Definition and Meaning of Tasación Pericial Contradictoria

Tasación Pericial Contradictoria is a formal process used to determine the fair market value of a property or asset for tax, legal, or financial purposes. It involves appointing an independent expert appraiser to provide an objective evaluation. This process is commonly used in situations where the initial valuation by a tax authority or insurer is disputed by the taxpayer or property owner. By engaging a third-party expert, both parties aim to reach a mutually agreeable assessment.

Key Features:

- Objective Evaluation: Conducted by an independent appraiser to ensure unbiased results.

- Dispute Resolution: Aimed at resolving valuation disagreements between parties.

- Legal Relevance: Frequent in tax disputes, especially in property taxation matters.

Steps to Complete the Tasación Pericial Contradictoria

Completing the Tasación Pericial Contradictoria involves several well-defined steps to ensure accuracy and compliance with legal standards.

-

Initiate the Process: Start by submitting a formal request to invoke the tasación pericial contradictoria, usually within a specific timeframe after receiving the initial valuation.

-

Appoint an Appraiser: Both parties must agree upon an impartial appraiser capable of delivering a fair assessment.

-

Gather Necessary Documents: Compile all relevant documents related to the property or asset, including previous valuations, property descriptions, and any relevant correspondence.

-

Conduct Appraisal: The appointed appraiser evaluates the property using standardized methods to establish its fair market value.

-

Review and Approve Findings: The parties review the appraiser's report. If both agree, the new valuation is finalized; if not, further negotiation or legal steps may be necessary.

Why Use Tasación Pericial Contradictoria

The Tasación Pericial Contradictoria is often employed to ensure fairness and accuracy in valuation disputes.

Benefits:

- Fair Valuation: Offers an unbiased assessment that parties are more likely to accept.

- Improved Tax Compliance: Ensures valuations meet legal standards, reducing the risk of penalties.

- Conflict Resolution: Minimizes potential disputes by involving a neutral third party.

Important Terms Related to Tasación Pericial Contradictoria

Understanding the terminology associated with this process is crucial for comprehending the nuances involved.

- Fair Market Value: The estimated price an asset would fetch in a competitive and open market.

- Appraiser: A qualified individual or entity responsible for estimating the value of property or assets.

- Dispute: A disagreement over the initial valuation that triggers the need for a contradictory appraisal.

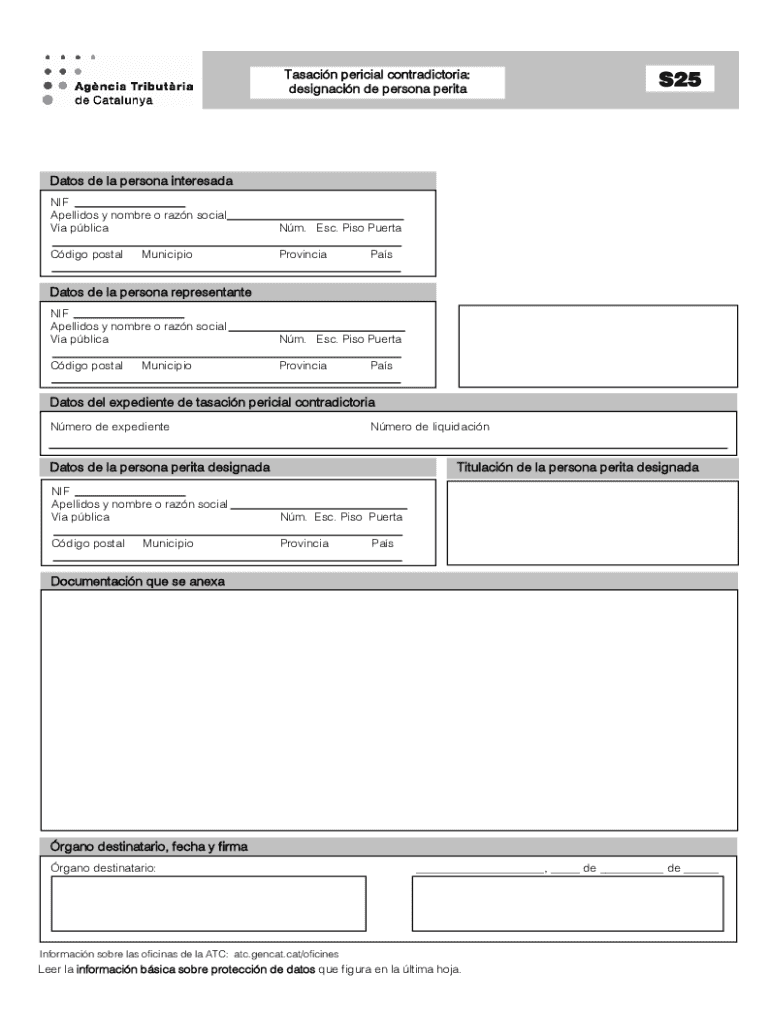

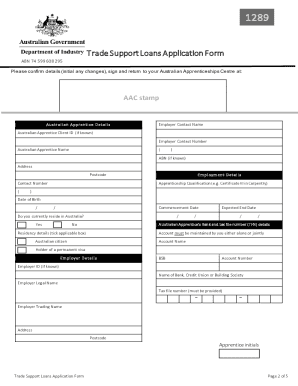

Required Documents for Tasación Pericial Contradictoria

Gathering the appropriate documentation is a critical step in the Tasación Pericial Contradictoria process.

Essential Documents:

- Initial Valuation Report: Provided by the tax authority or insurer.

- Property Descriptions: Detailed information about the asset or property in question.

- Correspondence Records: Communications regarding the initial valuation and any disputes.

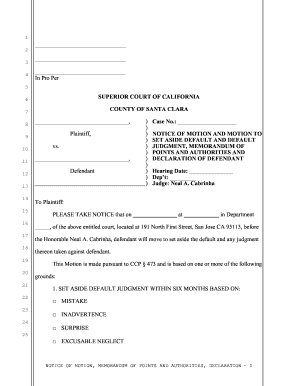

Legal Use of the Tasación Pericial Contradictoria

In a legal context, the tasación pericial contradictoria serves as a tool to address valuation discrepancies within the framework of property and tax law.

Legal Implications:

- Enhances Fairness: Provides a structured mechanism to address and resolve valuation disputes.

- Protects Rights: Ensures both parties have a voice in the valuation process.

- Compliance: Assists in adhering to legal standards and requirements for property valuation.

Who Typically Uses the Tasación Pericial Contradictoria

While this process can be employed by various individuals and entities, certain groups are more likely to engage in contradictory appraisal procedures.

Primary Users:

- Property Owners: Individuals or corporations owning significant assets subject to taxation.

- Legal Representatives: Attorneys involved in property or tax disputes.

- Corporations: Businesses undergoing property audits or assessments.

Examples of Using the Tasación Pericial Contradictoria

Practical examples can illuminate how Tasación Pericial Contradictoria works in real-world scenarios.

-

Case Study 1: A homeowner disagrees with the property tax assessment provided by the local government. They request a tasación pericial contradictoria to obtain an independent valuation.

-

Case Study 2: A company argues that the insurance valuation of their headquarters does not reflect the true market conditions. Through a contradictory appraisal, they achieve a revised valuation.

State-Specific Rules for the Tasación Pericial Contradictoria

The application of tasación pericial contradictoria can vary based on state-specific regulations and procedures.

- State Variability: Different jurisdictions may impose unique requirements regarding timelines, documentation, and acceptable appraisal methods.

- Localized Procedures: Some states might have distinct processes for selecting and approving appraisers, which could impact the appraisal schedule and delivery.

Application Process and Approval Time for Tasación Pericial Contradictoria

Initiating a Tasación Pericial Contradictoria involves an application process with particular timelines for approval.

Process Steps:

- Submit Application: Initiate with timely submission to relevant authority.

- Select Appraiser: Choose a qualified and neutral party recognized by both stakeholders.

- Waiting Period: Approval times can vary; typically, both parties must agree within a defined period before proceeding.

Business Types That Benefit from Tasación Pericial Contradictoria

Different types of businesses can gain various advantages from using Tasación Pericial Contradictoria.

Beneficial Business Entities:

- Real Estate Firms: Engage in frequent property assessments and disputes.

- Manufacturing Companies: Often evaluate machinery and equipment for fair valuation.

- Financial Institutions: Require accurate asset valuation for portfolio management.