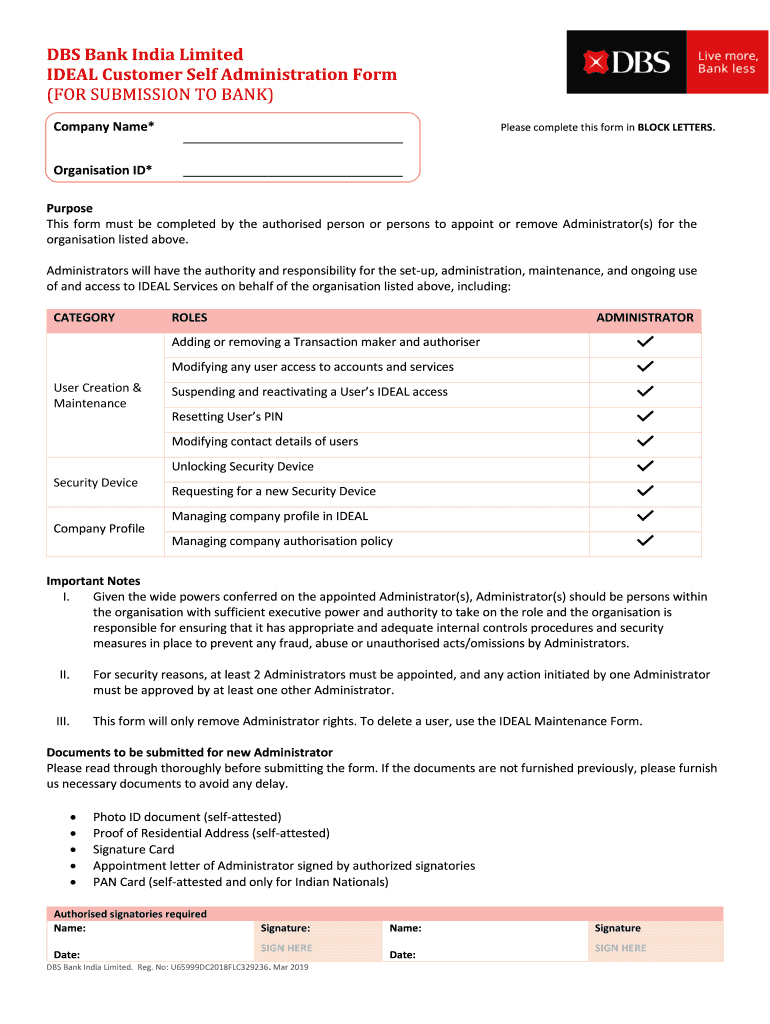

Definition and Purpose of the IDEAL Customer Self Administration Form

The IDEAL Customer Self Administration Form is a tool designed by DBS Bank India Limited to facilitate the appointment or removal of administrators responsible for managing IDEAL Services within an organization. This form is integral for maintaining clarity and accountability in assigning roles, ensuring that designated administrators are duly empowered to manage tasks associated with the service. The document is framed to meet the compliance standards set by the U.S. financial and data protection regulations. It emphasizes the necessity of robust internal controls and security protocols to prevent unauthorized administrative actions, thereby safeguarding sensitive information associated with organizational processes.

Acquiring the IDEAL Customer Self Administration Form

To obtain the IDEAL Customer Self Administration Form, interested parties should approach DBS Bank directly, either via their official website or customer service centers. The form may also be available through online banking portals provided by DBS Bank for authenticated users. it's crucial to acquire this form directly from authorized sources to ensure that it is the current and compliant version. Organizations could also receive guidance from customer service representatives of DBS Bank who can provide insights into filling out the form accurately and comprehensively.

Completing the IDEAL Customer Self Administration Form: A Step-by-Step Guide

-

Gather Required Information:

- Organizational Identification Number

- Full details of existing and prospective Administrators, including name, contact information, and official identification documents.

-

Filling the Details:

- Enter the organization's specific information and the names of persons being appointed or removed as Administrators. Ensure accuracy to prevent administrative delays.

-

Definition of Roles:

- Clearly outline the responsibilities assigned to each Administrator. This ensures that all parties understand the scope and limits of their authority.

-

Security and Documentation:

- Include documentation attesting to the qualifications required for the role, ensuring that Administrators comply with the internal controls and security measures standards.

-

Review and Validation:

- Double-check all details for accuracy. This should include verification of documents attached and the roles assigned.

-

Submission:

- Submit the form to the appropriate department or through official online channels provided by DBS Bank. Keep records of submission for future reference.

Importance of the Form for Organizations

The IDEAL Customer Self Administration Form is crucial for organizations as it streamlines administrative processes, ensuring that only authorized individuals have access to IDEAL Services. By formally appointing administrators, organizations can effectively manage operational risks and uphold data security. This form helps delineate clear lines of responsibility and prevents unauthorized access to critical organizational functions, thereby reducing the risk of data breaches and operational disruptions. Regular review and updates to administrative roles maintain accuracy and relevance in an organization's operational hierarchy.

Who Utilizes the IDEAL Customer Self Administration Form?

Typically, the IDEAL Customer Self Administration Form is used by organizational entities such as corporations, partnerships, and limited liability companies (LLCs) who engage with DBS Bank's IDEAL Services. It serves varied purposes from appointing an individual to managing corporate banking services to removing someone from such roles. These organizations require structured processes to manage financial transactions and ensure compliance with both internal policies and external regulatory requirements. Entities seeking to mitigate financial risk by ensuring tight controls around administrative access to banking services are the primary users of this form.

Key Components of the IDEAL Customer Self Administration Form

- Administrator Information: Detailed profiles including name, role, identification details, and contact information for both incoming and outgoing administrators.

- Role and Responsibilities: Clearly defined roles and responsibilities for each Administrator, ensuring there are no overlaps or ambiguities in duties.

- Security Compliance: Documentation of security measures and internal controls that Administrators are expected to adhere to.

- Authorizing Signatures: Signatures from authorized personnel within the organization to validate the changes and assignments of responsibilities.

- Required Attachments: Additional documentation such as identification proofs and prior consent forms, where applicable.

Legal Implications and Compliance

Completing and submitting the IDEAL Customer Self Administration Form carries significant legal implications. It designates individuals with authority over specific banking services, making them accountable for decisions made under their purview. The form must comply with financial industry regulations which dictate stringent requirements for record-keeping and data protection in the U.S. Ensuring compliance helps organizations avoid legal penalties and support sustainable access to banking services. Failure to accurately complete and maintain this form may lead to administrative sanctions or penalties, potentially disrupting access to essential banking services.

Examples and Use Cases

Consider a multinational corporation headquartered in the U.S. with regional offices in various countries. By assigning a seasoned financial executive to manage regional banking transactions through the IDEAL Services, the corporation ensures that all transactions comply with both local and global financial regulations. Similarly, a mid-sized business that frequently changes its management team may use this form to keep their administrative records up-to-date, ensuring that only current employees have access privileges, thereby adhering to best practices in internal governance and security.