Definition and Meaning of Restraining Leviathan

Restraining Leviathan refers to the concept of imposing limits on government power to enhance fiscal responsibility and efficiency. This term is often associated with measures to control government spending, reduce deficits, and ensure accountability through structured rules and regulations. In the fiscal context, it implies instituting checks and balances on government budgets to prevent unnecessary and potentially harmful financial practices.

How to Use the Restraining Leviathan

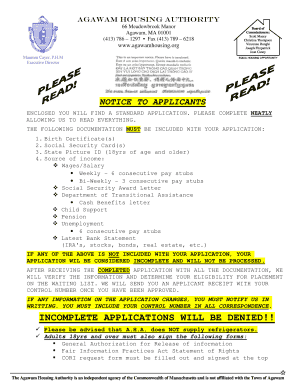

To effectively implement the principles of Restraining Leviathan, governments and organizations need a strategic approach. These steps often involve adopting fiscal policies that prioritize the reduction of public debt and the achievement of budget surpluses. Tools such as expenditure caps, budget rules, and transparency initiatives help enforce these principles. Stakeholders should focus on incorporating citizen input and ensuring policies align with long-term economic goals.

Key Elements of the Restraining Leviathan

The success of Restraining Leviathan relies on several critical elements:

- Tax and Expenditure Limitation Rules (TELs): These rules cap the rate of growth in government revenue and spending.

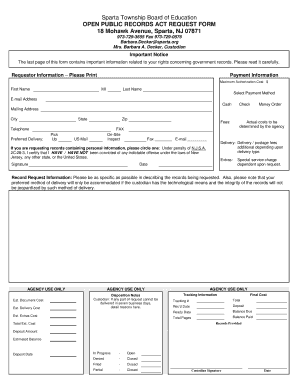

- Fiscal Transparency: Regular reporting and openness about government finances help build public trust and ensure accountability.

- Public Debt Limits: Setting strict limits on the amount and growth rate of national or local government debt.

- Performance-Based Budgeting: Allocating resources based on efficiency and effectiveness, focusing on outcomes rather than inputs.

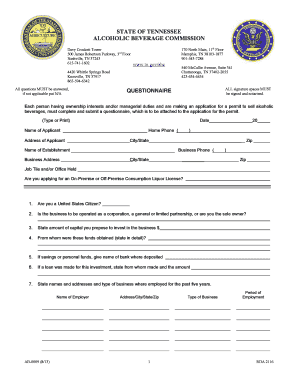

Legal Use of the Restraining Leviathan

In the United States, implementing Restraining Leviathan principles often involves legal frameworks that restrict fiscal mismanagement. Municipal charters and state constitutions sometimes embed TELs or similar stipulations to legally bind government entities to fiscal discipline. This legal grounding ensures that political changes do not easily overturn established financial prudence measures.

Important Terms Related to Restraining Leviathan

Understanding critical terminology is essential for those involved in fiscal policy or studying budgeting frameworks:

- Fiscal Responsibility Act (FRA): Legislation that often embodies Restraining Leviathan's principles.

- Balanced Budget Requirement: A mandate for governments to not spend more than their income.

- Deficit Spending: When government expenditures exceed revenue, necessitating borrowing.

- Budgetary Discipline: Commitment to policies that prevent unsustainable financial practices.

Examples of Using the Restraining Leviathan

A practical example of Restraining Leviathan in action is New Zealand's Fiscal Responsibility Act 1994, which successfully reduced public debt and achieved fiscal surpluses. U.S. states like Colorado have implemented TELs through measures like the Taxpayer's Bill of Rights (TABOR), illustrating Restraining Leviathan's applicability in diverse governance contexts.

Penalties for Non-Compliance

Non-compliance with Restraining Leviathan mandates or similar fiscal discipline measures can result in several penalties:

- Financial Penalties: Government entities might incur fines or reductions in federal aid.

- Increased Borrowing Costs: Non-compliance can lead to credit rating downgrades, raising the cost of future borrowing.

- Political Repercussions: Elected officials and governments may face a loss of public trust and political capital.

State-Specific Rules for the Restraining Leviathan

Different U.S. states have unique interpretations and implementations of Restraining Leviathan. For example, states like California incorporate balanced budget requirements directly into their constitution. Conversely, states like Texas adopt more pragmatic approaches, focusing on expenditure limitations without formal constitutional amendments. These distinctions underline the importance of understanding state-specific contexts for fiscal management.

Taxpayer Scenarios Impacted by Restraining Leviathan

Restraining Leviathan affects various taxpayer groups differently, depending on their roles and financial responsibilities.

- Businesses: Entities benefit from stable tax policies and reduced uncertainty in government spending.

- Individuals: Residents may experience varying levels of public service depending on how spending constraints affect governmental operations.

- Government Employees: Changes in fiscal policy might influence job security or resource allocation within government agencies.

Software Compatibility and Restraining Leviathan

Organizations and individuals can use software like QuickBooks and TurboTax to align personal and business finances with Restraining Leviathan principles. These tools often support features such as budget tracking, expenditure categorization, and financial forecasting, which help adhere to established fiscal responsibility guidelines. Advanced analytics provided by such platforms aid in understanding and implementing disciplined budgeting practices.