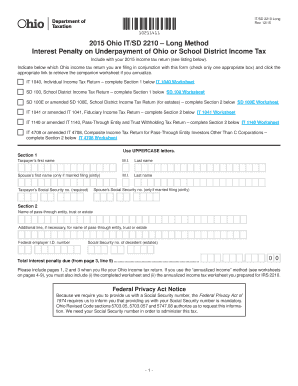

Overview of Form RC158

Form RC158 is a remittance voucher used by individuals and businesses in Canada to report their Harmonized Sales Tax (HST) obligations to the Canada Revenue Agency (CRA). This form is particularly significant for non-registered vendors required to self-assess and remit HST on taxable supplies made during a specified period. Understanding how to complete and submit this form is essential for compliance with tax regulations.

Key Components of Form RC158

Form RC158 includes several important sections that must be accurately completed to ensure successful submission:

- Identification Information: This section requires the filer to provide personal or business identification details, including the name, mailing address, and Business Number (BN) if applicable.

- Tax Calculation: Here, filers must calculate the total amount of HST due based on the applicable tax rate. Proper calculation is crucial to avoid penalties or interest for underpayment.

- Payment Information: Instructions on how to complete the payment section, including options for sending payment by cheque or electronic transfer, are outlined.

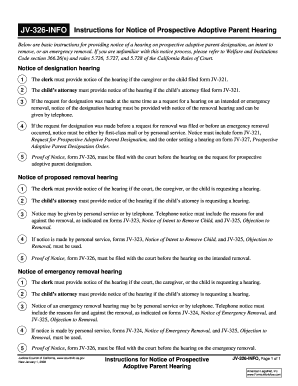

Steps to Complete Form RC158

Completing Form RC158 involves several detailed steps to ensure accuracy and compliance:

- Gather Necessary Information: Collect all relevant financial data, including sales and expenses that may affect your HST calculation.

- Fill Out Identification Information: Enter your name and address clearly. Ensure that the Business Number is provided if you have one.

- Calculate Tax Due: Determine the total taxable supplies and apply the appropriate HST rate, then input the total HST amount due in the designated field.

- Complete Payment Section: Indicate your payment method and amount. If paying by cheque, ensure it is made out to the CRA.

- Review and Submit: Double-check all information for accuracy before submitting it through the appropriate channels.

Important Dates and Filing Deadlines

Awareness of key deadlines is critical when submitting Form RC158. The remittance is typically due according to the taxpayer's filing frequency, which could be monthly, quarterly, or annually. Notably, failing to submit by the deadline can result in penalties. Taxpayers should consult the CRA for specific due dates based on their filing status.

Submission Methods for Form RC158

Taxpayers can submit Form RC158 through various methods:

- By Mail: Completed forms should be mailed to the designated CRA address based on the region.

- Online Submission: Certain qualifying taxpayers can submit their remittance online through CRA's My Business Account, simplifying tracking and paying tax obligations.

- In-Person: Taxpayers can also drop off their forms at local CRA offices.

Compliance and Penalties for Non-Submission

Failure to file Form RC158 accurately and on time can lead to significant consequences. The CRA imposes penalties based on the amount of tax owed and the duration of delay. It's vital for taxpayers to stay informed about HST obligations and to keep meticulous records, especially if they have substantial taxable supplies.

Understanding Variants and Updates of Form RC158

While Form RC158 has a standard format, there may be updated versions released by the CRA that reflect changes in tax legislation or processing protocols. Taxpayers should ensure they are using the current version of the form available on the CRA website to prevent complications during submission.

Supporting Resources for Form RC158 Completion

Filers can access numerous resources for assistance with Form RC158, including:

- CRA Website: The official CRA site offers downloadable forms, tax guides, and contact information for support.

- Tax Professionals: Engaging with accountants or tax advisors may provide personalized guidance and help prevent errors in submission.

- Online Forums: Tax forums can be helpful for peer support and sharing experiences regarding the completion of RC158.

Conclusion on Form RC158 Importance

Form RC158 serves a crucial function for those responsible for remitting HST in Canada. Proper knowledge of its requirements, along with awareness of submission methods and deadlines, can streamline the process and ensure compliance with Canadian tax regulations. Taxpayers should prioritize understanding this form to avoid potential penalties and ensure smooth handling of their tax obligations.