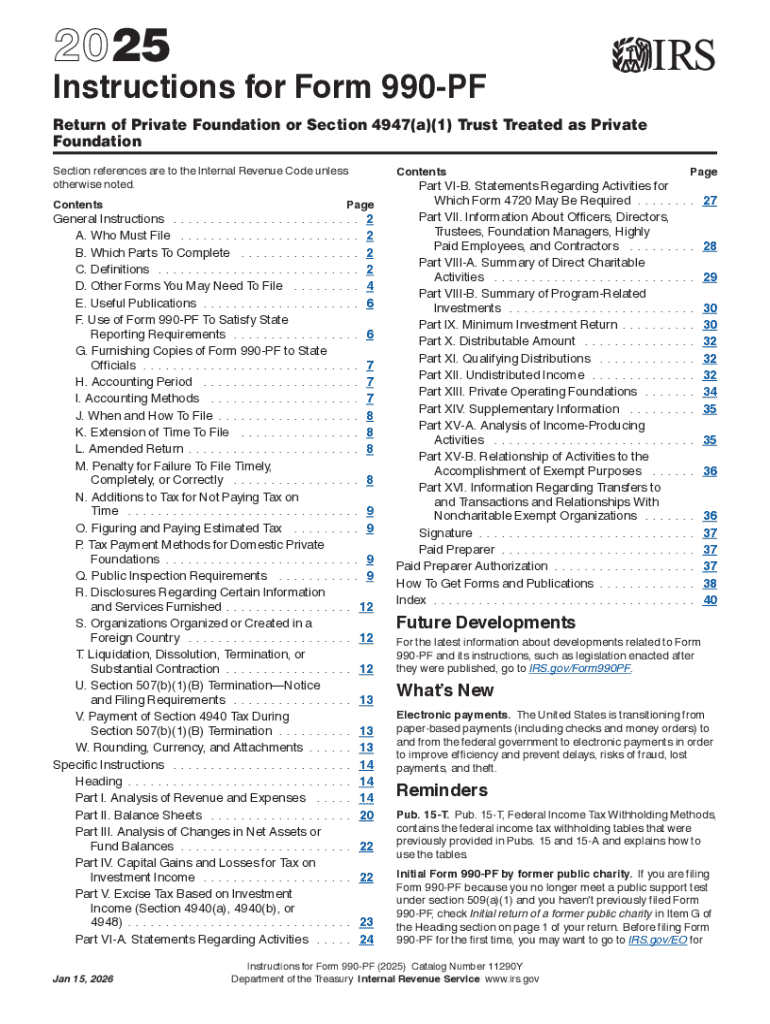

Understanding the 2025 Instructions for Form 990-PF

The 2025 Instructions for Form 990-PF provide guidance for completing the Form 990-PF, also known as the Return of Private Foundation or Section 4947(a)(1) Trust Treated as Private Foundation. These instructions are vital for private foundations and certain section 4947(a)(1) trusts to ensure compliance with the Internal Revenue Code when filing their annual returns with the IRS.

How to Obtain the 2025 Instructions for Form 990-PF

The instructions can be accessed through the official IRS website, providing comprehensive guidance for the accurate completion of the form. Alternatively, they can be obtained from tax professionals, accounting software platforms, or document management services like DocHub, which facilitate online document editing and filing processes.

Steps to Complete the 2025 Form 990-PF

- Gather Required Information: Compile financial data, including total assets, revenue, and expenses, as well as distributions and charitable activities for the reporting period.

- Download the Form: Ensure you have the latest version of Form 990-PF from the IRS website.

- Complete the Form: Accurately fill out all sections of the form, referencing the 2025 instructions for guidance on specific fields.

- Review for Accuracy: Double-check all entries to avoid errors that could result in penalties.

- Submit the Form: File electronically via the IRS’s e-file system or by mail if necessary. Verify submission guidelines and deadlines.

Important Terms Related to Form 990-PF

- Private Foundation: A non-profit organization typically funded by a single source, such as an individual or family, that uses its resources to support charitable activities.

- Section 4947(a)(1) Trust: A type of non-profit trust treated similarly to private foundations for tax purposes.

- Charitable Distribution: Funds distributed by a foundation to support charitable programs or activities, essential for maintaining tax-exempt status.

IRS Guidelines for Form 990-PF

The IRS provides specific guidelines regarding the reporting requirements for private foundations. These include maintaining detailed financial records, distributing at least five percent of net assets annually, and avoiding impermissible transactions to preserve tax-exempt status.

Filing Deadlines and Important Dates

Form 990-PF must be filed by the 15th day of the 5th month after the end of the organization’s accounting period. For example, if the fiscal year ends on December 31, the form must be filed by May 15 of the following year. Extensions may be available upon request.

Penalties for Non-Compliance

Failing to file Form 990-PF or filing late can result in significant penalties. These may include fines calculated based on the foundation’s net assets and potential additional scrutiny from the IRS, which could jeopardize the organization’s tax-exempt status.

Digital vs. Paper Version of Form 990-PF

While both digital and paper versions of Form 990-PF are available, electronic filing is encouraged by the IRS. E-filing reduces errors, facilitates faster processing, and may integrate seamlessly with document platforms like DocHub for enhanced productivity.

Eligibility Criteria for Filing Form 990-PF

All organizations classified as private foundations, as well as certain section 4947(a)(1) trusts, must file Form 990-PF annually. The form ensures transparency in their financial activities and compliance with relevant tax regulations.

Business Entity Types Using Form 990-PF

Private foundations, trusts, and philanthropic entities primarily use Form 990-PF. These entities utilize the form to report their financials, governing expenditures, and other activities aimed at achieving charitable goals.