Definition & Meaning

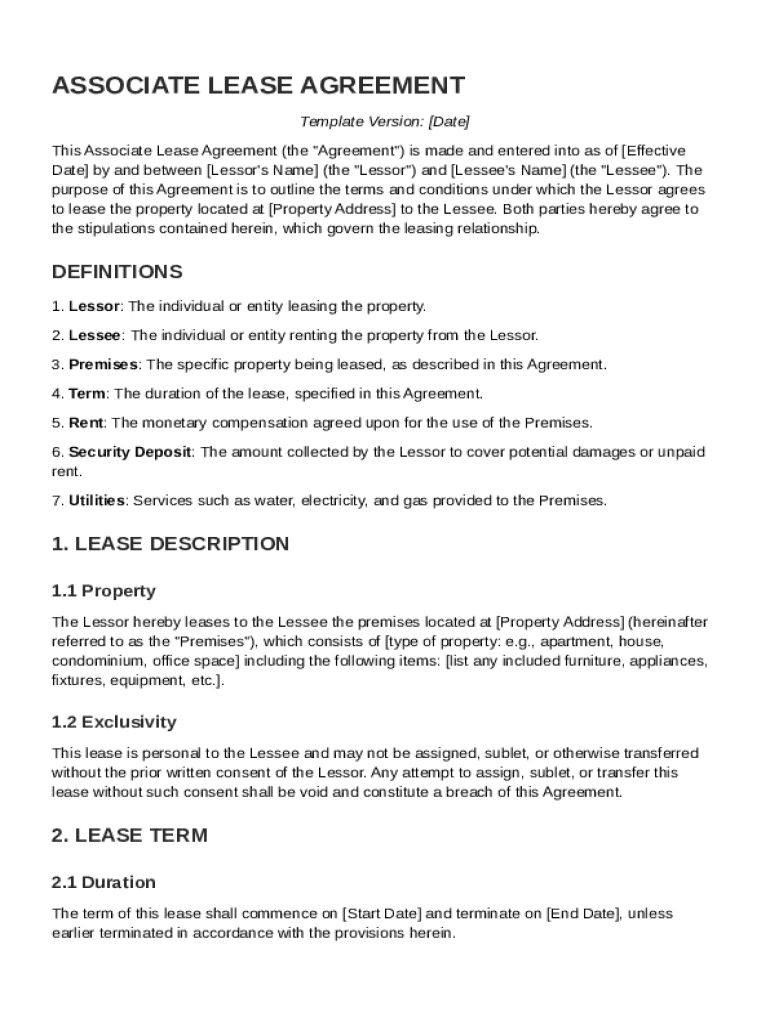

The "Associate Lease Agreement Template" is a legal document used to formalize the leasing arrangement between a lessor (property owner) and a lessee (tenant). It delineates the terms and conditions under which the property is leased, including the rights and obligations of each party. This essential document ensures that both the lessor and lessee have a mutual understanding of all contractual elements, reducing the risk of disputes. Key components typically covered include the lease duration, payment structure, maintenance responsibilities, and termination procedures.

How to Use the Associate Lease Agreement Template

Utilizing the Associate Lease Agreement Template effectively involves several steps to ensure all necessary components are accurately reflected:

-

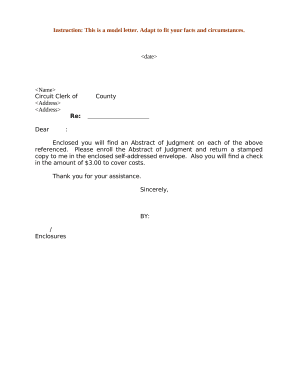

Review Standard Terms: Before customization, familiarize yourself with the standard terms and conditions included in the template. This ensures you understand the common clauses applicable to most lease agreements.

-

Customize Specific Details: Enter specific details such as property address, lease term duration, and rental amount. Tailor the template to the unique aspects of your leasing arrangement.

-

Incorporate Additional Clauses: If needed, add any custom clauses or conditions that are specific to your agreement. This might include pet policies, landscaping responsibilities, or modifications to the premises.

-

Legal Review: It's advisable to have a legal professional review the finalized document to ensure its compliance with local laws and regulations.

-

Execution: Both parties should sign the agreement to make it legally binding. Copies should be retained by both the lessor and lessee for their records.

Steps to Complete the Associate Lease Agreement Template

Completing the Associate Lease Agreement Template involves a systematic approach to ensure all sections are filled accurately:

-

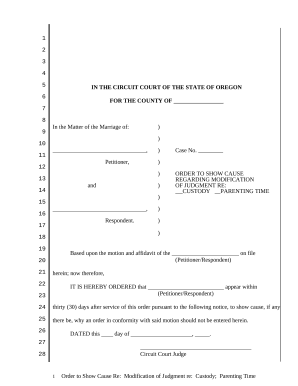

Identify the Parties: Clearly list the full names and contact information of both the lessor and lessee.

-

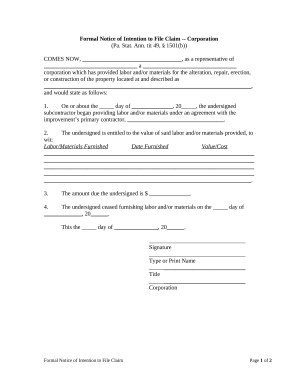

Property Description: Provide a detailed description of the leased property, including address and any included amenities or furnishings.

-

Specify Lease Terms: Clearly state the lease term, including start and end dates, and conditions for renewal if applicable.

-

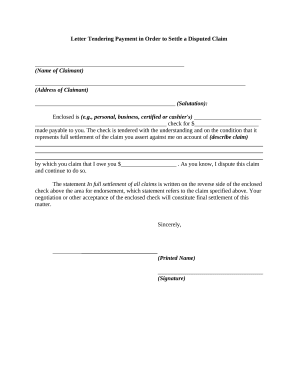

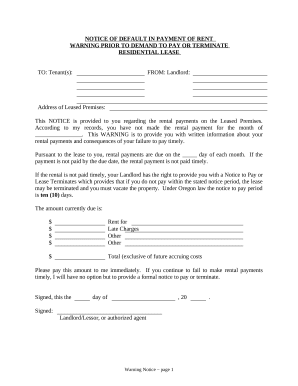

Set Payment Details: Define the rent amount, payment schedule, accepted payment methods, and any penalties for late payments.

-

Outline Responsibilities: Detail the maintenance duties of both parties, specifying who is responsible for repairs and utilities.

-

Include Termination Clauses: Establish the conditions under which the lease can be terminated by either party, including notice periods and any penalties.

-

Finalize with Signatures: Once both parties agree on all terms, they should sign and date the document in the presence of a witness if required.

Key Elements of the Associate Lease Agreement Template

The Associate Lease Agreement Template includes critical elements that ensure clarity and comprehensiveness:

- Definitions Section: Clarifies the terms used in the lease to avoid any ambiguity.

- Rent Payment Details: Includes the amount, due dates, and consequences of late payments.

- Duration and Renewal Options: Specifies the length of the lease and conditions under which it can be renewed or extended.

- Security Deposit Terms: Outlines the amount of the security deposit and conditions for its return.

- Maintenance and Repairs: Details the responsibilities each party has regarding property upkeep and repairs.

- Termination and Default Clauses: Includes conditions for ending the lease and what constitutes a breach of contract.

Legal Use of the Associate Lease Agreement Template

The legal use of the Associate Lease Agreement Template ensures that the leasing arrangement is both enforceable and compliant with state and federal laws. Key legal considerations include:

-

Compliance with Landlord-Tenant Law: Ensure that the lease agreement adheres to the relevant landlord-tenant laws in your jurisdiction, including fair housing guidelines.

-

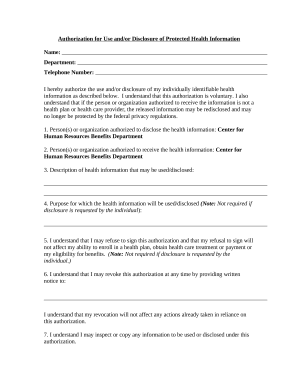

Inclusion of Required Disclosures: Certain disclosures, such as the presence of lead-based paint, must be included to comply with federal regulations.

-

Legally Binding Signatures: For the lease to be legally binding, all signing parties must be competent and sign without any form of duress.

Important Terms Related to the Associate Lease Agreement Template

Familiarity with the following terms is crucial for understanding lease agreements:

- Lessor and Lessee: The respective parties involved in the leasing arrangement; the lessor is the property owner, and the lessee is the tenant.

- Lease Term: The set duration for which the lease agreement is valid.

- Security Deposit: A sum of money held by the lessor to cover potential damages or unpaid rent.

- Premises: Refers to the physical property being leased.

- Default: The failure to fulfill contractual obligations, potentially leading to termination of the lease.

State-Specific Rules for the Associate Lease Agreement Template

Lease agreements must be tailored to comply with state-specific rules, which can vary significantly:

- Security Deposit Limits: Many states regulate the maximum amount a landlord can require as a security deposit.

- Notice Requirements: The amount of notice a landlord or tenant must give to terminate the lease can differ between states.

- Eviction Procedures: Each state has its own legal process for evicting a tenant, including required notices and court procedures.

Examples of Using the Associate Lease Agreement Template

The Associate Lease Agreement Template provides flexibility to accommodate various leasing scenarios. For instance:

- Residential Leases: For apartments, single-family homes, and condominiums.

- Commercial Properties: Suitable for office spaces, retail shops, or industrial purposes.

- Short-term Rentals: Useful for vacation homes or temporary housing.

Each use case will require the template to be tailored to the specific type of property and leasing situation.