Definition & Meaning

A Sole Proprietorship Account Application Form is a document used by individuals who are establishing or maintaining a business as a sole proprietor. This form is essential for setting up a business account with financial institutions, allowing the business owner to manage finances and transactions separately from personal accounts. Sole proprietorships are unique as the business and owner are legally considered one entity, thus simplifying the tax filing process while requiring diligent financial management to avoid personal and business liabilities mixing.

How to Use the Sole Proprietorship Account Application Form

The form is used to officially record and submit information necessary for opening a business account under a sole proprietorship. Users must accurately provide personal details, business information, and any required identification or documentation that establishes their ownership of the business. This ensures that the financial institution can establish an account that specifically caters to the business needs, including handling transactions, receiving payments, and managing expenses. The form will often require signatures that confirm the authenticity of the provided information.

Steps to Complete the Sole Proprietorship Account Application Form

-

Collect Necessary Information: Before filling out the application, gather required personal and business details, such as name, address, social security number, business name, and business EIN (Employer Identification Number) if applicable.

-

Fill Out Personal Information: Begin by entering personal details as listed on the form, ensuring accuracy in names, addresses, and contact information.

-

Provide Business Details: Input all relevant business information, including the business name, type of business, anticipated account activities, and industry classification.

-

Attach Required Documentation: Include necessary supporting documents like identification, business license or registration, and tax documents as specified.

-

Review and Sign: Carefully review completed information for errors, and sign the form to confirm the authenticity of the information before submitting it.

Required Documents

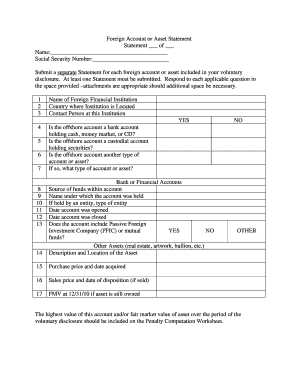

Obtaining a sole proprietorship account requires several documents that verify both personal and business identities:

- A government-issued photo ID, such as a driver's license or passport

- Social Security Number (SSN) or Employer Identification Number (EIN)

- Business license, registration, or a DBA (Doing Business As) certificate

- Recent utility bill or lease agreement proving business address

- Some financial institutions might request an initial deposit

These documents confirm the existence of the business as well as the identity of the proprietor, ensuring legal compliance and proper identification.

Key Elements of the Sole Proprietorship Account Application Form

- Personal Information Section: Collects details on the individual owner.

- Business Information Section: Requires data on business operations, such as name, address, and bank preferences.

- Signature and Authorization: Confirms that the applicant has provided truthful and accurate information and agrees to the institution’s terms.

These sections establish a foundational understanding of the applicant’s identity, the type of business operated, and the account specifications desired, ultimately ensuring proper banking protocols are followed.

Legal Use of the Sole Proprietorship Account Application Form

This form serves a critical legal function by formally documenting an individual’s request to open a business account under a sole proprietorship. In legal contexts, this document:

- Helps establish the separation of business and personal financial responsibilities

- Ensures compliance with banking regulations and anti-fraud measures

- Provides evidentiary support in legal disputes regarding business transactions or account ownership

Proper completion and submission of this form are imperative for compliance with federal and state regulations governing business operations and banking practices.

Application Process & Approval Time

After the form submission, approval time can vary based on the financial institution's processing policies. Generally, applicants can expect:

- Initial Submission: Complete and submit the application along with all required documentation.

- Review Period: The bank reviews the application to verify the provided information.

- Approval Notification: Once reviewed, the applicant receives confirmation of approval, often within one to two weeks.

- Account Setup: Upon approval, the bank sets up the account, providing account numbers and other necessary details.

Understanding this timeline helps applicants plan their financial operations and ensures a smooth transition from personal to business banking.

State-Specific Rules for the Sole Proprietorship Account Application Form

While the process can be generally consistent nationwide, specific states may have unique requirements or additional steps:

- Business Registration Requirements: Some states require a formal registration even for sole proprietors.

- DBA Filing: If a business operates under a name different from the owner’s, a state-specific DBA form might be necessary.

- Sales Tax Permits: States with sales taxes may require permits or additional forms.

Applicants should check with local state agencies or legal advisors to ensure they meet all regional requirements before submission, avoiding future compliance issues.