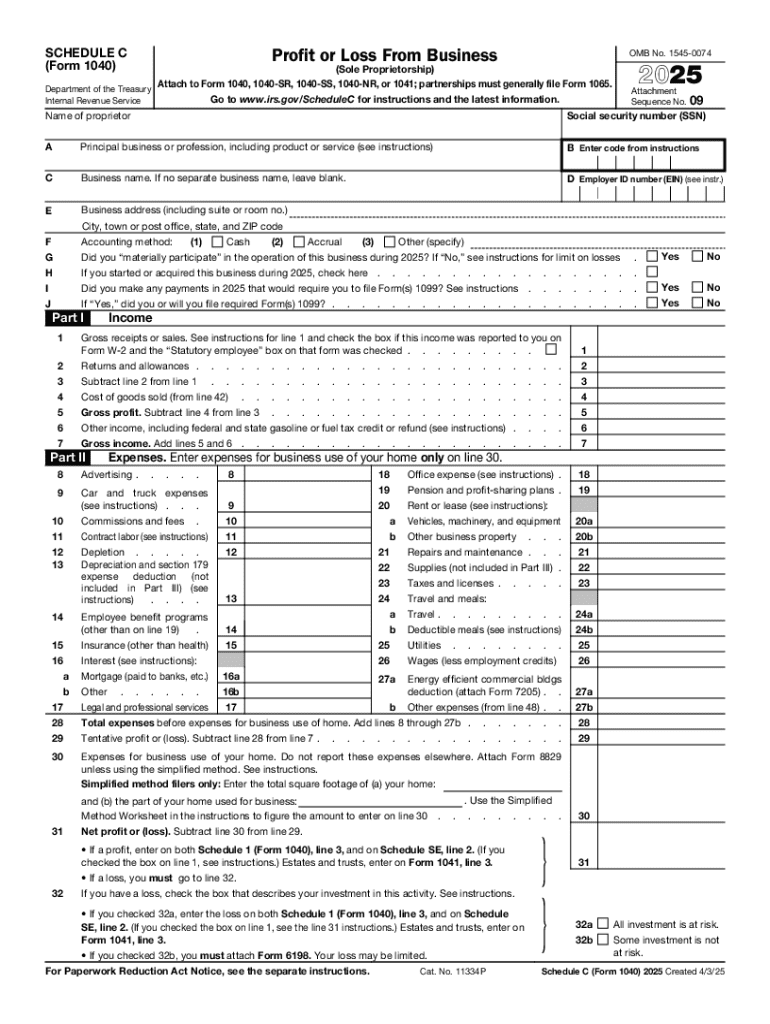

Steps to Complete the 2025 Schedule C (Form 1040)

The 2025 Schedule C (Form 1040) is integral for sole proprietors in the U.S. to report income or loss from a business. Completing this form involves several steps:

-

Business Information: Enter your business's name, address, and Employer Identification Number (EIN), if applicable. Sole proprietors usually use their Social Security Number (SSN) unless they've applied for an EIN.

-

Income Reporting: Report your gross income, which includes any earnings from sales or services. This section includes totals from any received payments, amounts reported on Form 1099-NEC, and any other miscellaneous incomes.

-

Deduction of Expenses: List all business-related expenses. Common categories include advertising, car and truck expenses, legal and professional services, office expenses, and utilities.

-

Costs of Goods Sold (COGS): For businesses that sell products, calculate the COGS. This includes the cost of inventory at the start of the year, purchases, labor, and materials, less any inventory remaining at year-end.

-

Adjustments and Asset Deductions: If your business assets depreciate over time, record these adjustments. This can include equipment, vehicles, or real estate used in the business.

-

Net Profit or Loss Calculation: Subtract total expenses from gross income to determine your net profit or loss. You'll carry this information over to Form 1040.

-

Signature and Date: After the form is thoroughly completed, ensure you sign and date it before submission.

Why Use the 2025 Schedule C (Form 1040)

The Schedule C (Form 1040) serves a critical purpose:

- Accurate Tax Reporting: It separates personal and business finances, ensuring that only business-related income and expenses impact tax liabilities.

- Business Legitimization: Filing Schedule C demonstrates a legitimate business operation, which is essential for financial integrity and credibility.

Key Elements of the 2025 Schedule C (Form 1040)

Understanding the core elements is vital:

- Principal Business: This is the primary activity your business engages in, such as retail, manufacturing, or service provision.

- Gross Receipts or Sales: The total income from sales or services provided before any deductions.

- Expenses Categories: Categorized lists reflect typical business expenses that can legally lower taxable income.

Important Terms Related to the 2025 Schedule C (Form 1040)

- Gross Income: Total earnings before any deductions or expenses.

- EIN (Employer Identification Number): A unique number assigned by the IRS that identifies a business entity.

- Depreciation: The process of allocating the cost of a tangible asset over its useful life.

Filing Deadlines and Important Dates

Sole proprietors must adhere to IRS deadlines to avoid penalties:

- Filing Deadline: Schedule C typically accompanies your Form 1040, due by April 15 following the tax year.

- Extension Requests: If more time is needed, file Form 4868 for an automatic six-month extension.

Who Typically Uses the 2025 Schedule C (Form 1040)

Primarily, the form applies to:

- Sole Proprietors: Individuals running unincorporated businesses.

- Independent Contractors: Freelancers or gig workers needing to report income independently from their personal finances.

Digital vs. Paper Version

Choose the right format:

- Digital Submission: Allows for quicker processing, with options to use software like TurboTax or QuickBooks for filing electronically.

- Paper Form: Suitable for those preferring manual completion but comes with mailing time considerations.

Required Documents

Accurate completion relies on:

- Profit and Loss Statements: Offers a snapshot of income and expenses over the fiscal year.

- 1099 Forms: Received from clients detailing earned income.

- Receipts and Invoices: Proof of expenses claimed as deductions on your Schedule C.

Software Compatibility

To simplify filing, most popular tax software options support the 2025 Schedule C:

- TurboTax: Guides users through entry and ensures all required fields are completed.

- QuickBooks: Ideal for businesses already using it for accounting, allowing easy imports.

- H&R Block Software: Provides a comprehensive walkthrough of income and expense reporting on the form.

IRS Guidelines

Following IRS guidelines is crucial for compliance:

- Standard Mileage vs. Actual Expenses: For vehicle expenses, choose between standard mileage rates or actual expense deductions.

- Record Retention: Maintain all supporting documentation for at least three years from the filing date in case of an audit.

Legal Use of the 2025 Schedule C (Form 1040)

Ensure adherence to the law:

- Honest Reporting: Accurately declare all sources of income and expenses.

- ID Theft Safeguards: Protect sensitive information such as SSNs and EINs during submission to prevent unauthorized use.

By understanding each aspect of the 2025 Schedule C, taxpayers can maximize accuracy and compliance while ensuring that they meet all necessary reporting obligations for their businesses.