Definition & Meaning

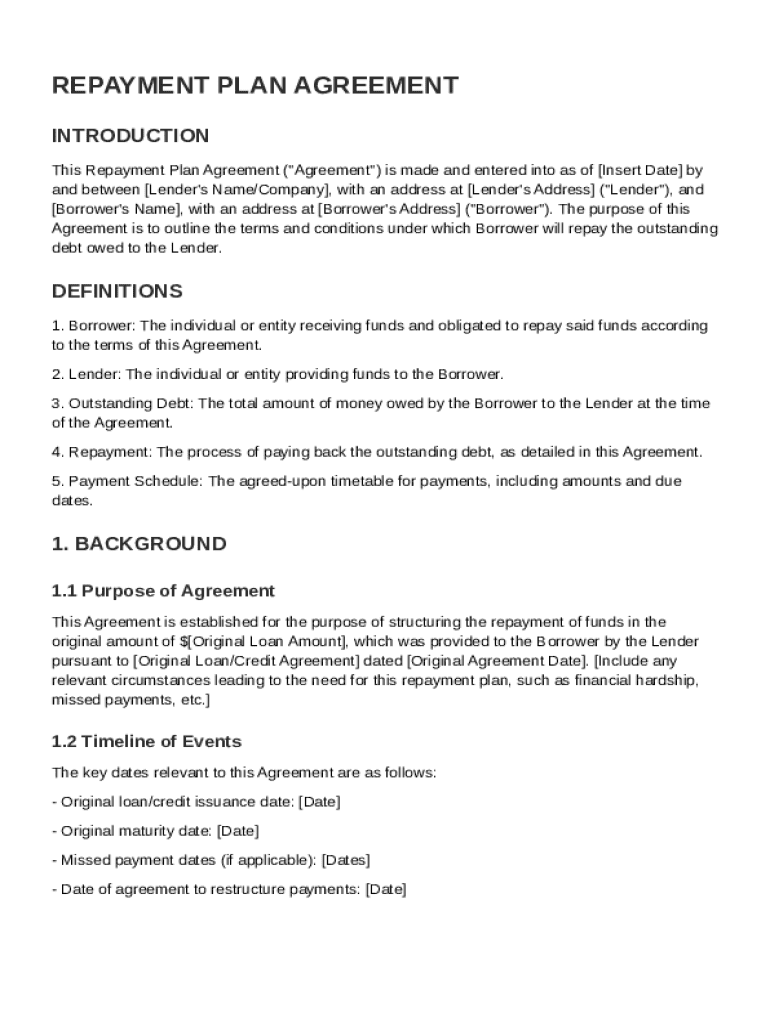

The "Repayment Plan Agreement Template" is a formal document that sets forth the terms and conditions under which a borrower will repay an outstanding debt to a lender. It offers a structured approach to debt repayment, ensuring both parties understand their responsibilities and obligations. The template typically includes crucial sections such as definitions of key terms, a background on the original loan arrangement, missed payments, and the negotiated repayment terms. These terms often cover the total amount owed, payment amounts and schedules, interest rates, and penalties for late payments. Clear articulation of these elements helps maintain transparency and fosters a cooperative relationship between lender and borrower.

Key Elements of the Repayment Plan Agreement Template

Understanding the primary components of the repayment plan agreement template can greatly enhance its effectiveness. Key elements include:

- Definitions: Clarify critical terms used within the document to avoid ambiguity.

- Loan Background: Detail the original loan terms and circumstances leading to the current repayment plan.

- Repayment Terms: Specify the total amount owed, including principal and interest, along with the payment schedule.

- Interest Rates: State the applicable interest rate and how it affects the total repayment.

- Penalties: Outline any penalties for missed or late payments, ensuring compliance is incentivized.

- Payment Methods: Discuss acceptable forms of payment and procedures for amendments to the agreement.

- Governing Law: Identify the legal jurisdiction applicable to the agreement, typically aligning with the lender’s location.

Steps to Complete the Repayment Plan Agreement Template

Filling out a repayment plan agreement template involves several methodical steps to ensure correctness and enforceability:

- Gather Required Information: Collect all relevant data, including borrower and lender details, initial loan terms, and outstanding balance.

- Define Key Terms: Clearly specify terms such as "borrower," "lender," "repayment period," and others that will be used throughout the agreement.

- Outline Repayment Conditions: Detail the repayment timeline, amounts, interest rates, and penalties.

- Review Legal Provisions: Ensure all legal aspects, including governing law and amendment procedures, are clearly defined.

- Confirm and Sign: Both parties should review the filled template, make necessary adjustments, and sign the document to establish a binding agreement.

Important Terms Related to Repayment Plan Agreement Template

The terminology used in a repayment plan agreement is vital for ensuring all parties involved have a mutual understanding. Terms frequently encountered in these documents include:

- Principal: The original sum of money borrowed, excluding interest or fees.

- Interest: The additional cost of borrowing money, expressed as a percentage of the principal.

- Amendment: Modifications to the original agreement terms, requiring consent from all involved parties.

- Default: Failure to meet the legal obligations of the agreement, such as missing scheduled payments.

- Governing Law: The jurisdiction under whose laws the agreement is enforceable.

Legal Use of the Repayment Plan Agreement Template

To be legally binding, repayment plan agreements must adhere to state and federal laws and often require the inclusion of specific terms and conditions:

- Compliance with Lending Laws: Ensure the terms conform to applicable state and federal lending regulations.

- Legal Enforceability: Contracts must meet formal legal requirements, including signatures from authorized representatives.

- Fairness and Consistency: Provisions must not be unconscionable or overly burdensome to any party involved.

Who Typically Uses the Repayment Plan Agreement Template

Several types of borrowers and lenders may find repayment plan agreements beneficial:

- Financial Institutions: Banks and credit unions use these agreements to restructure debts.

- Personal Lenders: Individuals lending money to friends or family can use the template to formalize repayment terms.

- Businesses: Commercial entities may employ such agreements when setting deferred payments with clients or debtors.

- Educational Institutions: Schools may utilize repayment plans for student loans.

Examples of Using the Repayment Plan Agreement Template

Real-world applications illustrate the versatility of the repayment plan agreement template:

- Debt Negotiation: A borrower facing financial challenges negotiates a new payment schedule, incorporating new terms in the agreement.

- Loan Consolidation: Consolidating multiple loans into a single payment involves restructuring terms under one comprehensive agreement.

- Litigation Avoidance: A lender agreeing to payment modifications to avoid legal actions can formally document the terms using this template.

State-by-State Differences

Repayment plan agreements must consider varying legal requirements across different jurisdictions. Some elements that might vary include:

- Interest Rate Limits: Each state has its own regulations concerning maximum allowable interest rates.

- Enforcement Procedures: Different jurisdictions have unique methods and protocols for enforcing debt collection agreements.

- Consumer Protections: States provide specific protections that influence the permissible terms of loan agreements and repayment plans.