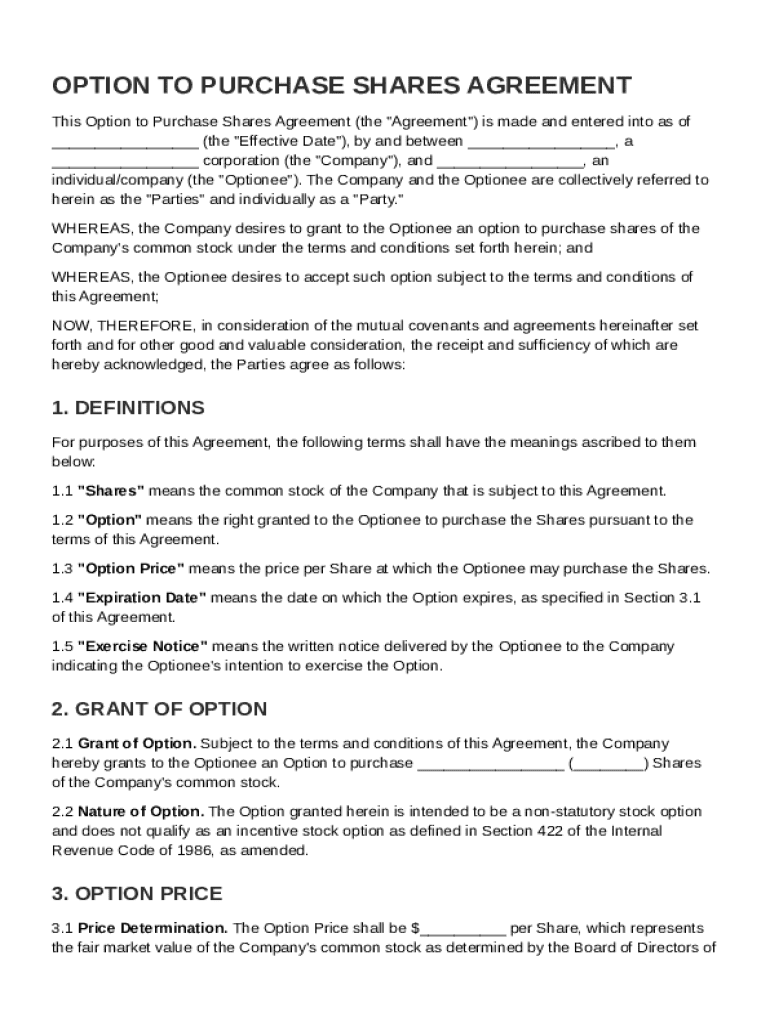

Key Elements of the Option to Purchase Shares Agreement Template

The Option to Purchase Shares Agreement Template is designed to detail the terms under which an optionee can acquire shares from a company. Here, several critical components make up this agreement:

-

Definitions: Clearly explains the terms used throughout the agreement, such as 'Optionee,' 'Company,' 'Shares,' and 'Exercise Price.' This section ensures both parties have a mutual understanding of key terms.

-

Exercise Conditions: Details the specific requirements that must be met for the optionee to exercise their rights to purchase shares, including the timeframe and any performance-based criteria.

-

Payment Terms: Outlines how and when the optionee must pay for the shares upon exercising the option, along with any penalties for late payment.

-

Representations and Warranties: Both parties provide assurances pertaining to their authority and capacity to execute the agreement.

-

Termination Events: Specifies the events that could lead to the termination of the agreement, such as insolvency or breach of terms.

Legal Use of the Option to Purchase Shares Agreement Template

Understanding the legal framework surrounding the Option to Purchase Shares Agreement Template is vital for all involved parties:

-

Non-Statutory Nature: This agreement is classified as non-statutory, meaning it does not confer the tax advantages associated with statutory options.

-

Governing Law: Typically, the agreement will specify which jurisdiction’s laws govern the contract, often aligning with the company's headquarters or main business operations.

-

Entire Agreement Clause: Confirms that the option agreement represents the full understanding between parties and supersedes any prior agreements.

-

Compliance with Securities Laws: Parties must ensure the agreement complies with U.S. federal and state securities laws, which may require registration or specific disclosures.

Steps to Complete the Option to Purchase Shares Agreement Template

Completing this template involves several detailed steps:

-

Fill in Parties’ Details: Enter the legal names and contact information of both the company and the optionee.

-

Specify Share Details: Identify the specific shares subject to the option, including type and total number.

-

Define Exercise Price: Clearly state the price per share that the optionee must pay to exercise the option.

-

Set Terms and Conditions: Outline all conditions related to the option exercise, payment terms, expiration, and termination clauses.

-

Review Legal Provisions: Ensure all legal frameworks, such as non-statutory classification and governing law, are appropriately documented.

-

Signatures: Finalize the agreement with authorized signatures from both parties.

Who Typically Uses the Option to Purchase Shares Agreement Template

This template is commonly utilized by various entities and individuals, including:

-

Startups and Small Businesses: Often use share options as an incentive for attracting and retaining key talent, especially when cash compensation is limited.

-

Investors: Make use of such agreements to secure favorable terms for purchasing potential future equity.

-

Executives: Typically receive stock options as part of their compensation package to align their interests with the company's performance.

-

Legal Advisors: Use and advise on the drafting and execution of such agreements to ensure they meet legal standards and align with business objectives.

Important Terms Related to the Option to Purchase Shares Agreement Template

Several terms are commonly associated with this agreement:

-

Option Agreement Date: The specific date when the option agreement is executed.

-

Vesting Schedule: Dictates when shares become eligible to be purchased, often contingent upon time or performance metrics.

-

Clawback Provision: Allows the company to reclaim shares or benefits if certain conditions occur, such as employment termination.

-

Right of First Refusal: Allows the company a chance to purchase the shares back before the optionee sells to another party.

Business Types That Benefit Most from the Option to Purchase Shares Agreement Template

Certain business structures find significant advantages from employing this agreement type:

-

Corporations: Utilize share options to manage equity distribution and incentivize growth.

-

Limited Liability Companies (LLCs): May offer options when seeking to transition to corporate status, allowing for future equity compensation.

-

Partnerships with Growth Objectives: Implement share options as a mechanism to transition into a corporate structure for clearer ownership distribution.

Digital vs. Paper Version

The move from traditional paper versions to digital formats offers several benefits:

-

Ease of Editing: Digital versions allow for quick updates or amendments to the agreement, providing flexibility to accommodate changes.

-

Security and Accessibility: With platforms like DocHub, digital agreements are securely stored and easily accessible for all authorized parties, ensuring compliance and record-keeping.

-

Tracking and Management: Digital tools offer real-time tracking of document changes and approvals, vital for maintaining version control and transparency.

State-by-State Differences

The Option to Purchase Shares Agreement may be subject to varying regulations across different states:

-

Securities Regulations: Diverse state securities laws may mandate specific filings or disclosures, including 'Blue Sky' laws.

-

Tax Considerations: Differences in state tax laws may impact how stock options are taxed, influencing both the company and optionee’s financial planning.

-

Employment Laws: Certain states have specific provisions affecting equity compensation tied to employment conditions and rights.

Versions or Alternatives to the Option to Purchase Shares Agreement Template

Businesses and individuals might explore variations or alternatives:

-

Standard Stock Option Agreement: For statutory options, offering tax benefits under certain qualifications.

-

Restricted Stock Units (RSUs): As a form of contingent equity, representing shares awarded without upfront payment requirement.

-

Employee Stock Purchase Plans (ESPPs): Allow employees to purchase stock, often at a discounted rate.

-

Convertible Notes: As an alternative financing mechanism, potentially convertible into equity at a later date.

Examples of Using the Option to Purchase Shares Agreement Template

Practical scenarios illustrate common uses of this agreement:

-

Scenario One: Startups offering share options attract tech talent unable to commit to high salaries by promising potential equity stakes.

-

Scenario Two: An early-stage firm offering investors options to purchase additional shares should the company meet performance targets, thus driving initial investment interest.

-

Scenario Three: A high-growth company implementing options to retain key executives by aligning their long-term financial success with company performance metrics.