Definition & Meaning

The LS-200 form, issued by the U.S. Department of Labor, is a mandatory reporting document under the Longshore and Harbor Workers' Compensation Act. It requires employees to declare their earnings, whether from direct employment or self-employment, within a specified timeframe. The primary function of this form is to ensure that all earnings are accounted for, which plays a critical role in determining eligible compensation benefits. Failure to accurately complete the LS-200 can result in the forfeiture of such benefits. The form includes detailed instructions for completion, definitions of what constitutes earnings, and the potential legal repercussions for providing false or misleading information.

How to Use the LS-200 Form

Filling out the LS-200 form involves several crucial steps to ensure compliance with federal regulations. Here’s how to utilize the form effectively:

-

Understand the Reporting Requirements: Familiarize yourself with the types of earnings that need to be reported. This includes wages, salaries, tips, or any self-employed income.

-

Gather Necessary Information: Compile all financial documents that reflect your earnings within the reporting period. This may include pay stubs, 1099 forms, or any relevant self-employment income records.

-

Complete the Form Accurately: Carefully fill in each section of the LS-200. Ensure that all required fields are completed to avoid any delays in processing.

-

Review for Accuracy: Double-check all entries for completeness and correctness before submission. Inaccuracies or omissions can lead to errors in your compensation calculation.

-

Submit the Form: Depending on the instructions provided, submit the form via the designated method—online, by mail, or in-person.

-

Retain a Copy: Keep a copy of the completed form for your records in case of future queries or audits.

Steps to Complete the LS-200 Form

Completing the LS-200 form involves multiple steps. Follow this detailed guide for an accurate submission:

-

Read Instructions Thoroughly: Before starting, read the included instructions to understand the requirements for each section.

-

Provide Personal Information: Enter your full name, address, and Social Security Number. Double-check for any typographical errors.

-

Report Earnings: In the earnings section, list your total income from employment and any self-employed work during the reporting period.

-

Disclose Additional Income Sources: If applicable, report any other sources of income not captured in standard wages, like rental income or dividends.

-

Sign and Date the Form: Ensure you sign and date in the designated area, certifying that the information provided is true and accurate.

-

Additional Attachments: If required, attach any supplemental documents that corroborate your reported income, such as tax returns or business records.

Important Terms Related to LS-200 Form

Understanding key terminology is crucial when dealing with the LS-200 form:

- Earnings: This encompasses any form of monetary compensation received, including wages, bonuses, and profits from business activities.

- Self-Employment: Income generated through your own business ventures or freelance work.

- Reporting Period: The specific timeframe for which income must be reported.

- Compensation Benefits: Financial entitlements under the Longshore and Harbor Workers' Compensation Act.

- False Information: Incorrect or misleading data that, if submitted, can lead to penalties.

Legal Use of the LS-200 Form

The LS-200 form serves several legal purposes within the framework of the Longshore and Harbor Workers' Compensation Act:

- Compliance Verification: It ensures that all earnings are disclosed, thereby safeguarding the integrity of compensation claims.

- Legal Oversight: The form helps in monitoring compliance with federal regulations governing worker compensation.

- Fraud Prevention: By requiring detailed earnings information, it minimizes the risk of fraudulent claims against the compensation system.

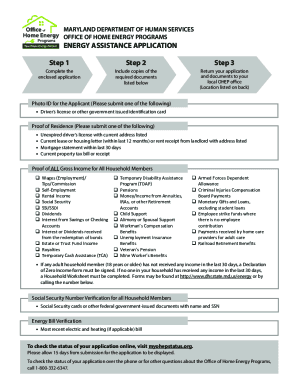

Required Documents

When preparing to complete the LS-200 form, it's essential to gather all necessary documents:

- Pay Stubs or Salary Statements: Evidence of earnings from your employer during the reporting period.

- Tax Forms: Such as W-2s or 1099s that reflect income from both employment and freelance work.

- Business Income Records: Documentation of profits and losses if you are self-employed.

- Previous Compensation Records: Any past documentation related to worker’s compensation claims that may affect current reporting.

Penalties for Non-Compliance

Not adhering to the requirements of the LS-200 form can lead to significant penalties:

- Loss of Benefits: Failure to submit the form or include accurate information may result in the suspension of compensation benefits.

- Fines and Legal Action: Providing false information can lead to monetary penalties or even legal proceedings.

- Delayed Processing: Incomplete submissions can cause delays in the processing and receipt of eligible benefits.

Digital vs. Paper Version

The LS-200 form is available in both digital and paper formats, each with its own set of advantages:

-

Digital Version: Offers ease of use with options for auto-calculation and data validation. It can be submitted online, which speeds up the processing time.

-

Paper Version: Preferred by those less comfortable with digital platforms or lacking internet access. It requires manual filling but provides a tangible record for personal documentation.

Choosing the right format depends on your personal preference and accessibility to digital tools.