Definition and Meaning

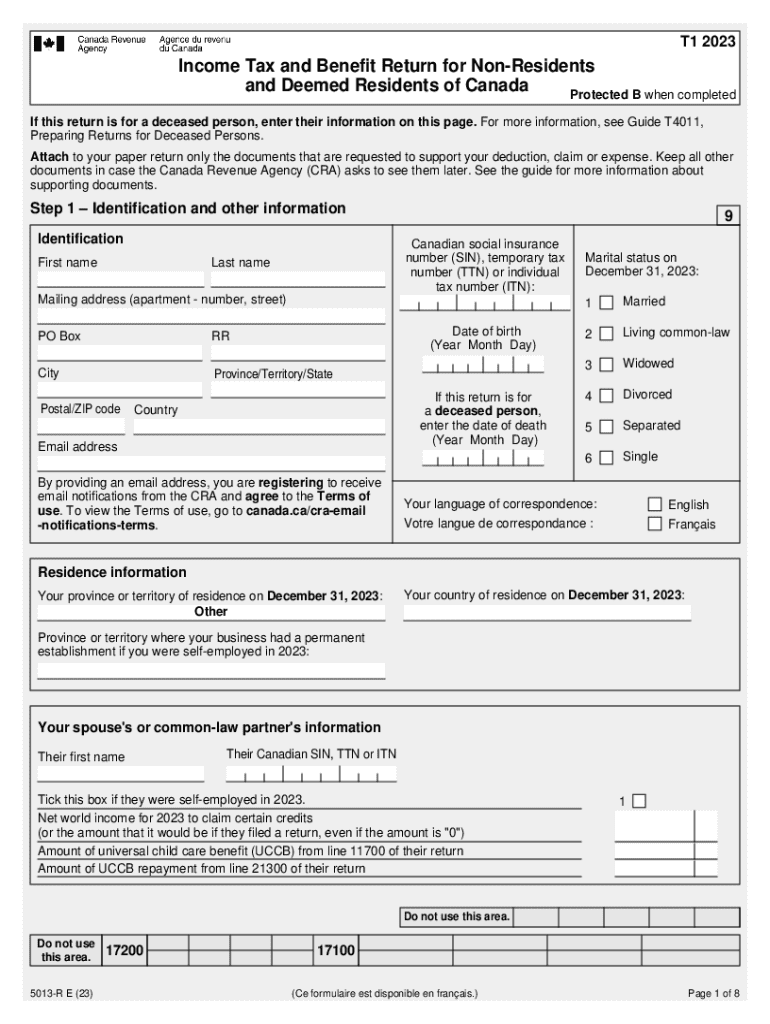

The "Income Tax and Benefit Return for Non-residents - Jeffcpa ca" is a specific tax filing document used by individuals who are non-residents of Canada but have income sources within the country. This form is crucial in ensuring that non-residents fulfill their tax obligations accurately and in compliance with Canadian tax laws. It encompasses guidelines for declaring income derived from Canadian sources, determining taxable income, and calculating taxes owed. The form plays a vital role in establishing the taxpayer's residency status and is designed to capture all relevant income information to ensure rightful taxation based on Canadian rules.

How to Use the Income Tax and Benefit Return for Non-residents

To effectively use the Income Tax and Benefit Return for non-residents, individuals must first collect all necessary income-related documents from Canadian sources. The form is structured to capture several types of income such as employment income, investment returns, or rental income from properties located in Canada. Users should carefully follow the instructions accompanying each section to accurately report income, calculate applicable deductions, and outline credits that they may be eligible for. It's also essential to fill out any additional forms related to specific tax exemptions or special circumstances addressed by Canadian tax law.

Steps to Complete the Income Tax and Benefit Return for Non-residents

-

Gather Documentation: Collect all relevant documents, including T4 slips for income or other slips for investment income earned in Canada.

-

Determine Residency Status: Establish whether you fall under the category of non-resident or deemed resident by reviewing residency conditions and applicable tax treaties.

-

Calculate Income: Accurately report all income earned from Canadian sources. Ensure to split and declare different types of income in their respective sections.

-

Deductions and Credits: Identify eligible deductions and tax credits. Examples include moving expenses, foreign tax credits, or deductions for residents of prescribed zones.

-

Complete Additional Forms: Fill out any additional required forms specific to your tax scenario, such as those for claiming non-refundable tax credits or foreign income exemptions.

-

Review and File: Double-check all filled sections for accuracy and completeness. File completed returns via the designated method – online submission, mail, or through an authorized representative.

Important Terms Related to the Income Tax and Benefit Return for Non-residents

-

Passive Income: Refers to earnings derived from rental properties, dividends, or any business in which the taxpayer does not actively participate.

-

T4 Slip: A statement of remuneration paid, detailing employment income including salary and wages earned in Canada.

-

Non-Resident with Canadian Income: An individual whose primary residence is outside of Canada but earns income through employment, investments, or business activities in Canada.

-

Tax Treaties: Bilateral agreements between Canada and other countries that define tax rules pertaining to income shared between residents of both jurisdictions.

Legal Use of the Income Tax and Benefit Return for Non-residents

Legally, non-residents earning income in Canada are obligated to comply with the Canadian tax system, irrespective of their home country jurisdiction. By filing the Income Tax and Benefit Return accurately, non-residents legally declare their financial engagements within Canada, ensure that taxes owed are paid, and maintain eligibility for applicable credits or deductions. Compliance with the form also protects individuals against possible legal penalties or audits by the Canadian tax authorities.

Required Documents

Completing the Income Tax and Benefit Return for non-residents requires several supporting documents to validate income reports. These include, but are not limited to:

-

T4 or T4A Slips: For employment income.

-

NR4 Slips: For investment or pension income received as a non-resident.

-

Receipts for Eligible Deductions: Proofs for expenses that qualify for deductions under Canadian tax laws.

-

Income Statements from Partnerships or Trusts: Detailing income sources for non-resident taxpayers involved in joint ventures or trust funds.

Filing Deadlines and Important Dates

The deadline for non-residents to file the Income Tax and Benefit Return aligns with general Canadian tax deadlines. Generally, the returns are due by April 30 of the following tax year. However, if businesses or rental income are involved, deadlines may extend to June 15, although any balance owing must still be paid by April 30 to avoid interest charges. Extensions may be available under special circumstances, and it's crucial to remain informed about any changes in tax laws or filing requirements.

Penalties for Non-Compliance

Failure to file the Income Tax and Benefit Return for non-residents by the due date can lead to various penalties, including:

-

Late Filing Penalties: A standard penalty is a percentage of the unpaid tax that increases with time until submission.

-

Interest Charges: Accumulative interest may be charged on both the outstanding tax amount and any applicable penalties if payment is delayed.

-

Legal Actions: Persistent non-compliance might invoke further legal actions, subject to the severity and frequency of delays or misreportings.

Software Compatibility with Income Tax Return Processing

The Income Tax and Benefit Return for non-residents can be processed through various accounting and tax software solutions like TurboTax or QuickBooks. Such platforms ensure accurate computations, facilitate digital submissions, and streamline the overall filing process through integrated features that handle different income types, applicable deductions, and Canadian tax-specific nuances. This compatibility is beneficial for non-residents seeking efficient, hassle-free, and precise tax return completions without extensive manual calculations or submissions.