Definition & Meaning

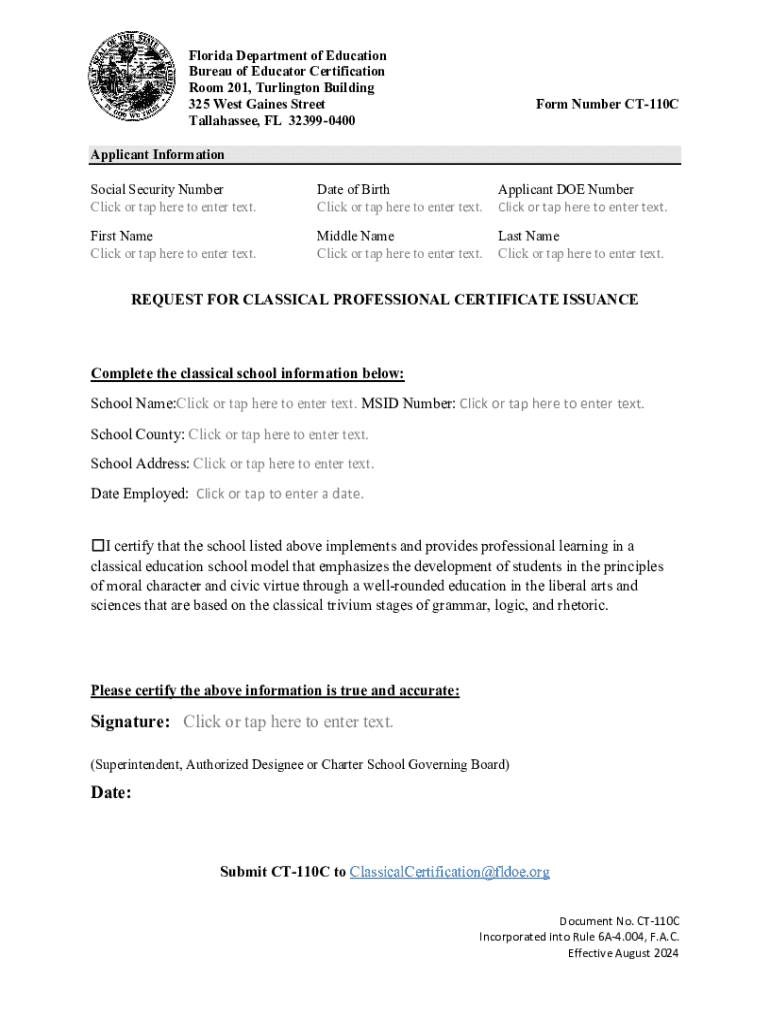

Form CT-110C is an official document designed for tax-related purposes within certain jurisdictions in the United States. It is primarily used by corporations to report specific financial details to the relevant state tax authority. Understanding this form's meaning and purpose is crucial for accurate filing and compliance. It typically involves capturing essential financial information, which can include taxable income and other relevant corporate earnings data.

Purpose and Utility

Form CT-110C serves a vital role in ensuring that corporations meet state tax obligations accurately and efficiently. This form facilitates the accurate calculation and reporting of a company's tax liabilities. By providing comprehensive financial data, it helps in auditing and verification processes conducted by tax authorities. Corporations benefit from using this form as it aids in maintaining transparency and accountability, ultimately supporting smooth legal and financial operations.

How to Use the Form CT-110C

Filling out Form CT-110C involves a systematic approach to capture all necessary financial information related to a corporation's earnings and taxes. Proper use of the form ensures compliance with state tax laws and avoids potential legal complications.

Step-by-Step Guidance

-

Gather Required Information: Begin by compiling all relevant financial documents. This includes income statements, balance sheets, and other financial records that reflect the financial status of the corporation.

-

Complete Identification Details: Fill out the sections requiring basic corporate information, such as the company's name, address, and identification number.

-

Report Earnings and Deductions: Accurately enter the data regarding corporate earnings, deductions, and other financial activities. Ensure that all values are consistent with the supporting documentation.

-

Review and Confirm Accuracy: Before final submission, double-check all entered information for errors or discrepancies. This step is crucial for avoiding penalties associated with incorrect reporting.

-

Submit the Form: Depending on jurisdictional regulations, submission may be completed online, via mail, or in person. Follow the preferred method to finalize the filing process.

Steps to Complete the Form CT-110C

Completing Form CT-110C requires a detailed, step-by-step process to ensure all financial data is accurately captured and reported.

Detailed Instructions

-

Compile All Financial Documentation: To ensure accuracy, gather financial records that pertain to the tax period in question, including income statements and balance sheets.

-

Enter Corporate Information: Input the necessary corporate identification details at the top of the form, ensuring all information matches official records.

-

Record Financial Details: Carefully input information regarding total expected income, allowable deductions, and other pertinent financial data. Ensure calculations are accurate and supported by documentation.

-

Ensure Compliance with State-Specific Rules: Account for any state-specific requirements or additional sections that need to be filled out, to ensure full compliance.

-

Finalize and Submit the Form: Once reviewed, submit the form using the appropriate method. Consider any deadlines to ensure timely submission and avoid penalties.

Who Typically Uses the Form CT-110C

Corporations operating within specific states in the U.S. use Form CT-110C to document and report key financial activities for tax purposes. This form is crucial for those legally recognized as corporations and required to disclose financial earnings to state tax authorities.

Target Users

-

Corporations: Primarily used by incorporated entities that need to report their income and tax obligations to state authorities.

-

Financial Officers: Corporate financial officers or accountants typically handle the form's completion due to its detailed financial nature.

-

Tax Professionals: External tax consultants may engage in the preparation process for corporations, particularly larger entities requiring professional expertise.

Important Terms Related to Form CT-110C

Understanding the terminology associated with Form CT-110C is essential for accurate completion and compliance with tax laws.

Key Terminology

- Taxable Income: The amount of income subject to state tax, as reported on the form.

- Deductions: Allowable reductions from gross income that can influence the taxable income total.

- State Tax ID: An identification number assigned to the corporation by state tax authorities used for tracking and reporting purposes.

- Filing Requirements: Specific criteria a corporation must meet to file Form CT-110C accurately and within the legal timeframe.

Key Elements of the Form CT-110C

Form CT-110C includes critical elements that must be addressed to ensure compliance with state tax regulations and accurate financial reporting.

Essential Components

- Identification Section: Contains fields for corporate identification and contact information.

- Financial Data Section: Sections dedicated to documenting income, deductions, and other financial specifics.

- Declaration: A section for authorized personnel to sign, confirming the accuracy and completeness of the information provided.

Filing Deadlines / Important Dates

Meeting the filing deadlines for Form CT-110C is crucial for avoiding penalties and ensuring compliance with state tax laws. Each state may have its own specific deadline, and being aware of these is essential for all corporations required to file.

Timing Considerations

- Regular Filing Deadlines: Typically align with the end of the fiscal year, but specific dates will depend on state regulations.

- Extensions: Some states may offer extensions for filing, though these usually require a formal request and can be subject to approval.

- Penalty Dates: Missing filing deadlines often results in monetary penalties and potential legal complications.

Form Submission Methods (Online / Mail / In-Person)

Corporations can choose from various methods to submit Form CT-110C, each with its own procedures and benefits. Selecting the appropriate submission method is important for ensuring timely and secure delivery of tax documents.

Available Submission Options

- Online Submission: Many states offer electronic filing systems for ease and efficiency, enabling secure, fast submissions with instant confirmation.

- Mail Submission: A traditional method preferred by some corporations, involving sending physical copies of the completed form and supporting documentation by post.

- In-Person Filing: Though less common, some entities may file forms directly at designated offices, a method that may suit corporations requiring additional support or verification.

Penalties for Non-Compliance

Failure to accurately complete or timely submit Form CT-110C can result in significant penalties. Understanding these consequences is important for corporations to maintain good standing with state tax authorities.

Overview of Consequences

- Monetary Penalties: These can include fines based on the amount of tax due or a flat rate penalty for late filings.

- Legal Repercussions: In severe cases, failure to comply with tax reporting requirements might result in legal action, affecting the corporation's operation and reputation.

- Loss of Good Standing: Persistent non-compliance may impact a corporation's registration status within the state, affecting business operations.