Definition and Meaning

The 'Offer to Purchase and Contract' is a legal document commonly used in real estate transactions. Specifically tailored for North Carolina, this form acts as a formal proposal from the buyer to the seller to purchase a property under specified terms and conditions. The document outlines critical aspects such as payment details, due diligence processes, and the obligations of both parties, ensuring that the transaction adheres to legal standards and mutual agreements.

Key Components of the Document

- Buyer and Seller Information: Identifies the parties involved in the transaction, including full names and contact details.

- Property Description: Specifies the property’s location and a detailed description to avoid any ambiguities.

- Purchase Price and Earnest Money Deposit: Clearly states the offered purchase amount and the preliminary financial commitment from the buyer.

- Due Diligence and Closing Dates: Highlights the timeline for inspections, investigations, and the final settlement of the transaction.

How to Obtain the Offer to Purchase and Contract

To acquire this essential document, parties usually approach real estate agents or legal professionals experienced in North Carolina property laws. Many real estate agencies provide this form as a standard part of their service when engaging in a property transaction. Additionally, copies may be available through real estate legal services or downloadable from online platforms specializing in legal documents.

Common Sources

- Real Estate Agents: Often provide the form during property transactions.

- Legal Services: Law firms specializing in real estate law.

- Online Document Platforms: Websites offering legal documents for download.

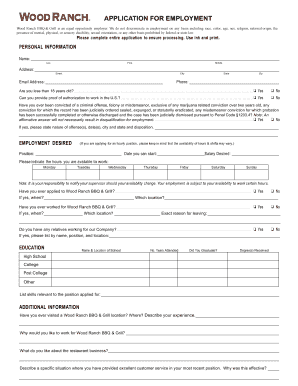

Steps to Complete the Offer to Purchase and Contract

Completing the 'Offer to Purchase and Contract' form requires attention to detail and a clear understanding of each section. Here’s a step-by-step guide:

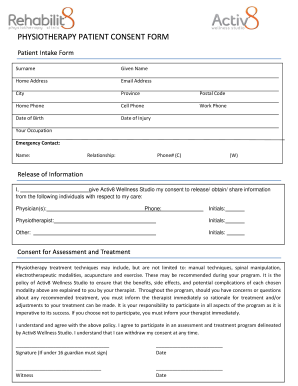

- Fill in Contact Information: Include accurate details for both buyer and seller.

- Describe the Property: Provide a full description and address of the property.

- State the Offer Amount: Detail the purchase price and earnest money deposit.

- Set Dates for Due Diligence and Closing: Specify the periods for preliminary checks and the closing date.

- Outline Contingencies: Mention any conditions that must be met for the contract to be valid.

- Signatures: Ensure both parties sign to acknowledge agreement.

Important Terms Related to Offer to Purchase and Contract

Understanding terms associated with the 'Offer to Purchase and Contract' is crucial for a seamless process. These terms ensure clarity and legal compliance.

Commonly Used Terms

- Earnest Money: A deposit made to demonstrate a buyer's commitment to completing the transaction.

- Due Diligence Period: A timeframe allowing the buyer to perform necessary evaluations of the property.

- Contingencies: Conditions that must be satisfied for the sale to proceed, such as securing financing or passing inspections.

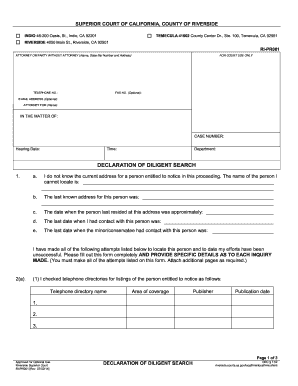

Legal Use of the Offer to Purchase and Contract

The 'Offer to Purchase and Contract' is legally binding once both parties sign it. It encompasses the seller's agreement to the terms proposed by the buyer, and the buyer's commitment to those terms and conditions. This document acts as a security measure, protecting both parties by recording mutual acceptance and providing a framework for legal recourse if either party defaults.

Compliance and Enforcement

- Adhering to State Laws: The form is designed to comply with North Carolina real estate laws.

- Legal Consequences: Breaching the contract can lead to legal disputes and potential financial penalties.

Key Elements of the Offer to Purchase and Contract

A strong comprehension of the form's key elements assists in ensuring that all necessary components are addressed and agreed upon by both parties.

Critical Sections

- Property Details: Clarity on the property involved.

- Financial Terms: Includes offer price, deposits, and closing costs.

- Inspection and Repair Agreements: Procedures for property assessment and potential repairs.

- Closing Details: Final terms for transferring ownership.

State-Specific Rules for the Offer to Purchase and Contract

In North Carolina, specific regulations govern the creation and execution of the 'Offer to Purchase and Contract'. These guidelines are in place to protect both buyers and sellers and ensure that the property transaction abides by state law.

Noteworthy Regulations

- Disclosure Requirements: Sellers must disclose any known issues with the property.

- State-Mandated Forms: Usage of state-approved forms ensures compliance with real estate protocols.

Examples of Using the Offer to Purchase and Contract

Real-world examples help illustrate the form’s application and importance in property transactions.

Case Study

- Example Transaction: A buyer names the price for a suburban home in North Carolina, deposits earnest money, and specifies a 30-day due diligence period. During this time, inspections reveal minor repairs needed, which the seller agrees to address. Both parties proceed to a successful closing.

Effective Utilization

- Multiple Property Bids: Buyers can submit offers on multiple properties using customized terms, optimizing their chances for a successful purchase.

Disclosure Requirements

Sellers must ensure full transparency regarding the property's condition through mandated disclosures. This requirement aims to avoid future disputes and provide buyers with confidence in their purchase by revealing any existing issues or defects prior to finalizing the deal.

Eligibility Criteria

To engage in an 'Offer to Purchase and Contract', the buyer and seller must meet specific eligibility criteria, such as legal capacity, identification verification, and financial stability, ensuring both parties are legally able to participate in the transaction.