Definition & Overview of Publication 17

Publication 17, also known as "Your Federal Income Tax," serves as a comprehensive guide for individual taxpayers in the United States to aid in the preparation of their federal tax returns. It provides detailed explanations on various tax topics, including income, deductions, credits, and the filing process. By covering topics relevant to individuals preparing their 2025 tax returns, it serves as a valuable resource for clarifying complex tax regulations and ensuring compliance with IRS rules.

Importance and Utility

Publication 17 is essential for anyone seeking to understand and accurately navigate federal tax obligations. It breaks down tax laws into understandable language, offering guidance on reporting income and claiming deductions and credits. This ensures that taxpayers pay the correct amount of tax and maximizes their potential for refunds.

How to Use Publication 17 Effectively

Publication 17 is structured to facilitate its use as a reference guide during tax preparation. Start by examining the table of contents to find relevant sections quickly. Keep it handy while filling out your tax forms, using it to confirm eligibility for deductions or credits, understand income classifications, and ensure that you adhere to current tax laws.

Step-by-Step Guide

- Identify Relevant Sections: Use the table of contents or search function in the digital version to locate applicable topics.

- Clarify Definitions: Understand terms by referring to sections explaining specific words or phrases.

- Apply Examples: Follow practical examples to see how tax rules might apply to your situation.

- Check for Updates: Verify that you have the latest edition, as tax laws can change annually.

Obtaining Publication 17

Sources for Access

Publication 17 is available through several channels:

- Access a free digital copy on the IRS website (IRS.gov).

- Obtain a printed version by requesting it via mail from the IRS.

- Visit libraries or community centers that might offer physical copies for public use.

Digital vs. Paper

Consider how you prefer to interact with the material. The digital version allows for easy searches and is environmentally friendly, while a paper copy might be suitable for those who prefer offline reading or annotating.

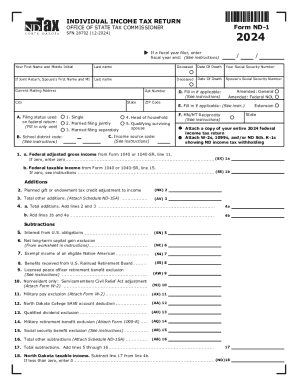

Steps to Complete Tax Forms Using Publication 17

Publication 17 serves as a step-by-step guide for completing various sections of your tax return. Here’s a succinct approach:

- Gather Documents: Assemble all necessary documents, such as W-2s, 1099s, and receipts.

- Determine Filing Status: Identify your correct filing status according to the guidelines.

- Report Income: Use the explanation in Publication 17 to report income accurately.

- Claim Deductions and Credits: Follow detailed instructions to claim legitimate deductions and credits.

- Review and Submit: Double-check for errors before submitting your return electronically or by mail.

Key Elements of Publication 17

The guide provides extensive sections including:

- Filing Information: Essentials on how to file your return.

- Understanding Income: Guidance on income types and reporting requirements.

- Deductions and Credits: In-depth details on available tax benefits.

- Tax Computation: How to calculate your correct tax liability.

- Amended Returns and IRS Notices: Instructions for handling changes and responses.

IRS Guidelines for Publication 17

Publication 17 consolidates the IRS’s instructions and guidelines on filing returns. These guidelines aim to ensure compliance and reduce errors. Taxpayers should regularly review it each year for updates or changes in tax laws that could affect their filing.

Compliance and Updates

Stay informed of amendments that might require adjusting your tax planning strategies or filings.

Filing Deadlines and Important Dates

Publication 17 highlights crucial deadlines to track:

- Regular Filing Deadline: Typically April 15.

- Extension Requests: Procedures for requesting an extension if unable to meet the initial deadline.

- Estimated Tax Payments: Deadlines for quarterly estimated tax payments.

Penalties for Non-Compliance

Failure to adhere to these dates can result in penalties. Publication 17 outlines potential fines for late filing or underpayment of taxes, stressing the importance of punctual submissions.

Relevant Scenarios for Publication 17 Use

Taxpayers in various situations, from employees, self-employed individuals, retirees, to students, can benefit from Publication 17. It outlines scenarios and examples to assist different taxpayer types in understanding how tax laws apply uniquely to their situation.

Examples

- Self-Employed: Guidance on how to report business income and claim related expenses.

- Retirees: Information on reporting retirement distributions and understanding Social Security benefits.

- Students: Advice on educational expenses and available credits.

Conclusion

Publication 17 is an indispensable tool for U.S. taxpayers, enabling them to confidently tackle their federal income tax obligations by providing detailed guidance, examples, and insights into tax regulations. By making use of this comprehensive guide, taxpayers can ensure accurate reporting and maximize their tax benefits.