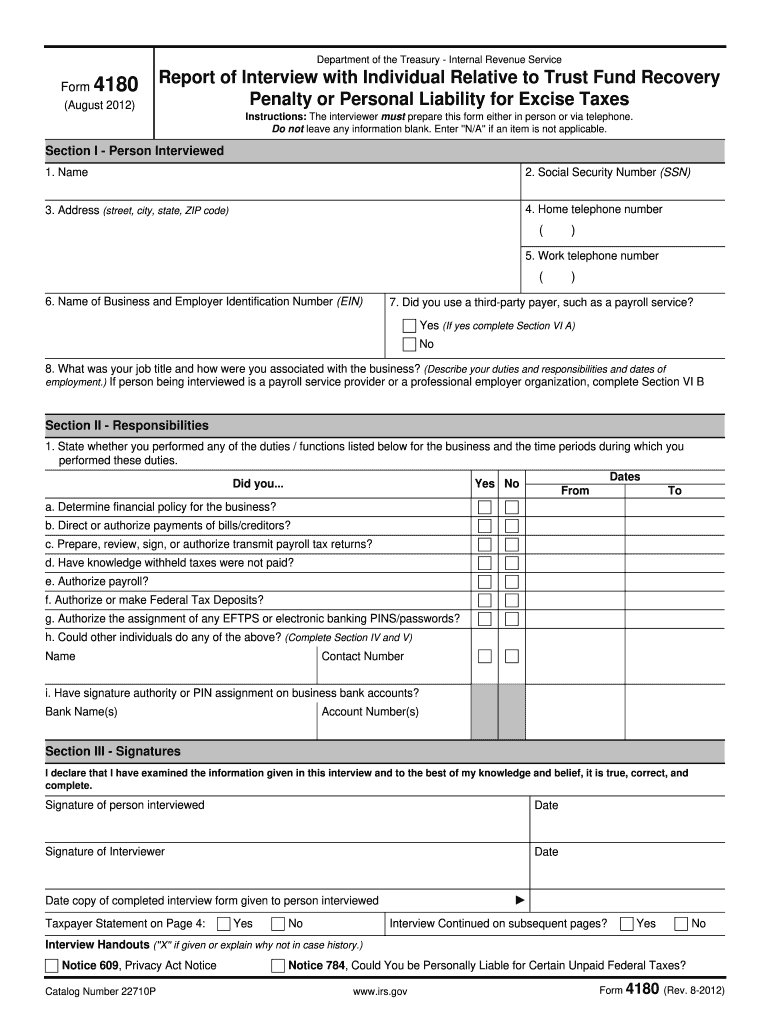

Definition and Meaning of IRS Form 4180

IRS Form 4180 is officially known as the "Respondent's Interview Summary." It is utilized by the Internal Revenue Service (IRS) to document interviews with individuals regarding their potential responsibilities related to trust fund recovery penalties for unpaid excise taxes. The form aims to collect detailed information about the individual's role in a business's financial decisions, particularly about tax compliance. Understanding its core purpose is crucial; it helps the IRS identify whether an individual may be held liable for failing to pay certain taxes owed by a business.

The form encompasses several sections that request personal and business information, as well as inquiries regarding the individual's knowledge of tax obligations and responsibilities. Completing this form accurately is vital, as it can have significant implications for tax liabilities and compliance.

How to Use the IRS Form 4180

Using IRS Form 4180 involves a systematic approach to ensure that all required information is provided accurately. The following key steps guide users through the process:

- Obtain the Form: Access the form directly from the IRS website or download the form 4180 PDF to fill it out.

- Prepare Documentation: Collect any relevant documents that may assist in answering the questions on the form, such as previous tax returns, business financial documents, and partnership agreements.

- Complete the Form: Fill out each section of the form carefully, ensuring that the information reflects your role and understanding of the business's tax responsibilities.

- Review for Accuracy: Before submitting, review the form to ensure that all details are correct and complete. Mistakes or missing information can lead to complications in the review process.

- Submit the Form: Follow the submission guidelines provided by the IRS, which may include online submission options or mailing the completed form to an appropriate IRS address.

How to Obtain the IRS Form 4180

Acquiring IRS Form 4180 can be done through the following methods:

- IRS Website: The most straightforward method is to visit the IRS official website, where the form is available for download as a PDF. Users can easily print it for completion.

- Tax Professional: Consulting with a tax professional or accountant may provide access to the form and additional guidance on how to fill it accurately.

- IRS Office: For individuals who prefer in-person assistance, visiting a local IRS office can result in obtaining the form and any required instructions for its completion.

Steps to Complete the IRS Form 4180

Completing IRS Form 4180 requires careful attention to detail to ensure compliance with IRS requirements. Follow these structured steps:

-

Section One: Personal Information

- Provide your name, position, and contact information.

- Include your social security number or taxpayer identification number.

-

Section Two: Business Information

- Fill in the details regarding the business, including its legal name, address, and Employer Identification Number (EIN).

- Indicate the nature of the business and its operational status.

-

Section Three: Responsibilities

- This section demands insights into your role and decision-making authority related to the business's financial transactions.

- Answer questions regarding your knowledge of tax liabilities and operational compliance.

-

Section Four: Tax Obligations

- Respond to inquiries about the awareness of unpaid taxes, including previous communications received from the IRS regarding tax obligations.

-

Section Five: Signature

- The form must be signed and dated to certify that the information provided is true and complete.

Who Typically Uses the IRS Form 4180

IRS Form 4180 is primarily used by individuals who have key roles in businesses facing potential trust fund recovery penalties. Typical users include:

- Business Owners: Those who manage or own corporations, partnerships, or sole proprietorships.

- Corporate Officers: Individuals who hold significant decision-making authority within their companies, including treasurers, chief financial officers, and controllers.

- Tax Professionals: Consultants and accountants may utilize the form to gather information necessary for representing clients in disputes with the IRS concerning trust fund recovery penalties.

Understanding the demographics of typical users helps clarify the importance of accurate and comprehensive completion of the form to mitigate potential penalties.

Important Terms Related to IRS Form 4180

Familiarity with specific terminology enhances comprehension and accuracy while working with IRS Form 4180. Key terms include:

- Trust Fund Recovery Penalty: A penalty imposed on individuals deemed responsible for collecting, accounting for, and paying certain taxes, typically employment taxes, when those taxes are not paid.

- Respondent: The individual who is completing the form, typically a business representative or officer.

- EIN (Employer Identification Number): A unique identifier assigned to businesses for tax purposes, essential for completion of the form.

- Personal Liability: Legal responsibility an individual may incur if they fail to ensure payment of trust fund taxes, potentially resulting in personal financial consequences.

Understanding these terms is crucial for both accurate form completion and effective communication with the IRS, especially in the context of interviews regarding financial compliance.