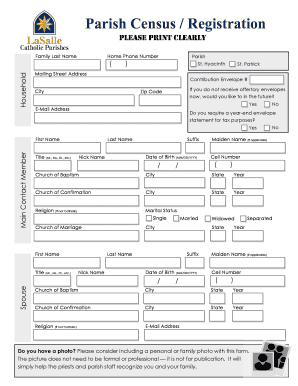

The buyer's information sheet is a critical document used in various transactions, primarily real estate, to gather essential details from prospective buyers. This form serves as a formal record that consolidates buyer-specific data, ensuring that all parties involved have access to the necessary information for the transaction's progression. It typically includes personal information, financial details, and specific preferences related to the property purchase.

Key Information Captured

- Personal Details: Full name, contact information, and Social Security number.

- Property Preferences: Desired location, type of property, and budget constraints.

- Financial Details: Income, current debts, and pre-approval status for loans.

Having a clear understanding of the buyer's information ensures smoother communication and transaction flow, enabling sellers and agents to cater to specific needs efficiently.

How to Use the Buyer's Information Sheet

Completing and utilizing the buyer's information sheet effectively involves several strategic steps. Properly leveraging this document is essential for ensuring that crucial information does not get overlooked.

Steps for Effective Use

- Fill Out Accurate Details: Buyers should ensure that all personal and financial information provided is up-to-date and accurate. This sets a transparent groundwork for future dealings.

- Review for Completeness: Double-check that no fields are left blank unless they are explicitly optional. Missing data might delay processing.

- Submit to Relevant Parties: Ensure that the sheet is submitted to the real estate agent or relevant parties handling the transaction promptly.

- Update as Needed: Should any significant changes occur, such as alterations in financial standings or personal contact details, the buyer's information sheet should be updated accordingly and re-submitted.

Proper use of the buyer's information sheet facilitates a streamlined transaction process, minimizing misunderstandings and errors.

Steps to Complete the Buyer's Information Sheet

Accurate completion of the buyer's information sheet is pivotal for maintaining clear and effective communication throughout the buying process. Here’s a detailed guide to assist buyers in this task.

Step-by-Step Guide

- Begin with Personal Information: Enter your full legal name, address, and contact details. This serves as the foundational data for the transaction.

- Financial Information Section: Provide details about your income, any current debts, and the status of any mortgage pre-approvals. This financial snapshot helps assess eligibility for property financing.

- Property Preferences: Specify any preferences concerning the type of property, neighborhood, or specific features desired. This assists agents in aligning listings with your expectations.

- Sign and Date the Document: After filling out all relevant sections, sign and date the sheet to confirm its authenticity and accuracy.

Ensuring all steps are diligently followed guarantees that the buyer's information sheet will be a reliable resource throughout the transaction.

Key Elements of the Buyer's Information Sheet

Understanding the core components of the buyer's information sheet enables users to appreciate its purpose and potential utility fully.

Core Components

- Personal Details: A segment dedicated to capturing the buyer's identity and personal background.

- Financial Overview: This section outlines financial capabilities and establishes credibility.

- Property Details: Identifies the buyer's specific interests and requirements in a property.

- Authorization and Signature: Confirms the buyer's acknowledgment and commitment to the document's content.

Recognizing these elements contributes to a more thorough and effective use of the buyer's information sheet within real estate transactions.

Who Typically Uses the Buyer's Information Sheet

The buyer's information sheet is not exclusive to one party but is used by various stakeholders within real estate transactions.

Typical Users

- Home Buyers: Primarily used by prospective homeowners to provide essential background information to sellers.

- Real Estate Agents: Unifies the data needed to present buyers with suitable property options.

- Mortgage Lenders: Evaluates financial information to assess loan eligibility and terms.

- Sellers: Understands potential buyer interest and qualifications, aiding in negotiation and decision-making.

By knowing who uses this form, individuals can better coordinate with these stakeholders for a seamless real estate process.

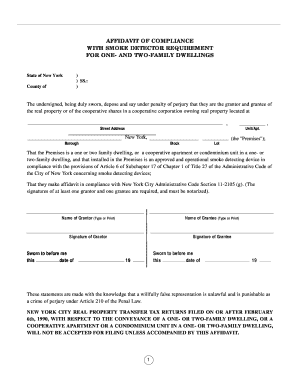

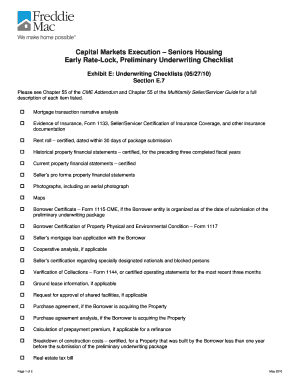

Legal Use of the Buyer's Information Sheet

Legal considerations surrounding the buyer's information sheet are integral to ensuring that all procedures comply with relevant laws and regulations.

Legal Considerations

- Privacy Policies: Buyers should be informed about how their data will be used and stored, in compliance with privacy laws like HIPAA and the Consumer Privacy Act.

- Disclosure Obligations: Both parties should disclose any information that could impact the transaction, such as changes in financial status or property conditions.

- Verification Requirements: Buyers may need to supply verification documents to substantiate the information provided on the sheet.

Adhering to these legal frameworks not only ensures compliance but also builds trust between parties.

State-Specific Rules for the Buyer's Information Sheet

Understanding that regulations can vary by state is crucial for those using the buyer's information sheet in the United States.

Variations by State

- Data Requirements: Certain states might require additional information or documentation compared to others.

- Regulatory Compliance: Each state has unique real estate regulations that can affect how information is collected, stored, and used.

- Documentation Rules: Varying rules regarding notarization or supplementary documentation could apply.

Familiarity with state-specific rules assists in avoiding legal pitfalls and ensures smoother transaction processes.

Common Challenges with Buyer's Information Sheets

Navigating the buyer's information sheet can present a few challenges. Being aware of these common issues can help buyers and agents mitigate them effectively.

Potential Issues

- Incomplete Information: Missing sections can delay transactions and readiness for loan processing.

- Errors: Mistakes in financial data can impact loan approvals and interest rates.

- Miscommunication: Lack of clarity or misunderstood entries can affect negotiations and overall buyer satisfaction.

Addressing these challenges with diligence ensures the buyer's information sheet effectively supports the buying journey.