Definition & Meaning

The "Insurance and Benefits PlansRetail Sales Tax" form is primarily concerned with the calculation and reporting of sales tax related to insurance and benefits plans in retail settings. This form requires businesses to declare the specific sales taxes applicable to the retail insurance benefits they offer or utilize. This involves understanding which elements of the insurance and benefits plans are subject to tax, distinguishing between taxable and non-taxable items, and accurately documenting the sales tax owing.

Key Components

- Insurance Coverage: Certain kinds of insurance, particularly those offered at a retail level, may include sales tax in premiums or additional fees. Businesses must determine taxable amounts within these premiums.

- Benefits Plans: These often encompass health savings accounts (HSAs) or other employee benefits, which can potentially incorporate taxable elements depending on jurisdiction-specific statutes.

How to Use the Insurance and Benefits PlansRetail Sales Tax

Businesses utilize this form to calculate, report, and remit sales tax specifically associated with the retail sale of insurance and associated benefit plans. Proper use ensures compliance with state and local tax laws and mitigates potential penalties related to tax underreporting.

Steps to Utilization

- Gather Relevant Documents: Collect all necessary paperwork associated with insurance and benefits plans, including policy documents, invoices, and previous tax filings.

- Determine Tax Obligations: Use the form to calculate which parts of the insurance benefits are taxable.

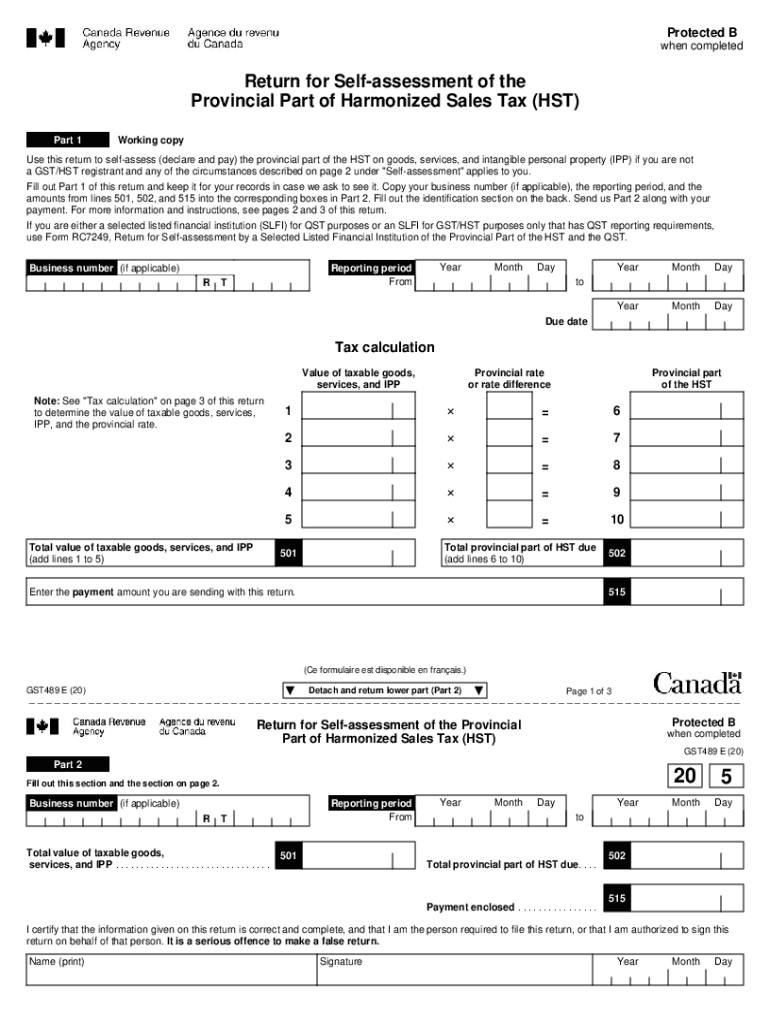

- Fill Out the Form: Complete each section of the form with accurate data, ensuring each payment and taxable item is recorded.

Steps to Complete the Insurance and Benefits PlansRetail Sales Tax

Completing the form correctly involves a clear understanding of the required details and accurate data entry.

Detailed Process

- Review the Instructions: Before filling the form, carefully read through the guidelines to ensure complete understanding of each section.

- Input Sales Information: Start by entering sales data, focusing on items that directly apply to the benefits plans.

- Calculate the Tax: Implement the tax rates as relevant to your state or locality, using tools or software as necessary.

- Double-Check Entries: Verify all entered information for accuracy to avoid errors or discrepancies.

Why Businesses Use the Insurance and Benefits PlansRetail Sales Tax

Businesses are required to report and pay taxes on certain sales associated with insurance and benefits plans as part of statutory tax obligations. Properly completing and submitting this form is crucial for legal compliance and financial planning.

Specific Benefits

- Ensures Compliance: Keeps businesses in line with local and federal tax laws.

- Financial Forecasting: Helps businesses prepare financial statements and forecasts with accurate tax deductions.

Important Terms Related to Insurance and Benefits PlansRetail Sales Tax

Understanding key terms within the form is crucial for accurate completion and compliance.

Glossary

- Taxable Insurance Premiums: Parts of an insurance plan that are subject to sales tax.

- Imputed Income: The value of non-cash employee benefits that may be subject to taxation.

- Exemption Certificates: Documentation granting relief from the payment of taxes on certain goods or services.

Legal Use of the Insurance and Benefits PlansRetail Sales Tax

This form serves as a legal document to declare and remit due taxes. Compliance with the given procedures ensures legality and avoids potential audits or penalties.

Compliance Requirements

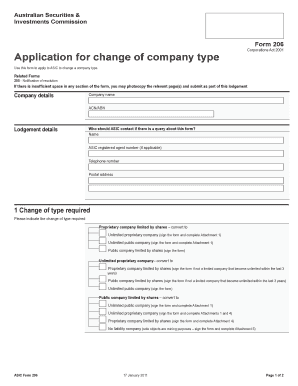

- State Regulations: Varying from state to state, businesses must adhere to specific guidelines that determine what components are taxed.

- Audit Trails: Maintain records of all submitted forms in case of an audit.

Filing Deadlines / Important Dates

Meeting deadlines is crucial to avoid penalties. The deadlines and dates are determined by the state and can influence reporting obligations.

Submission Timeline

- Quarterly Deadlines: Often, these forms are due quarterly but can vary, so businesses must check specific dates pertinent to their location.

- Penalty Dates: Be aware of late submission penalties or fees and ensure timely filing to avoid these.

State-Specific Rules for the Insurance and Benefits PlansRetail Sales Tax

Each state may have different rules pertaining to what parts of the insurance and benefits plans are taxable, thus affecting the form's preparation and submission process.

Examples of Variances

- Tax Rates: Different states impose different tax rates and requirements for insurance benefits.

- Exemptions: Some states may offer specific exemptions for certain types of insurance or benefits plans.

Comprehensive understanding of each relevant section is critical for any business dealing with retail sales tax related to insurance and benefits plans, ensuring compliance while maximizing efficiency and accuracy in their reports.