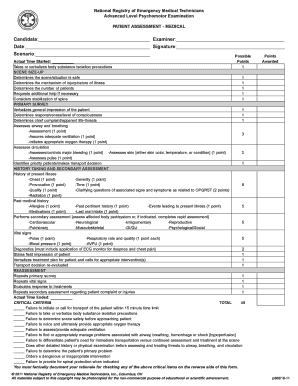

Definition & Meaning

The "Over 80 Pension Form BR2488" is a critical document for individuals who are claiming the over-80 State Pension in Northern Ireland. It is designed to collect detailed information about the claimant and their spouse or civil partner, ensuring that the necessary criteria for pension eligibility are met. This form is integral in the pension application process, as it gathers essential data such as personal and tax information, benefits previously received, hospital admissions, and living arrangements. Ensuring correct and complete data avoids delays in receiving pension benefits.

How to Use the Over 80 Pension Form BR2488

To effectively use the Over 80 Pension Form BR2488, applicants should start by carefully reading through the instructions provided within the document. This ensures a comprehensive understanding of what is required in each section. Begin by filling in personal details, followed by sections on financial history and living circumstances. Applicants should confirm that all information provided is accurate and up-to-date, as discrepancies can lead to delays. Including any significant changes in personal circumstances since the last claim is also critical for an accurate benefit assessment.

Practical Tips for Completion

- Break down the form into sections; tackle each section one at a time.

- Use accurate and legible handwriting or a typewriter for clarity.

- Double-check financial figures and dates to ensure precision.

How to Obtain the Over 80 Pension Form BR2488

Acquiring the Over 80 Pension Form BR2488 is accessible through the NIDirect government website, which offers a downloadable PDF version. For those who prefer a physical copy, forms can be requested directly through local benefits offices in Northern Ireland. In some cases, it may be possible to order a copy via telephone or through assistance from family or social care workers, who can facilitate the process on behalf of senior citizens.

Steps to Complete the Over 80 Pension Form BR2488

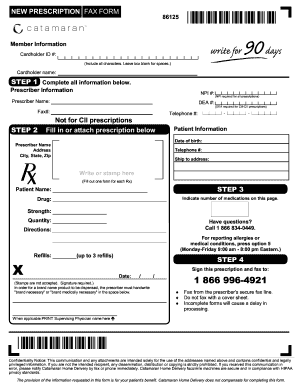

Completing the Over 80 Pension Form BR2488 involves a structured, multi-step process:

- Gather Required Information: Assemble all necessary documentation, including identity proofs, tax records, and previous benefit information.

- Fill in Personal Details: Start with personal identification, including name, date of birth, and National Insurance number.

- Detail Financial Information: Provide accurate details of financial circumstances, including income, savings, and any other benefits received.

- Health and Living Situations: Disclose any hospital stays and current living arrangements.

- Review and Submit: Thoroughly review the completed form for errors or omissions before submission.

Key Elements of the Over 80 Pension Form BR2488

The form is structured to include several key sections that gather necessary information for processing pension claims:

- Personal Identification: Details of the claimant and any associated partner.

- Financial and Tax Information: Income details, along with any tax references or benefits previously received.

- Health and Housing Circumstances: Current living arrangements and any recent hospital admissions.

- Verification and Declarations: Mandatory declarations confirming the accuracy and truthfulness of the information provided.

Legal Use of the Over 80 Pension Form BR2488

The BR2488 form serves as a legal document within the pension application process. It lays the groundwork for verifying eligibility and authorizing pension payments. It is vital that all information submitted is truthful and accurate, as falsification may lead to legal consequences, including potential penalties or discontinuation of benefits. The form must comply with all regulatory requirements as stipulated by Northern Ireland’s pension authority.

Important Terms Related to Over 80 Pension Form BR2488

- Claimant: The individual applying for the pension benefits.

- Spouse or Civil Partner: The legal partner of the claimant who might influence pension eligibility.

- National Insurance Number: A unique number allocated to individuals in the UK for social security and tax purposes.

- Pension Authority: The government body responsible for administering pension schemes.

Eligibility Criteria

Eligibility for the over-80 pension is contingent upon specific criteria stipulated within the form documentation:

- Age Requirement: Claimant must be eighty years or older.

- Residency: Must be residing in Northern Ireland at the time of the claim.

- Previous Benefit Records: Consideration of any existing benefits or pensions currently received.

By adhering closely to these criteria and following the structured process detailed on the form, applicants can effectively navigate the pension claim process and secure their entitled benefits.