Definition and Meaning of the Treasure Trove Reporting Form

The Treasure Trove Reporting Form serves as an important document for individuals who discover valuable objects that may legally qualify as treasure. It is a means for finders to report the specifics of their discovery, ensuring compliance with relevant regulations. This form gathers comprehensive details about the object, including its description, the location where it was found, and the method of its discovery. The form is pivotal for establishing the finder's ownership rights and facilitating further assessment by authorities or institutions, such as museums, which may express interest in the artifact for educational or conservation purposes.

How to Use the Treasure Trove Reporting Form

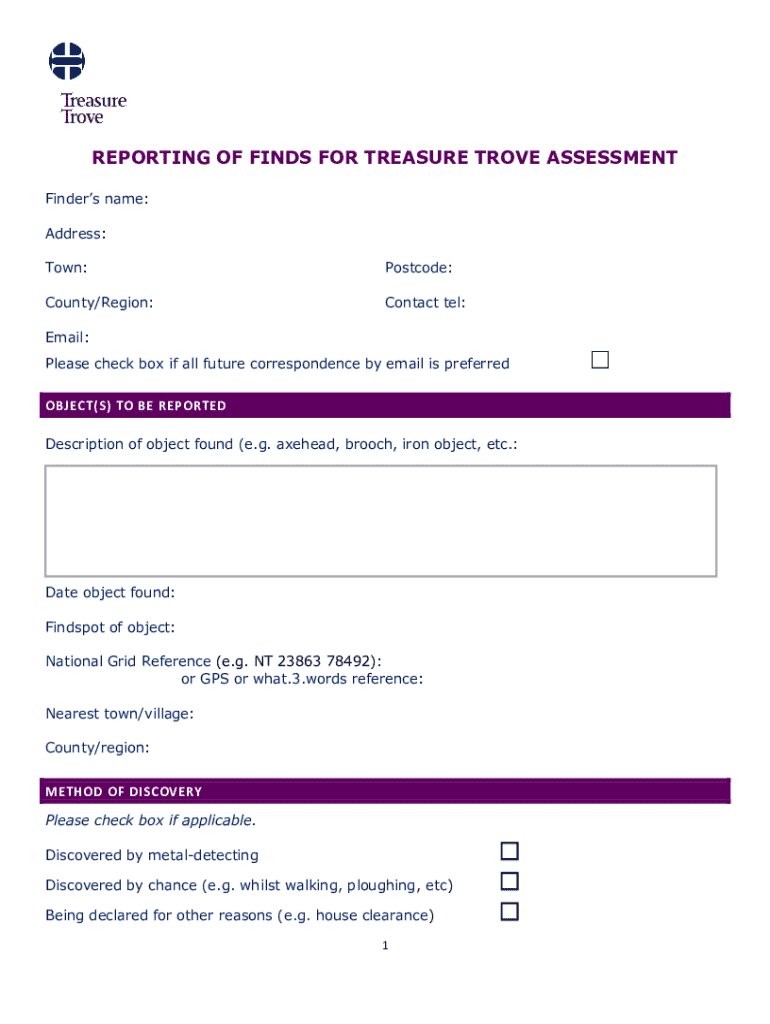

Understanding the use of the Treasure Trove Reporting Form is crucial for accurate and efficient reporting. The form is utilized to document the find in a manner that is clear and precise. It involves detailing various aspects, such as:

- Describing the object, including size, shape, and any inscriptions.

- Specifying the exact location of the find, with possible usage of geographical coordinates for accuracy.

- Including the date and method of discovery, such as metal detecting or excavation.

These documented details ensure the appropriate handling and assessment of the treasure trove, potentially influencing its historical value or legal status.

How to Obtain the Treasure Trove Reporting Form

Acquiring the Treasure Trove Reporting Form can be done through multiple channels, ensuring accessibility for anyone who might need it. Often, the form can be requested from local government offices or downloaded from official websites dedicated to historical preservation or heritage management. Some institutions may offer both printable versions for physical submission and digital forms that can be filled out and submitted online. It is important to use the most current version of the form to ensure compliance with any updated legal requirements.

Steps to Complete the Treasure Trove Reporting Form

Filling out the Treasure Trove Reporting Form requires attention to detail and thoroughness to ensure it meets legal and institutional standards. The process generally involves the following steps:

- Gather Information: Collect all required details regarding the object, including physical characteristics, discovery location, and date.

- Provide Personal Details: Include the finder's full name, contact information, and any affiliations or permissions for accessing the discovery site.

- Describe the Discovery: Clearly explain how and under what circumstances the object was discovered.

- Acknowledge Ownership: Complete any sections that pertain to ownership declarations or intentions to retain or donate the object.

- Submit the Form: Depending on guidelines, submit the form online, in person, or via mail.

Thorough completion ensures that all necessary information is available for authorities to evaluate the claim efficiently and effectively.

Legal Use of the Treasure Trove Reporting Form

The legal implications of the Treasure Trove Reporting Form underscore its importance in managing ownership rights and complying with heritage laws. When properly completed, the form acts as a formal declaration of the discovery, which helps protect the finder's rights as well as those of potential stakeholders like landowners or public institutions.

- Ownership Rights: Depending on jurisdiction, completing the form could establish preliminary ownership claims or conditions under which the finder might retain the object.

- Compliance with Laws: Reporting the find using this form helps ensure adherence to laws governing the excavation and possession of culturally or historically significant objects.

Recognizing these legal uses is essential for both preserving the finder’s rights and contributing to shared cultural heritage.

Key Elements of the Treasure Trove Reporting Form

The form comprises several critical components designed to collect detailed and necessary information. These include:

- Finder Details: Name, address, and contact information of the individual who discovered the object.

- Object Description: Comprehensive depiction of the object, including size and materials.

- Discovery Site Information: Precise location data, ideally with GPS coordinates or recognizable landmarks.

- Discovery Method: Explanation of how the object was found, whether through digging, detecting, or accidental exposure.

These elements are integral to constructing a complete record that may influence legal and cultural stewardship decisions.

State-Specific Rules for the Treasure Trove Reporting Form

Regulations governing treasure troves can vary significantly by state, impacting the reporting and subsequent legal treatment of such finds. While some states may require immediate reporting to local historical societies or government committees, others might have more lenient rules.

- Reporting Timelines: Some states impose specific deadlines for reporting discoveries.

- Ownership Clauses: Different states may have unique stipulations regarding ownership transfer or finder's compensation.

- Protection Measures: Variations exist around protective measures for sites once a find is reported.

Being aware of these state-specific guidelines is crucial for ensuring that the reporting process is compliant and that important historical properties are respected.

Examples of Using the Treasure Trove Reporting Form

Several real-world scenarios illustrate the form's use, from discovering ancient coins to unexploded ordnance. These examples serve as practical references:

- Finders of Historical Artifacts: Individuals discovering objects like coins or jewelry often use the form to report finds that might have historical significance.

- Professional Archaeologists: During excavations, archaeologists may encounter items of notable cultural value, requiring formal documentation through the form.

- Estate Discoveries: When dealing with property estates, treasures unearthed unexpectedly in gardens or old buildings are reported using the form for legal clarification on ownership and stewardship.

These scenarios highlight the form's role in safeguarding important discoveries and ensuring their proper integration into cultural heritage records.

Form Submission Methods: Online, Mail, or In-Person

Options for submitting the Treasure Trove Reporting Form are designed for convenience and accessibility. The chosen method can depend on personal preference, institutional requirements, or specific form instructions:

- Online Submission: Allows for quick and direct submission through an official portal, offering benefits like instant confirmation and tracking capabilities.

- Mail Submission: Offers a traditional method where physical copies can be sent to designated institutions or offices, ensuring traceable and secure delivery.

- In-Person Submission: Provides an opportunity for face-to-face consultations or discussions about the discovery, beneficial for complex submissions.

Choosing the appropriate submission method facilitates compliance and efficiency in processing the reported information.