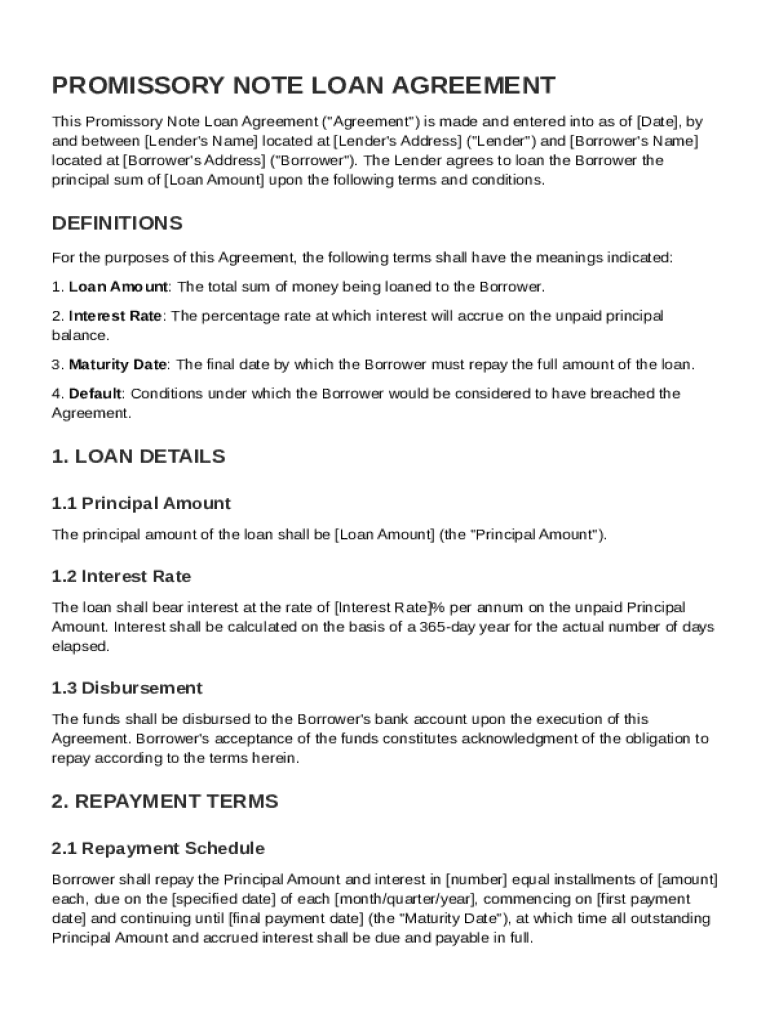

Definition and Meaning of a Promissory Note Loan Agreement Template

A Promissory Note Loan Agreement Template is a document used to formalize a loan transaction between a lender and a borrower. It details the terms of the loan, including the principal amount, interest rate, repayment schedule, and conditions for default. The document ensures both parties are clear about their rights and obligations, providing a legally binding framework for repayment. Typically governed by specific state laws, this template also defines key terms and includes provisions for amendments, notices, severability, and waiver.

Key Aspects of the Agreement

- Principal Amount: The total sum of money that the borrower promises to repay.

- Interest Rate: The percentage charged on the principal amount that the borrower must pay as interest.

- Repayment Schedule: Outlines how and when the borrower will repay the principal and interest.

- Default Conditions: Specifies the circumstances under which the borrower would be considered in default.

How to Use the Promissory Note Loan Agreement Template

The Promissory Note Loan Agreement Template can be employed in various lending scenarios, providing flexibility for both individuals and businesses. Users must fill in specific details about the loan terms to customize the template to fit their needs.

Steps for Customization

- Download the Template: Obtain the template from a reliable source like DocHub.

- Fill in the Loan Details: Customize sections such as the principal amount, interest rate, and repayment schedule.

- Identify Parties: Clearly state the names and contact information of both the borrower and the lender.

- Review Legal Terms: Ensure that all legal provisions align with state-specific requirements.

- Execute the Agreement: Sign the document to make it legally binding.

Key Elements of the Promissory Note Loan Agreement Template

The template contains several critical sections that ensure a comprehensive lending agreement. These elements are essential for protecting both parties' interests.

Important Sections

- Loan Amount and Terms: Details the amount lent and the duration of the loan.

- Interest Rate Clause: Describes the calculation and application of interest.

- Payment Terms: Frequency and method of payments.

- Rights and Responsibilities: Outlines the obligations of both the borrower and lender.

Important Terms Related to Promissory Note Loan Agreements

Understanding the terminology used in a Promissory Note Loan Agreement is crucial for effective communication and comprehension.

Commonly Used Terms

- Lender: The entity providing the loan.

- Borrower: The entity receiving the loan.

- Collateral: An asset used to secure the loan.

- Maturity Date: The date by which the loan must be fully repaid.

Steps to Complete the Promissory Note Loan Agreement Template

To effectively complete the template, follow these systematic steps which ensure accuracy and legal compliance.

Completion Procedure

- Gather Required Information: Collect all necessary details about the loan terms.

- Fill Out the Template: Input the collected information accurately in the correct sections.

- Legal Review: Have the document reviewed by a legal professional to ensure compliance with applicable laws.

- Sign the Agreement: Both parties should sign the document in the presence of witnesses if required.

Legal Use of the Promissory Note Loan Agreement Template

Using the promissory note within legal boundaries is paramount to ensure its enforceability. This involves adhering to state laws and regulatory standards.

Ensuring Legal Compliance

- State Laws: Conform to state-specific regulations governing loan agreements.

- Interest Rate Limitations: Ensure the interest rate does not exceed state-imposed limits.

- Documentation: Keep a notarized or witnessed copy for authenticity.

State-Specific Rules for Promissory Note Loan Agreements

Loan agreements must be adapted to meet varying state legal requirements, impacting the terms and enforceability.

State Considerations

- Usury Laws: Each state imposes maximum allowable interest rates.

- Disclosure Requirements: Some states require specific disclosures to be included.

- Enforcement Mechanisms: Understand the legal process for enforcing a promissory note within each jurisdiction.

Examples of Using the Promissory Note Loan Agreement Template

Real-world scenarios provide clarity and demonstrate the versatility of the template in different settings.

Practical Scenarios

- Personal Loans: Securing a loan between family members without collateral.

- Business Financing: A company lending funds to an employee for professional development.

- Educational Loans: Parents lending to children to cover college expenses.

Providing a robust framework, the Promissory Note Loan Agreement Template ensures that all parties involved in a loan transaction have a clear record of the agreement terms, protecting their respective interests and facilitating smooth financial management.