Definition and Purpose of the ASIC Auditor Registration

The "BApplicationb for registration as an auditor - ASIC," officially known as Form 903AA, is a critical document required for individuals seeking to register as auditors under the Corporations Act 2001 in Australia. This form acts as a comprehensive application through which applicants provide essential personal information, outline their professional qualifications, secure residency status proof, and disclose any past disciplinary actions. The form ensures that auditors meet the requirements set by the Australian Securities and Investments Commission (ASIC) to uphold the integrity and trustworthiness of auditing practices. This registration is crucial for maintaining public confidence in the financial disclosures of corporations.

Eligibility Criteria for Auditor Registration

- Professional Qualifications: Applicants must have relevant formal qualifications in accounting or auditing fields, ensuring they possess the technical expertise necessary for the role.

- Experience: Demonstrable practical experience in auditing is required, often measured in years working under a registered auditor or within an auditing practice.

- Residency Status: Proof of residency or eligibility to work in Australia is mandatory to ensure compliance with national employment standards.

- Good Character: A clean professional history, free from disciplinary actions, is critical. Applicants must provide evidence or declarations regarding their professional conduct.

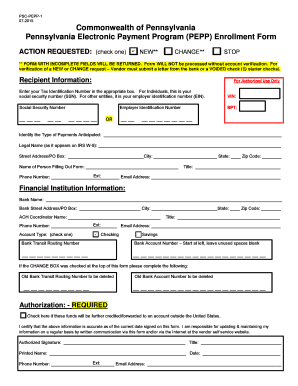

Steps to Complete the ASIC Auditor Registration

- Gathering Required Documents: Collect personal identification, academic qualifications, proof of residency, and any documents related to previous professional conduct.

- Filling Out the Form 903AA: Complete all sections of the form, providing accurate and up-to-date information about professional qualifications and experience.

- Verification of Information: Review the form meticulously to ensure all information and accompanying documents are correct, as false information can lead to rejection.

- Submission: Submit the completed form and all required documents to ASIC, either through their online portal or via mail, following their specific submission guidelines.

Required Documents for the Application

- Identification: Passport or other government-issued ID proving identity and residency.

- Professional Certificates: Copies of academic and professional qualifications.

- Experience Verification: Letters or documents from previous employers verifying relevant experience in auditing.

- Character References: Statements or references attesting to the applicant's professional integrity and ethical conduct.

Legal Implications of Auditor Registration

Registered auditors must adhere to stringent ethical and professional standards set forth by ASIC. Non-compliance can lead to sanctions, including fines, revocation of registration, or legal actions. Maintaining an up-to-date registration is essential, and auditors are required to uphold transparency and accountability in all financial audits. The registration also facilitates the recognition of an auditor as competent to assess and verify financial statements of corporations in Australia, ensuring compliance with legal and regulatory requirements.

Key Elements of the ASIC Auditor Registration Form

- Personal Information: Includes full name, contact details, and residency status.

- Professional Background: Detailed information on education, relevant training, and experience in the auditing field.

- Declaration: A signed statement affirming that all information is true and acknowledging the legal obligations of holding a registration as an auditor.

Potential Penalties for Non-Compliance

Non-compliance with ASIC's auditor registration requirements can result in various penalties:

- Fines: Financial penalties for providing incorrect information or failing to maintain standards.

- Revocation of Registration: Loss of the ability to practice as a registered auditor.

- Legal Consequences: Potential legal proceedings for severe breaches, impacting career and reputation.

Submission Methods and Tips

- Online Submission: Preferred method, allowing for faster processing and confirmation of receipt through ASIC's portal.

- Mail Submission: Requires careful packaging of documents and tracking for assurance of delivery.

- In-Person Submission: May be available for those close to ASIC offices, offering direct confirmation of receipt.

Use Cases and Examples

- Corporate Auditors: Individuals seeking to audit the financial statements of medium to large enterprises.

- Consulting Firms: Partners or senior associates in consulting firms focusing on financial audits.

- Independent Practitioners: Sole practitioners aiming to offer auditing services under their name to various business entities.