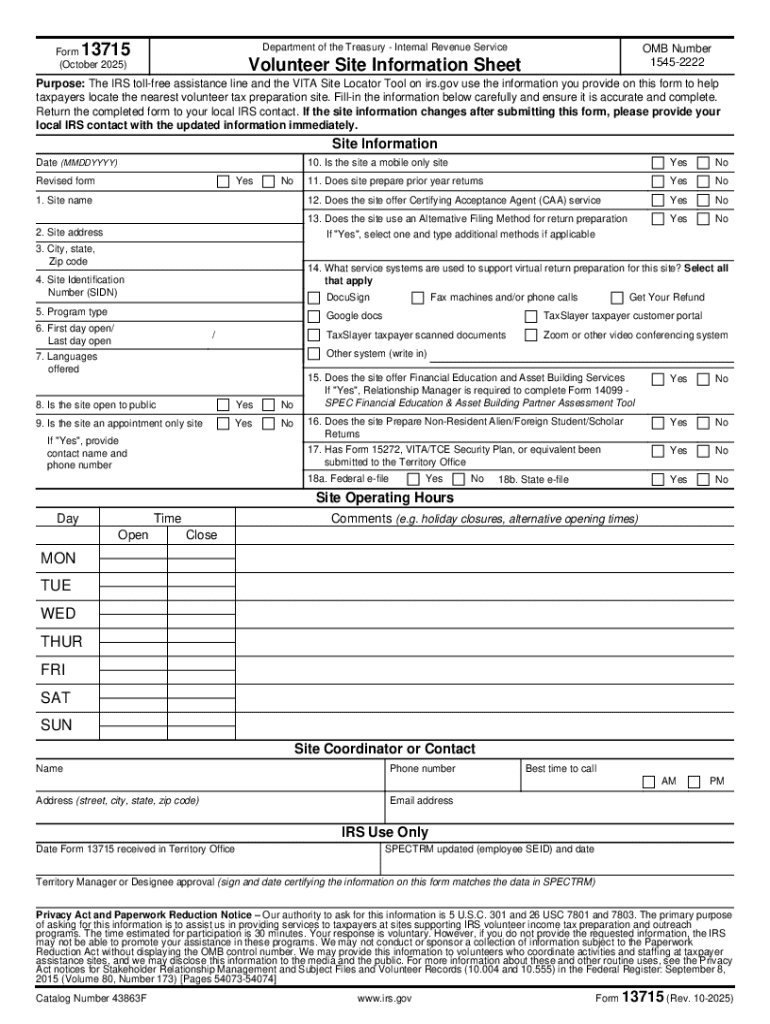

Definition & Purpose of Form 13715

Form 13715, also known as the Volunteer Site Information Sheet, is issued by the Department of the Treasury's Internal Revenue Service (IRS). Its primary purpose is to provide essential information about Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) sites. These sites offer free tax help to individuals who need assistance in preparing their own tax returns, including those who qualify as low-income, elderly, persons with disabilities, and limited English-speaking taxpayers.

Key Components

- Site Identification: Form 13715 includes information such as the site's name, location, and operating hours. This information is crucial for directing taxpayers to the appropriate VITA or TCE site.

- Services Offered: The form outlines the types of services and support available at each site, ensuring that taxpayers are aware of what assistance they can receive.

- Site Qualifications: Details about the specific qualifications of volunteers and the scope of assistance provided are included, ensuring compliance with IRS regulations.

How to Obtain Form 13715

Obtaining Form 13715 can be done through several methods, ensuring easy access for those who manage or oversee VITA and TCE sites.

Online Access

- IRS Website: The most straightforward method is to download the form from the IRS official website. This ensures you're getting the most current version of the form.

- Electronic Request: Stakeholders can request an electronic version through the VITA or TCE program office if they are involved in managing or coordinating these programs.

Physical Copies

- IRS Offices: Physical copies of the form can be obtained from IRS walk-in offices for those who prefer hard copies.

- Partner Organizations: Many community organizations that host VITA or TCE sites may also distribute Form 13715 to site coordinators and volunteers.

Steps to Complete Form 13715

Completing Form 13715 accurately is crucial for maintaining effective VITA and TCE site operations.

- Site Information: Enter the name, address, and contact details of the site. Make sure the details correspond to what will be registered with the IRS.

- Operating Details: Fill out the days and hours of operation. This helps ensure that users know when the site is available for visits.

- Services Provided: Clearly list the assistance services that are offered, specifying any unique capabilities like multilingual support.

- Volunteer Information: Include details about qualified volunteers and the types of tax returns they are approved to assist with.

- Submission: Once completed, submit the form according to IRS instructions, generally through the VITA or TCE program office.

Importance and Benefits of Using Form 13715

Using Form 13715 is critical for aligning with IRS standards and ensuring effective service delivery at volunteer sites.

- Compliance with IRS Standards: Form 13715 ensures that the site operates under IRS guidelines, providing consistent and reliable taxpayer assistance.

- Coordination and Management: Helps manage resources effectively by providing clear information about site capabilities and operations.

- Facilitating Access to Services: By listing accurate and comprehensive site information, Form 13715 helps taxpayers easily find and access the services they need.

Key Elements of Form 13715

Understanding the essential elements of Form 13715 is important for those managing VITA or TCE sites.

Site Specifics

- Location and Accessibility: Includes how accessible the site is to various community members, highlighting features like wheelchair access or public transport links.

- Technology and Tools: Details on available tools and technology at the site, which can enhance the processing of tax returns.

Compliance and Regulations

- Volunteer Clearances: Information on background checks or training that volunteers have completed.

- IRS Sanctioning: Confirmation of adherence to IRS rules and regulations, validating the site's legitimacy.

Legal Use and Compliance

Form 13715 is fundamental in legal adherence for VITA and TCE sites, ensuring they operate within legal frameworks.

- Verification of Operations: Provides a documented trail verifying that site operations conform to IRS standards.

- Authorization for Services: Documents the authorization for offering tax-related services, a legal requirement for nonprofit sites engaging in these activities.

Examples of Using Form 13715

Form 13715 is utilized across a variety of contexts, reflecting its adaptability and necessity in tax assistance.

Real-World Scenarios

- Community Centers: Used by community centers to formalize the offering of tax assistance, documenting specifics like language support or digital filing capabilities.

- Mobile Tax Units: Mobile units, often deployed in underserved areas, rely on Form 13715 to coordinate locations and available services efficiently.

Who Typically Uses Form 13715

The users of Form 13715 include a diverse group of individuals and organizations involved in tax preparation assistance.

- Site Managers: Responsible for completing and submitting the form to the IRS, ensuring that site information is up to date.

- Volunteers: Use the form to understand operational expectations and the services they are authorized to provide.

- Taxpayers: Indirectly benefit from the streamlined documentation of services and operational details.

By thoroughly understanding Form 13715, stakeholders can ensure compliant and effective operation of VITA and TCE sites, fostering an environment that supports taxpayer needs efficiently and reliably.