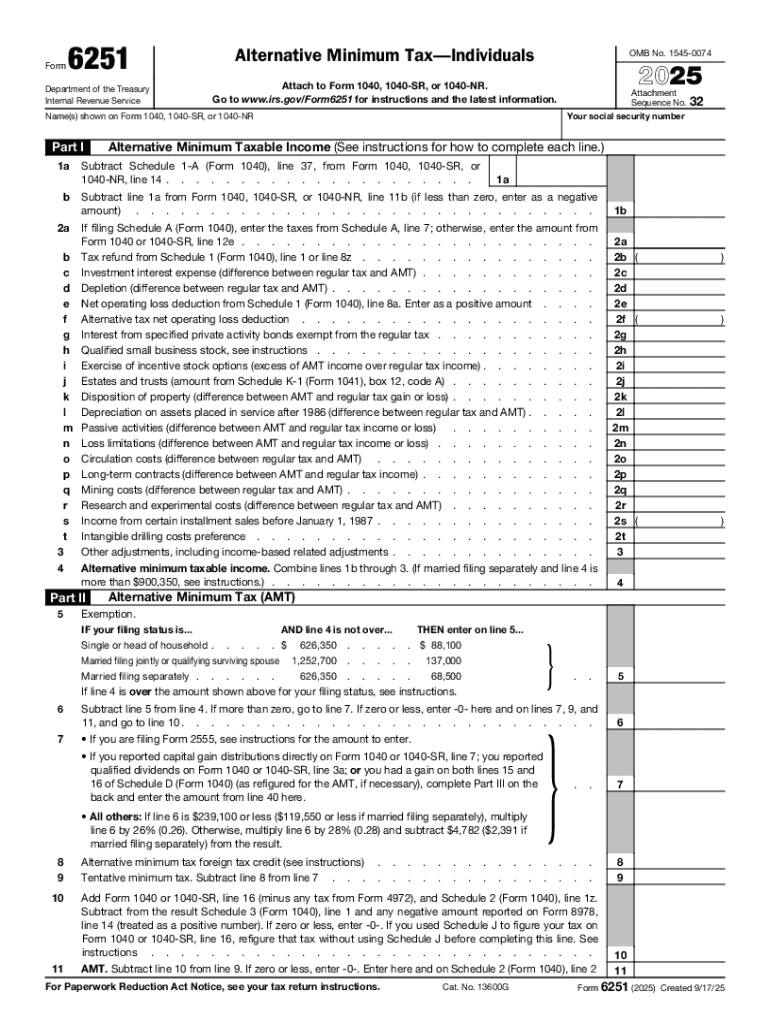

Definition and Meaning of Form 6251

Form 6251, also known as the Alternative Minimum Tax (AMT) form, is a document used by individuals in the United States to calculate whether they owe the AMT. This tax ensures that individuals who benefit from certain deductions pay a minimum amount of tax. It is attached to tax forms like Form 1040, 1040-SR, or 1040-NR when filing taxes with the IRS. The AMT is designed to ensure that high-income taxpayers cannot completely avoid paying taxes through deductions and credits.

How to Use Form 6251

To use Form 6251 effectively:

- Identify AMT Items: Determine if you have income or deductions that trigger the AMT. Common triggers include investment-related deductions and tax-exempt interest from private activity bonds.

- Compute Tentative Minimum Tax: Calculate your tentative minimum tax based on Form 6251. This involves adding back certain deductions to your taxable income.

- Compare with Regular Tax: Subtract your regular tax from the tentative minimum tax. If the tentative tax is higher, the difference is your AMT liability.

- Attach to Main Tax Form: Attach Form 6251 to your Form 1040, 1040-SR, or 1040-NR when submitting your return.

Steps to Complete Form 6251

Completing Form 6251 involves several detailed steps:

- Form Types Input: Enter information from Form 1040, 1040-SR, or 1040-NR.

- Adjust Taxable Income: Adjust your taxable income by adding specific preferences like excess depreciation and depletion.

- Calculate AMT Exemption: Use the exemption amount applicable to your filing status.

- Determine AMT: Subtract the exemption from the modified adjusted gross income and compute the tentative minimum tax using IRS tax rate schedules.

- Compare Tax Amounts: Compare the AMT with your regular tax. Report any additional amount as AMT liability.

Filing Deadlines and Important Dates

Adhering to filing deadlines is crucial:

- Regular Filing Deadline: By April 15, unless it falls on a weekend or holiday, extending the deadline to the next business day.

- Extension Date: If you file for an extension, the deadline is October 15.

- Quarterly Estimated Payments: For those required to make estimated payments, stay aware of the quarterly due dates to avoid penalties.

Legal Use of Form 6251

Form 6251 must comply with the ESIGN Act, making electronic signatures legally binding in the U.S. It's crucial for individuals and their accountants to ensure all details are accurately reported to avoid disputes or audits. The form ensures transparency in converting various income scenarios under the lens of AMT, preventing potential misuse of exclusions or deductions.

Examples of Using Form 6251

Real-world scenarios provide clarity on using Form 6251:

- Dual Income Stream: An individual earning high wages and substantial capital gains might need to file Form 6251 to check for AMT due to these triggers.

- Investment Income: Tax-exempt bonds can influence AMT calculation, requiring Form 6251 to correctly compute tax obligations.

- Multiple Deductions: Those with numerous itemized deductions must assess if these will result in an AMT liability.

Key Elements of Form 6251

Understanding the form’s critical components is vital:

- Part I - Adjustment and Preferences: Lists the items that need adjustment to calculate AMT.

- Part II - Total Tax Computation: Determines the AMT due by subtracting regular tax from the tentative minimum tax.

- Exemption Amounts: Specific to filing status and critical in lowering AMT liability for eligible taxpayers.

Penalties for Non-Compliance

Failing to file or incorrect filing can result in:

- Monetary Penalties: Interest on unpaid taxes and potential penalties for late filing.

- Increased Scrutiny: Higher likelihood of audits due to inaccurate or omitted AMT calculations.

- Legal Repercussions: Persistent non-compliance may lead to civil penalties or, in severe cases, more stringent legal action.

IRS Guidelines for Form 6251

Adhere to IRS guidelines:

- Instructions for Form 6251: Available on the IRS website, providing comprehensive guidance.

- AMT Guidelines: Details on how to determine applicable triggers and calculations.

- Regular Updates: Stay informed on legislative changes impacting the AMT to ensure compliance.