Definition & Meaning

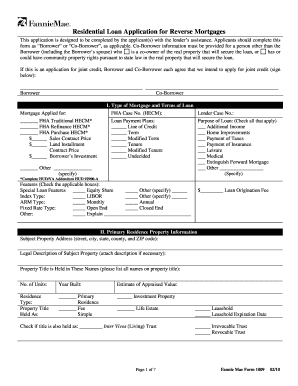

The OPCF 38 form serves as an essential document in the realm of automobile insurance, specifically addressing coverage limits for electronic accessories and equipment that are not installed by the manufacturer. This form functions as an amendment to existing insurance policies, thereby altering the terms regarding coverage for such items. Under the OPCF 38 endorsement, insurers typically agree to cover up to $1,500 for loss or damage to these non-factory-installed electronic components, such as aftermarket sound systems or navigation devices. The document also specifies applicable deductibles, ensuring both policyholders and insurers have clarity on the financial responsibilities associated with these items.

Key Elements of the OPCF 38

Several fundamental components characterize the OPCF 38, making it a crucial addition to automobile insurance policies. Primarily, the form delineates which electronic accessories and equipment are eligible for coverage. This includes a variety of items, such as audio systems, GPS units, and other electronic devices not originally part of the vehicle's construction. The OPCF 38 also describes the maximum coverage limit of $1,500, laying out the financial threshold insurers will adhere to. Furthermore, the document incorporates definitions and descriptions of various types of covered equipment to eliminate any ambiguity.

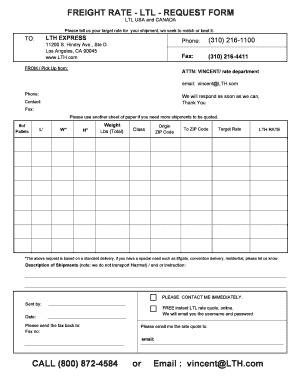

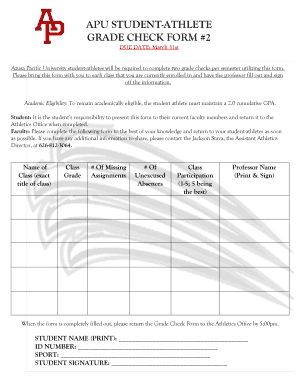

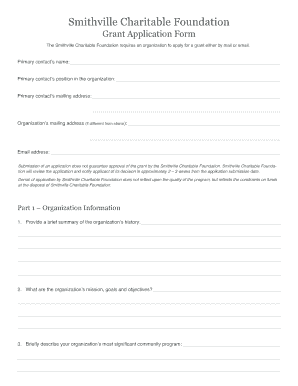

Steps to Complete the OPCF 38

Completing the OPCF 38 form involves a series of methodical steps to ensure policyholders receive the appropriate coverage. Initially, individuals should review their existing automobile insurance policy to verify current terms related to electronic accessories. Subsequently, they can request the OPCF 38 endorsement from their insurer. Upon receipt, the form requires accurate detailing of all non-factory-installed equipment the policyholder wishes to insure. It is crucial to provide thorough descriptions and valuations of these items. Lastly, returning the completed document to the insurance provider finalizes the inclusion of the OPCF 38 into the policy.

Legal Use of the OPCF 38

The OPCF 38 form complies with legal standards and regulations surrounding automobile insurance policies. It ensures policyholders have an avenue to extend their coverage to aftermarket electronic accessories and equipment, which are often excluded under standard automobile insurance policies. By incorporating the OPCF 38, insurers are legally binding themselves to cover the agreed value for the specified items. This legal framework provides an extra layer of financial protection for policyholders, safeguarding their investment in additional vehicle enhancements.

Important Terms Related to OPCF 38

Several critical terms are associated with the OPCF 38, each contributing to a comprehensive understanding of the form. "Non-factory-installed equipment" refers to all electronic accessories added to a vehicle after its original purchase. The "coverage limit" signifies the maximum amount the insurer will pay for a claim on these items, typically capped at $1,500 under the OPCF 38. "Deductible" is another significant term, indicating the initial amount a policyholder must pay out-of-pocket before the insurance coverage applies.

Examples of Using the OPCF 38

There are numerous scenarios in which the OPCF 38 form proves invaluable to vehicle owners. For instance, consider a car enthusiast who installs a high-end sound system into their vehicle. Without the OPCF 38 endorsement, damages to this aftermarket system might not be covered under a standard policy. Similarly, a driver who adds a sophisticated navigation system would benefit from this form, ensuring they receive compensation if the device suffers loss or damage. Such examples illustrate the practical application of the OPCF 38 in protecting additional automobile investments.

Digital vs. Paper Version of the OPCF 38

Both digital and paper versions of the OPCF 38 form are available to policyholders, each offering distinct advantages. The digital version provides a convenient and eco-friendly alternative, allowing users to complete and submit the form electronically. This method is particularly advantageous for those who prefer managing documents online or through cloud-based storage solutions. Conversely, the paper version may appeal to individuals who prefer traditional documentation methods or require physical copies for their records. Both versions ensure that the necessary information is conveyed accurately to the insurer.

Form Submission Methods (Online / Mail / In-Person)

Policyholders have multiple avenues for submitting the OPCF 38 form, depending on their preferences and the insurer's available options. An online submission provides the quickest and most convenient method, especially for tech-savvy users who value immediacy and efficiency. Alternatively, mailing the completed form offers a more traditional approach, suited to individuals who prefer handling physical documents. Lastly, in-person submissions are an option for those who wish to interact directly with their insurance provider, allowing any questions or concerns to be addressed immediately. Each method upholds the importance of ensuring that amendments to the policy are processed correctly and efficiently.