Definition and Meaning of Florida Enhanced Life Estate Deed

The Florida Enhanced Life Estate Deed, commonly referred to as the Lady Bird Deed, is a legal document that allows property owners to transfer their real estate to beneficiaries while retaining certain rights for themselves during their lifetime. This type of deed enables the grantor to remain in control of the property without it being included in their estate for probate purposes upon death.

Key Features of the Enhanced Life Estate Deed

- Retention of Control: The grantor maintains the right to sell, mortgage, or alter the property without the consent of the beneficiaries.

- Avoids Probate: Upon the grantor’s death, the property automatically transfers to the named beneficiaries, bypassing the probate process.

- Flexibility: The grantor can change beneficiaries or revoke the deed if needed.

- Tax Benefits: There may be potential advantages regarding capital gains tax as the property receives a step-up in basis upon the grantor’s death.

How to Use the Florida Enhanced Life Estate Deed

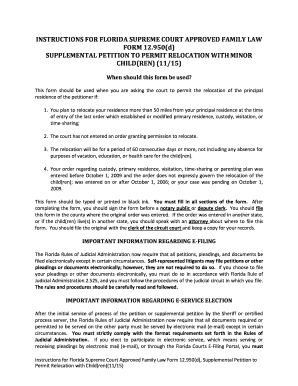

Using the Florida Enhanced Life Estate Deed involves several steps that ensure the document is legally valid and serves its intended purpose.

Steps to Use the Deed

- Consult a Legal Professional: Prior to creating the deed, it is advisable to consult with an attorney who specializes in estate planning to understand the implications.

- Draft the Deed: Prepare the deed, including the legal description of the property and the names of the beneficiaries.

- Sign the Deed: The grantor must sign the deed in front of a notary to validate it.

- Record the Deed: File the deed with the county clerk’s office to ensure that it is publicly accessible and legally binding.

Important Considerations

- Ensure that all legal descriptions are accurate to avoid disputes.

- Confirm that all beneficiaries understand their future rights regarding the property.

Steps to Complete the Florida Enhanced Life Estate Deed

Completing the Florida Enhanced Life Estate Deed involves several stages that include preparation, execution, and recording:

Detailed Steps to Complete the Deed

- Gather Necessary Information: Collect details about the property, including its legal description and the identities of all beneficiaries.

- Drafting:

- Use a reliable template for the Lady Bird Deed, ensuring all necessary sections are included.

- Clearly state that the grantor retains the right to manage the property.

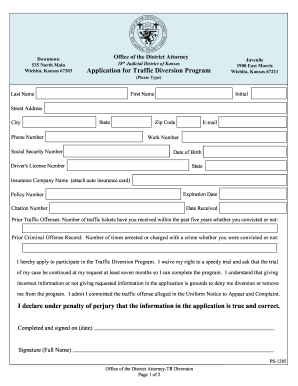

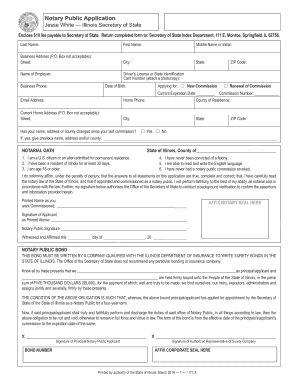

- Signing:

- Both the grantor and a notary public must sign the document.

- Some counties may require witnesses as well; check local regulations.

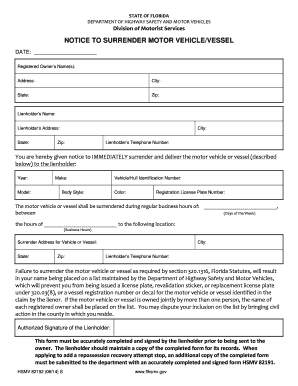

- Recording the Deed:

- Submit the signed deed to the appropriate county office for recording.

- Pay any applicable recording fees.

Special Tips

- Double-check that the form is completed accurately before notarization.

- Retain copies of the recorded deed for personal records and for the beneficiaries.

Who Typically Uses the Florida Enhanced Life Estate Deed

The Florida Enhanced Life Estate Deed is frequently used by specific groups of individuals:

Main Users of the Deed

- Homeowners: Individuals seeking to transfer property to their heirs while retaining control over it.

- Retirees: Elderly individuals who want to plan for future property distribution without engaging in probate.

- Families: Families looking to secure inheritance while protecting the property from external claims or debts after death.

Benefits for Users

- Provides peace of mind that their property will pass directly to their loved ones.

- Minimizes tax complications that can arise from traditional estate planning methods.

- Retains flexibility in managing their property, even after executing the deed.

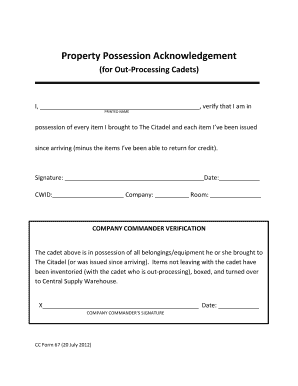

Legal Use of the Florida Enhanced Life Estate Deed

Understanding the legal framework surrounding the Florida Enhanced Life Estate Deed is crucial for effective planning.

Essential Legal Aspects

- Compliance with Florida Laws: The deed must comply with Florida statutes governing real estate and estate planning.

- Legally Binding: Once properly executed and recorded, the deed is legally binding on all parties involved.

- Tax Implications: Consult tax professionals for clarity on estate taxes and potential capital gains implications.

Common Legal Myths

- Not a Will Substitute: While it aids in property transfer, it does not replace a last will and testament.

- Cannot Be Contested Easily: Unlike other estate planning tools, this deed is harder to contest due to the clear beneficiary designation and lack of probate involvement.

By understanding these elements, individuals can effectively utilize the Florida Enhanced Life Estate Deed while adherent to legal standards.