Definition and Meaning

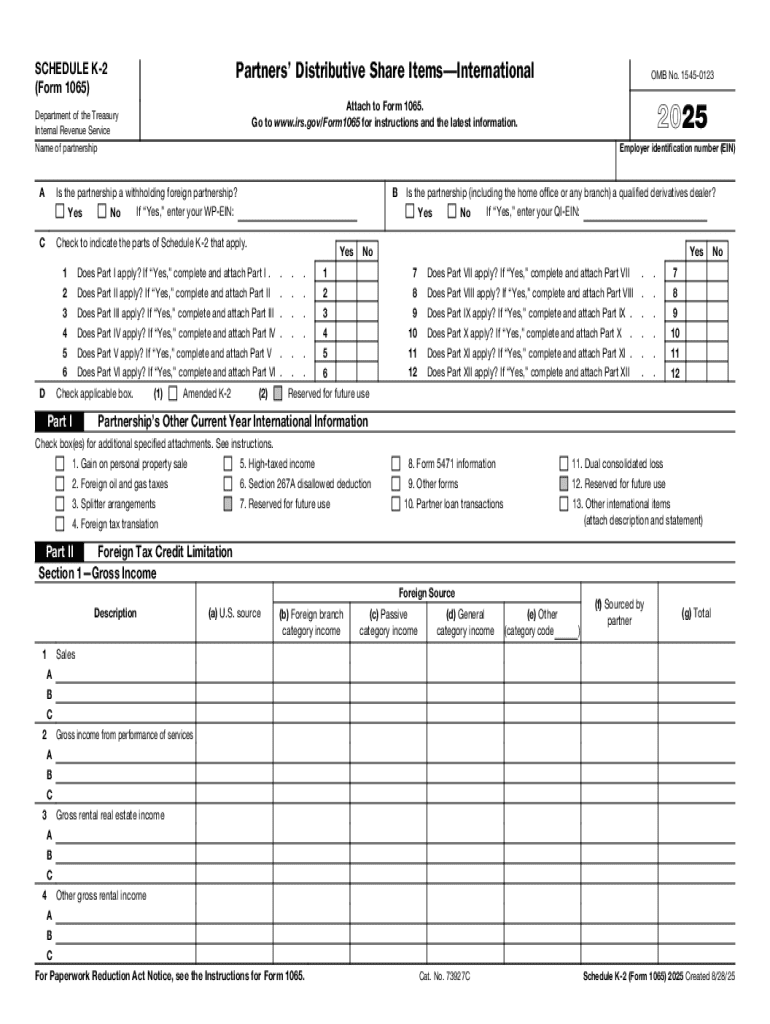

The 2025 Schedule K-2 (Form 1065) is a supplementary form to the main Form 1065 used by partnerships in the United States. It provides details on international tax-related items that partners must report. This form helps ensure compliance with global tax regulations, requiring partnerships to disclose apportioned international income, credits, and deductions.

Steps to Complete the 2025 Schedule K-2 (Form 1065)

- Gather Required Documents: Collect all relevant documents, including Form 1065, previous financial records, and international income statements.

- Review International Transactions: Identify and organize transactions related to foreign income, assets, and residents.

- Complete Each Part of the Form: Fill out income, deduction, and credit sections carefully, ensuring accuracy in apportioning the international items.

- Validate Currency Conversions: Ensure currency conversions comply with IRS guidelines, using the correct exchange rates.

- Check IRS Instructions: Regularly consult the IRS website for specific instructions related to the form.

- Seek Professional Assistance: Consider consulting a tax professional for complex international transactions to ensure compliance with U.S. regulations.

Important Terms Related to 2025 Schedule K-2 (Form 1065)

- Apportionment: Allocation of income and expenses to the appropriate jurisdictions.

- Foreign Tax Credit: A non-refundable credit that reduces U.S. tax liability based on taxes paid to a foreign government.

- Exchange Rate: The rate at which one currency can be exchanged for another, impacting how foreign earnings are reported.

- Partnership: A business entity where multiple individuals share ownership and, commonly, international income and deductions.

Key Elements of the 2025 Schedule K-2 (Form 1065)

- International Income Reporting: Details each partner's share of income from international sources.

- Foreign Partner Information: Captures specific information about foreign partners to align with international tax regulations.

- Profit and Loss Allocation: Breaks down how profits and losses are distributed among partners for international business activities.

- Deductions for International Expenses: Outlines allowed deductions related to international transactions and operations.

IRS Guidelines

The IRS provides comprehensive guidelines to ensure the accurate completion of the Schedule K-2 form. These guidelines cover how partnerships should report international financial activities, the use of consistent currency exchange rates, and specific reporting requirements for various types of international income and expenses.

Filing Deadlines and Important Dates

The Schedule K-2 (Form 1065) must be filed alongside the main Form 1065, generally due by March 15th for calendar-year partnerships. However, this deadline may vary based on specific business circumstances or IRS directives. Timely filing avoids potential penalties for non-compliance.

Software Compatibility

Many tax preparation platforms, such as TurboTax and QuickBooks, accommodate Form 1065 and its Schedule K-2 supplementary form. These software solutions are designed to streamline the tax filing process, offering step-by-step instructions and ensuring accurate reporting and filing of international tax-related items.

Business Entity Types

Schedule K-2 is specifically applicable to partnerships, including Limited Liability Companies (LLCs) classified as partnerships. The form addresses the needs of these entities, focusing on appropriately distributing foreign income and credits among partners and ensuring that each partnership meets its international reporting obligations.

Who Typically Uses the 2025 Schedule K-2 (Form 1065)

The 2025 Schedule K-2 is primarily used by partnerships engaged in international business activities. It is essential for partnerships with foreign partners or those receiving international income or paying foreign taxes. This form ensures all international aspects are accurately reported to the IRS.