Definition & Meaning

The "Top Eight Tax Tips about Deducting Charitable Contributions" provides taxpayers with strategic insights into optimizing their charitable deductions on federal tax returns. These tips are designed to clarify how charitable contributions can be itemized to reduce taxable income, as defined by the IRS, thereby potentially lowering overall tax liability.

Key Concepts

- Charitable Contributions: These are donations made to qualified organizations that may be tax-deductible.

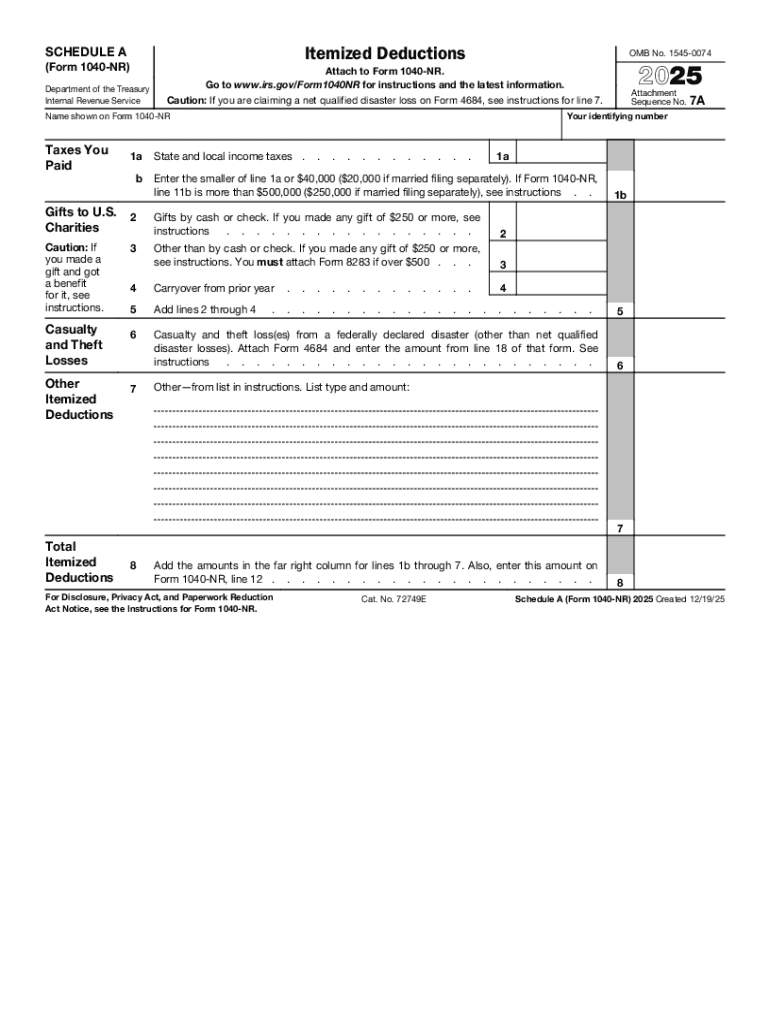

- Itemized Deductions: Taxpayers can choose to itemize deductions on Form 1040 Schedule A to include charitable contributions, instead of taking the standard deduction.

Practical Implications

Understanding these tax tips shows taxpayers how to maximize their deductions, manage tax responsibilities effectively, and comply with IRS regulations. By grasping the specific nuances of these tax tips, individuals can ensure they are adhering to guidelines and potentially increasing their tax savings.

IRS Guidelines

Adhering to IRS guidelines is critical when deducting charitable contributions. The IRS requires that taxpayers keep accurate records of all charitable contributions, including receipts and acknowledgment letters from the charitable organizations.

Important IRS Rules

-

Contribution Limits: Generally, the deduction for charitable contributions cannot exceed 60% of a taxpayer's adjusted gross income (AGI), although lower limits may apply based on the type of contribution and organization.

-

Documentation: For contributions of $250 or more, a written acknowledgment from the charity is required. For all cash donations, maintaining a bank record or written communication is necessary.

-

Qualified Organizations: Only donations to qualified non-profit organizations are deductible. IRS Publication 78 lists eligible organizations.

Key Elements of Charitable Deduction Tips

Understanding the core components of these tips is essential for maximizing tax benefits while staying within legal requirements.

Critical Elements to Consider

-

Cash vs. Non-Cash Donations: Different rules apply to cash contributions versus non-cash items, with special considerations for fair market value determinations and appraisal requirements.

-

Timing of Donations: Contributions are deductible in the year made. Cash or check donations are considered paid when mailed, and credit card donations are deductible when charged.

-

Substantiation and Valuation: Accurate valuations of non-cash donations and proper substantiation, including photos or appraisals, are crucial for IRS compliance.

How to Use the Tips

To effectively use these tax tips, taxpayers should integrate them into their annual tax planning strategy.

Step-by-Step Utilization

-

Identify Eligible Contributions: Review financial records to identify donations made to qualifying organizations.

-

Choose Deductions: Decide whether to take the standard deduction or itemize, considering potential savings.

-

Organize Documentation: Gather all necessary paperwork, including receipts, acknowledgment letters, and valuations for non-cash contributions.

-

Consult Professionals: When in doubt, consult with a tax professional or financial advisor to ensure compliance and accuracy.

Examples of Effectively Using Charitable Deduction Tips

Exploring practical scenarios provides clarity on how these tips can be applied in real-life situations.

Real-World Scenarios

-

High-Income Taxpayers: A high-income individual maximizes their tax savings by exceeding the standard deduction with charitable contributions. They strategically plan their cash and stock donations to align with the actual tax year and keep detailed records.

-

Small Business Owners: A small business owner donates surplus inventory to local charities, ensuring they receive appraisals and acknowledgment letters. By accurately reporting these on their tax return, they effectively reduce their taxable business income.

State-Specific Rules and Considerations

Taxpayers must be aware of varying state regulations regarding charitable contributions, as some states have unique rules that differ from federal guidelines.

State Differences

-

State Deductions: Not all states allow itemized deductions that mirror federal deductions. Taxpayers need to consider state-specific tax laws and potential alternative state-level credits for charitable contributions.

-

Local Charities: Some states encourage donations to state-specific organizations by offering additional tax incentives, which may influence donation decisions.

Required Documents for Deducting Charitable Contributions

Having the correct documentation is crucial for substantiating deductions and ensuring compliance with tax laws.

Essential Documents

- Receipt or Letter: Must include the donation amount and may need to specify that no goods or services were received in exchange for the contribution.

- Appraisals for High-Value Items: If the fair market value of donated property exceeds specific IRS thresholds, an appraisal is needed.

- Bank Statements: For cash donations, bank statements must reflect the transaction as evidence of the deductible contribution.

By understanding and implementing "Top Eight Tax Tips about Deducting Charitable Contributions", taxpayers can efficiently navigate the complexities of federal taxation related to philanthropic efforts. These insights allow individuals and businesses to take advantage of potential tax savings while maintaining adherence to IRS regulations.