Definition and Meaning

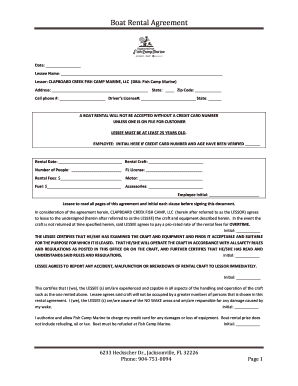

The Individual Long Term Care Claim Form is a document utilized to file claims related to long-term care insurance. This form allows claimants to provide necessary information about the type of care needed, any relevant hospitalization history, and the existing insurance coverage. It serves as a standardized method for communicating these details to the insurance provider, CNA Insurance Companies, or an authorized representative. This ensures that the necessary information is received and processed efficiently.

To fully understand this form's purpose, consider its role as a communication bridge between the claimant and the insurance company. It gathers all pertinent personal and medical information required to assess and approve the claim. In doing so, it protects both parties by documenting the claimant’s needs and the insurance provider's obligations.

How to Use the Individual Long Term Care Claim Form

Using the Individual Long Term Care Claim Form involves a few methodical steps to ensure proper completion and submission. Here’s a step-by-step guide to navigate this process successfully:

-

Obtain the Form: First, acquire the form from CNA Insurance Companies or an authorized representative. It may also be available through the provider’s website or customer service.

-

Complete the Form: Fill out all required sections thoroughly. This includes personal information, specifics of the long-term care needed, and insurance details. Be meticulous to avoid errors that could delay the processing.

-

Attach Required Documents: Collect and attach any supporting documentation, such as medical records or proof of insurance. These attachments are crucial for verifying the details provided.

-

Review and Verify Information: Double-check all entered data for accuracy. An incorrect or incomplete form can lead to delays or claim rejection.

-

Submit the Form: Send the completed form along with any attachments to the designated address or via an electronic submission method specified by CNA Insurance Companies.

-

Follow-Up: After submission, stay in communication with the insurance provider to confirm receipt and track the progress of your claim.

Key Elements of the Individual Long Term Care Claim Form

The form is composed of several key sections that gather essential information. Here’s a breakdown of these sections:

-

Personal Information: Includes the claimant’s full name, address, contact information, and policy number. This data identifies the claimant and links them to their insurance policy.

-

Care Details: Specifies the type of long-term care required, such as home health care, nursing home care, or personal care services. Each type may require distinct information based on the services involved.

-

Medical History: Provides a comprehensive overview of the claimant's medical condition(s) and recent hospitalizations. This supports the need for long-term care.

-

Provider Information: Identifies the healthcare providers involved in delivering care. This includes their contact details and the specifics of services rendered.

-

Authorization and Signature: Claims are validated by the claimant’s signature, authorizing the release of medical information to assess the claim.

Steps to Complete the Individual Long Term Care Claim Form

Completing the Individual Long Term Care Claim Form involves several systematic steps:

-

Gather Personal and Policy Information: This includes your basic identifying details and insurance policy number. Ensuring this information is current and correct is crucial.

-

Detail the Type of Care Required: Outline specific care types you are seeking coverage for, ensuring this aligns with what your policy covers.

-

Document Medical History: Include any conditions that necessitate long-term care, listing recent medical visits or hospitalizations that relate to these conditions.

-

Provide Healthcare Provider Information: List and describe the involved healthcare providers, offering details about the care they’ve provided or will provide.

-

Review the Form: Carefully check the completed form to ensure every section is filled accurately. Missing information or errors could slow processing time.

-

Sign the Form: Affirm the truthfulness and accuracy of the information by signing the document. This signature also authorizes the release of required information.

Required Documents for Submission

Submitting the Individual Long Term Care Claim Form typically necessitates additional documentation to substantiate the claim:

-

Medical Records: Recent medical records that highlight the need for long-term care.

-

Proof of Insurance: A copy of your insurance policy or benefits statement.

-

Service Invoices or Receipts: If applicable, provide invoices from care providers to evidence the incurred costs.

-

Physician’s Statement: In some cases, a physician’s assessment or statement of necessity for long-term care is required.

Form Submission Methods

The Individual Long Term Care Claim Form can be submitted through various channels:

-

Mail: Traditional mailing to the address provided by CNA Insurance Companies.

-

Online Submission: An electronic submission may be available through the insurer's website, ensuring faster processing times.

-

In-Person: If advised, submit the form in person at a designated location for personal assistance.

Legal Use of the Individual Long Term Care Claim Form

The use of the form adheres to specific legal guidelines to ensure authenticity and prevent fraud:

-

Legally Binding: The information provided becomes part of a legal document binding both the claimant and the insurer to the agreed terms.

-

Authorization for Information Release: Signing the form allows healthcare providers to share necessary medical information with the insurer, which is crucial for claim assessment.

Who Typically Uses the Individual Long Term Care Claim Form

This claim form is predominantly used by individuals seeking to access benefits under a long-term care insurance policy. This includes:

-

Elderly Individuals: Seniors who require ongoing healthcare assistance.

-

Disabled Persons: Individuals with disabilities that necessitate long-term care services.

-

Caregivers Acting on Behalf of Claimants: Spouses, family members, or legal guardians managing claims for those unable to do so themselves due to health reasons.

Understanding the audience and their unique needs ensures the form is completed and used in the most advantageous manner.