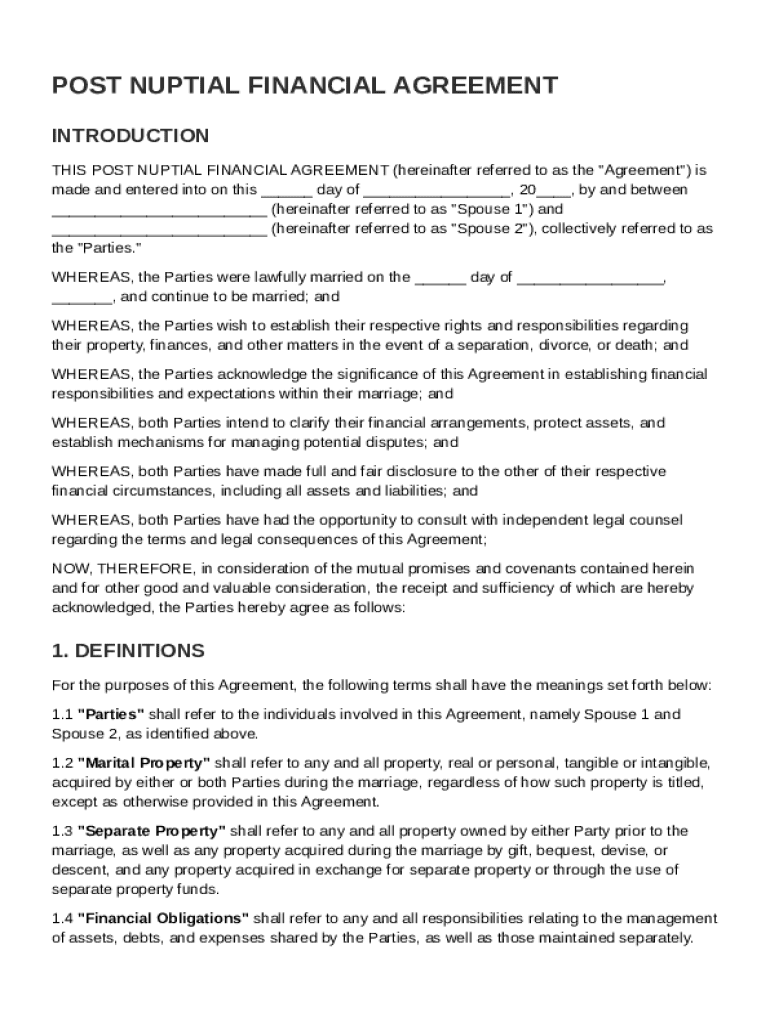

Definition & Meaning

A Post Nuptial Financial Agreement, also referred to as a postnup, is a legal document designed for married couples to outline the division of assets, financial responsibilities, and other relevant matters in the event of a separation, divorce, or death. This agreement can define what constitutes marital and separate property, assign financial obligations, and establish rules for spousal support and debt management. Unlike prenuptial agreements, which are signed before marriage, postnups are executed after the marriage has taken place. This distinction can be crucial for couples who did not have a prenuptial agreement or whose financial circumstances have changed significantly during the marriage.

Specific Objectives

- Property Division: Clarifies which assets are considered joint or separate, reducing disputes.

- Debt Management: Details the handling of existing and future debts, offering clear responsibility guidelines.

- Spousal Support: Provides terms for potential alimony or support, based on mutual agreement.

- Dispute Resolution: Establishes mechanisms for resolving disagreements, potentially avoiding costly legal battles.

Key Elements of the Post Nuptial Financial Agreement Template

Each postnuptial agreement should include specific key elements to ensure it comprehensively addresses the couple's financial landscape and personal circumstances.

Essential Components

- Marital vs. Separate Property: Clearly defines which assets are joint and owned individually.

- Spousal Support Terms: Specifies conditions under which alimony is applicable.

- Debt Responsibilities: Outlines who is responsible for existing or future debts incurred during the marriage.

- Asset Distribution: Lists how different types of assets will be divided in the event of a separation.

Additional Provisions

- Business Interests: If applicable, details the handling of business interests and ownership stakes.

- Inheritance Plans: Confirms any preexisting arrangements about inheritances.

- Dispute Resolution Mechanisms: Provides methods for mediation or arbitration to resolve conflicts.

Steps to Complete the Post Nuptial Financial Agreement Template

Creating a comprehensive postnuptial agreement involves several detailed steps to ensure that both parties' interests are clearly articulated and legally protected.

Step-by-Step Guide

- Initial Discussion: Couples should discuss and mutually agree on the need for a postnuptial agreement.

- Consultation with Attorneys: Each spouse should seek independent legal counsel to understand their rights and obligations.

- Information Gathering: Compile detailed financial records, including assets, liabilities, and income sources.

- Drafting the Agreement: Work with legal professionals to draft the agreement, incorporating all essential elements.

- Review and Revise: Each party reviews the draft, making necessary revisions to reflect mutual interests.

- Final Review: Conduct a thorough review with attorneys to ensure legality and comprehensiveness.

- Signing: Both parties sign the agreement in the presence of a notary public to validate the document.

Legal Use of the Post Nuptial Financial Agreement Template

Postnuptial agreements are legally binding documents in the United States, provided they are drafted accurately and signed voluntarily by both parties. They must be executed with an awareness of the laws of the relevant state, as requirements and enforceability can differ significantly.

Legal Considerations

- Voluntary Execution: Both parties must sign willingly without duress or coercion.

- Full Disclosure: Complete transparency of all financial information is required to prevent future challenges.

- Fairness: Courts will typically evaluate the agreement for fairness at the time of execution.

State-Specific Rules for the Post Nuptial Financial Agreement Template

State laws govern the enforceability and requirements of postnuptial agreements, leading to variations across different jurisdictions in the U.S.

Variations Across States

- Formalities: Some states may have unique requirements such as the need for witnesses in addition to a notary public.

- Property Distinctions: States may differ in how they classify community property and separate property.

- Public Policy: Certain clauses, like those that potentially encourage divorce, may not be enforceable in some jurisdictions.

Important Terms Related to the Post Nuptial Financial Agreement Template

Understanding terminology is crucial when drafting or reviewing a postnuptial agreement to ensure clarity and precision.

Common Terms

- Equitable Distribution: A legal principle for fair asset division during divorce proceedings.

- Alimony: Financial support provided to a spouse post-divorce, as outlined in the agreement.

- Separate Property: Assets owned individually by a spouse, not subject to division.

- Marital Property: Assets acquired during the marriage, considered part of the joint estate.

Examples of Using the Post Nuptial Financial Agreement Template

Postnups can be utilized in various scenarios to effectively manage marital finances and responsibilities.

Real-World Scenarios

- Business Encounters: A couple might sign a postnup when one spouse starts a new business to protect entrepreneurial assets.

- Inheritance Planning: When couples receive substantial inheritances and wish to define these as separate property.

- Financial Windfalls: Postnuptial agreements can be drafted after unexpected financial gains, like lottery winnings.

Software Compatibility (Digital vs. Paper Version)

With advancements in digital documentation platforms, creating and managing postnuptial agreements can be done efficiently online.

Online Tools

- Document Editing: Platforms like DocHub provide online tools for editing and managing digital agreements.

- Integration with Cloud Services: Use cloud storage options like Google Drive for secure document management.

- Legally Binding Digital Signatures: Platforms enable legally binding e-signatures, ensuring authenticity and compliance.