Definition & Meaning

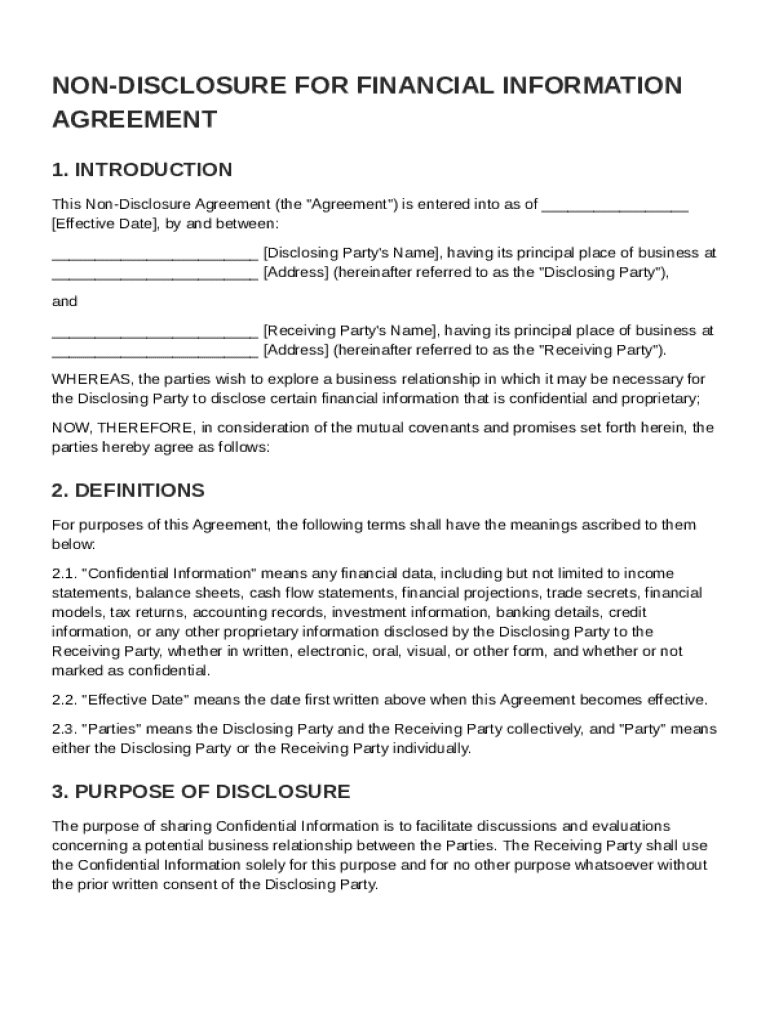

A Non-Disclosure Agreement (NDA) for financial information is a legal document designed to protect sensitive financial data shared between parties, typically in anticipation of a potential business relationship. This agreement helps ensure that confidential information is not disclosed to unauthorized individuals or entities. The NDA for financial information becomes especially crucial in maintaining the integrity and confidentiality of proprietary business details. It establishes obligations for both the Disclosing Party and the Receiving Party, ensuring that the information shared is used solely for its intended purpose, contributing to trust and collaboration in business dealings.

Key Characteristics

- Confidential Information: This section defines what constitutes confidential financial information, which may include income statements, client lists, financial projections, and proprietary financial systems.

- Parties Involved: Identifies the Disclosing Party, who owns the information, and the Receiving Party, who gains access under specific conditions.

How to Use the Non-Disclosure for Financial Information Agreement Template

Understanding the Template's Structure

This template typically includes several key sections: an introduction, definitions, confidentiality obligations, exclusions, and general provisions, among others. Each section plays a crucial role in ensuring comprehensive coverage of the parties' rights and obligations.

Step-by-Step Instructions

- Customize the Template: Insert the legal names and details of the parties involved.

- Define Confidential Information: Clearly specify what financial data is considered confidential.

- Set the Duration: Determine the period during which the information must remain confidential.

- Outline Obligations and Exclusions: Establish the responsibilities of the Receiving Party, along with any exclusions from confidentiality.

- Legal Review: It is advisable to have a legal professional review the document for compliance and completion.

Why Use a Non-Disclosure for Financial Information Agreement Template

Benefits of the Template

Using a template streamlines the creation of an NDA by providing a structured format that covers all essential aspects. This approach saves time and ensures no important details are overlooked, reducing the risk of legal disputes.

Key Advantages

- Time Efficiency: Templates allow for quick and easy customization.

- Legal Protection: Helps ensure both parties are legally safeguarded.

- Clarity and Structure: Provides a clear outline of obligations, thereby reducing potential misunderstandings.

Who Typically Uses the Non-Disclosure for Financial Information Agreement Template

Common Users

NDAs for financial information are often employed by businesses of all sizes, start-ups, freelancers, and consultants. Any entity or individual planning to share sensitive financial data can benefit from this template.

Scenarios of Use

- Business Mergers: Companies negotiating mergers or acquisitions often use NDAs to protect financial information.

- Partnering Firms: Collaborating businesses sharing strategic financial data.

- Consultants and Advisors: Freelancers or independent consultants accessing confidential client financials.

Key Elements of the Non-Disclosure for Financial Information Agreement Template

Essential Components

These agreements typically consist of certain critical elements necessary for legal enforceability:

- Identifying Information: Details of the parties involved and the subject matter of confidentiality.

- Definitions Section: Clarification of terms used within the agreement, especially "Confidential Information."

- Obligations of the Receiving Party: Steps the receiving party must take to safeguard confidential data.

- Duration and Termination: Specifies how long confidentiality must be maintained and circumstances under which the agreement can be terminated.

Legal Use of the Non-Disclosure for Financial Information Agreement Template

Legal Framework

The NDA must comply with applicable laws to be enforceable. Typically acknowledged under contract law, this agreement is subject to local jurisdictional regulations regarding confidentiality and trade secrets.

Ensuring Enforceability

- Clear Language: Use precise and understandable language to prevent misinterpretations.

- Inclusion of Governing Law Clause: Specify which state’s laws will apply in case of disputes.

State-Specific Rules for the Non-Disclosure for Financial Information Agreement

Variability Across States

While the general structure of an NDA remains consistent, there can be state-specific variations that impact enforcement. For instance, California's laws are particularly stringent about employee NDAs.

Critical Differences

- Non-Compete Clauses: Some states impose specific requirements or limitations on non-compete agreements included in NDAs.

- Trade Secret Protection: States like Massachusetts and Florida have particular definitions and protections for trade secrets, affecting NDA terms.

Software Compatibility for Non-Disclosure Agreement Templates

Platforms and Tools

A variety of software platforms are available to create and manage NDAs.

- DocHub: Facilitates easy creation, customization, and signing of NDAs online.

- Compatibility with Document Formats: Supports PDF, DOC, and other common file types for convenient access and sharing.

Using Technology to Enhance NDAs

- Digital Signing: Legally binding electronic signatures streamline the signing process.

- Cloud Storage: Secure online storage ensures that NDAs are easily accessible and safely stored.

By selecting these relevant blocks and following the headings and content structure guidelines, one can provide a thorough and detailed explanation of the Non-Disclosure Agreement for financial information, ensuring users can easily understand and utilize the template.