Definition & Meaning

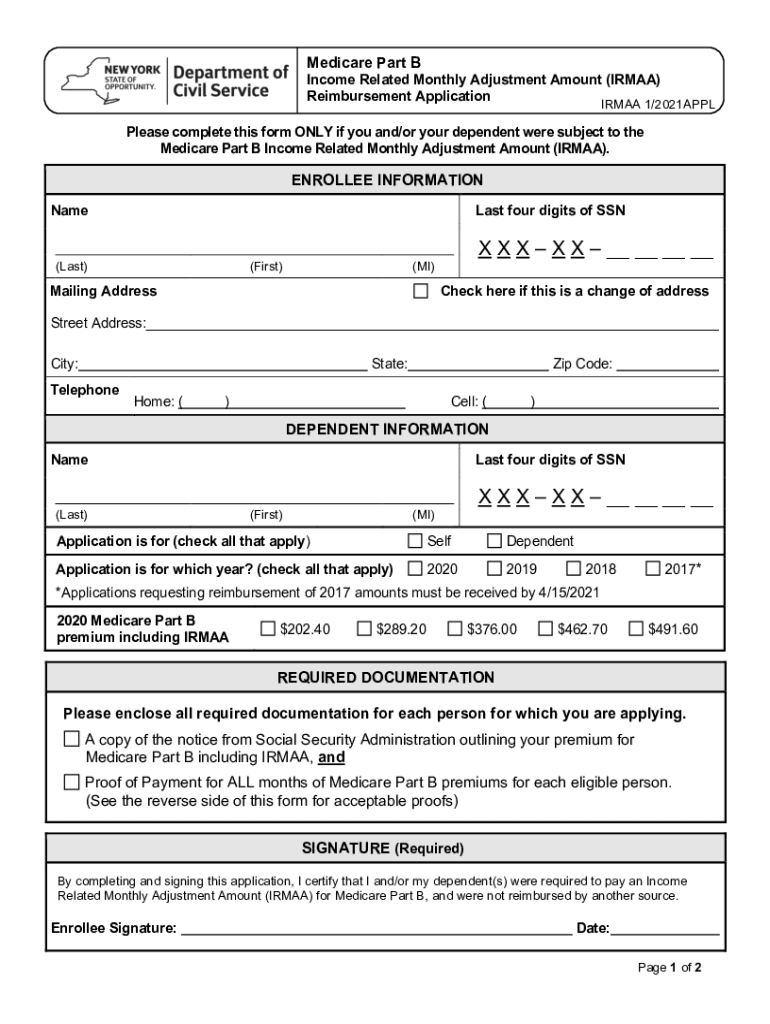

The Medicare Part B Income Related Monthly Adjustment Amount (IRMAA) reimbursement application is a form used by individuals who are eligible to apply for reimbursement of the additional cost incurred due to IRMAA. IRMAA is an additional charge applied to Medicare Part B and Part D premiums for individuals with income exceeding a certain threshold. This reimbursement application is crucial for those seeking relief from these additional expenses, particularly affecting higher-income enrollees or those with dependents subject to this adjustment.

How to Obtain the Application

To obtain the Medicare Part B IRMAA reimbursement application, there are several methods available:

- Online Access: Many healthcare providers and governmental websites offer downloadable versions of the application form.

- Local Social Security Office: Forms can often be obtained directly from your local Social Security office.

- Mail Request: You may request the form to be sent to you by mail by contacting your insurer or the Social Security Administration (SSA).

Ensuring the correct version of the form is used is essential for successful submission, as outdated versions might not be accepted.

Steps to Complete the Application

Thoroughly completing the Medicare Part B IRMAA reimbursement application requires attention to detail and accurate information:

- Personal Information: Start by entering the applicant’s full name, contact information, and Social Security number.

- Income Details: Include documentation verifying income, such as tax returns, as IRMAA adjustments are income-based.

- Proof of Payment: Attach evidence of Medicare Part B premium payments subject to IRMAA.

- Sign and Date: Ensure the form is signed and dated by the applicant. An unsigned form may delay processing.

- Submission: Submit the form via the method specified, ensuring all supporting documents are included.

Who Typically Uses the Application

The application is typically utilized by:

- Medicare Beneficiaries: Individuals who have been subject to an IRMAA due to their income levels.

- Retirees: Many retirees apply to mitigate the impact of IRMAA on their fixed income.

- Dependents: Family members of enrollees affected by IRMAA premiums.

Important Terms Related to the Application

Understanding key terms related to the IRMAA reimbursement application enhances comprehension:

- IRMAA: Income Related Monthly Adjustment Amount, an additional charge on top of standard Medicare premiums.

- MAGI: Modified Adjusted Gross Income, the determinant for IRMAA eligibility.

- SSA-44: A form associated with appealing IRMAA charges due to life-changing events.

Eligibility Criteria

Eligibility for the IRMAA reimbursement application requires meeting specific criteria:

- Income Levels: Applicants must have incomes that subject them to IRMAA, typically above $97,000 for individuals or $194,000 for couples (2023 figures).

- Medicare Enrollment: Beneficiaries must be enrolled in Medicare Part B and affected by the adjustment amount.

- Evidence of Adjustment Payment: Proof that IRMAA charges have been paid must be presented.

Failure to meet these criteria might result in denial of the reimbursement application.

Required Documents

Accompanying documentation is essential to process the IRMAA reimbursement application effectively:

- Tax Returns: Federal tax returns for the year in question to validate income levels.

- Medicare Payment Proofs: Statements or receipts showing payments made, including those incorporating IRMAA.

- Personal Identification: Copies of ID for verification of the applicant’s identity.

Ensuring these documents are accurate and complete is necessary to avoid delays in processing.

Application Process & Approval Time

The process for applying and the expected time to receive a decision involve multiple steps:

- Preparation: Gathering all required documents and ensuring they comply with the submission guidelines.

- Filing: Complete the form accurately and send it together with documentation either online or by mail.

- Review and Decision: The processing time can vary but typically takes several weeks. The applicant will be notified upon approval or if additional information is required.

Delays may occur if forms are incomplete or documents are not properly submitted, so accuracy is critical.