Definition and Meaning

The Texas Resale Certificate is a crucial document that allows businesses to purchase items tax-free that are intended for resale. This certificate is an essential tool for retailers and wholesalers, as it permits them to defer paying sales tax on qualifying items until they are resold. When a business presents the Texas Resale Certificate to their supplier, they signify that the items purchased will not be used personally but will be sold in the normal course of business. For businesses to properly utilize this document, understanding its purpose and scope is vital.

How to Use the Texas Resale Certificate

In practical terms, the use of a Texas Resale Certificate involves presenting it to vendors when making qualifying purchases. This presentation exempts these purchases from sales tax at the point of sale. To effectively utilize the certificate:

- Ensure that the certificate is completed accurately with all required details such as the buyer's information, the seller’s details, and a clear description of the items for resale.

- Provide the vendor with a physical or digital copy of the certificate at the time of transaction.

- Maintain records of all transactions where the certificate was used, as it is crucial for compliance and auditing purposes.

How to Obtain the Texas Resale Certificate

Obtaining a Texas Resale Certificate involves a straightforward process that starts with registering for a Texas Sales and Use Tax Permit if not already obtained. Here are the steps to secure the certificate:

- Register your business with the Texas Comptroller’s office.

- Complete the necessary application for a Sales and Use Tax Permit.

- Once approved, use your permit details to fill out the Texas Resale Certificate form, which can typically be downloaded from the Texas Comptroller's website.

Fulfilling these requirements ensures businesses can legally make tax-exempt purchases intended for resale.

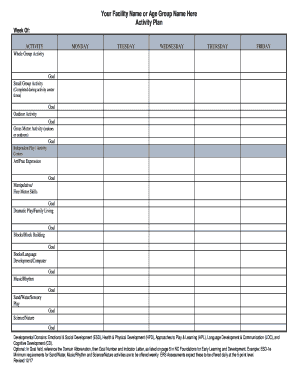

Steps to Complete the Texas Resale Certificate

Completing a Texas Resale Certificate requires attention to detail to ensure compliance. Follow these steps:

- Enter the purchaser's details, including business name and address.

- Provide the Texas Sales Tax Permit Number issued by the Comptroller’s office.

- Fill in the seller’s details, ensuring accurate information.

- Describe the goods being purchased and their intended resale purpose.

- Sign and date the form, certifying your understanding and compliance with applicable tax laws.

Maintaining precision in these steps ensures the resale certificate is valid and enforceable.

Legal Use of the Texas Resale Certificate

The legal usage of a Texas Resale Certificate is governed by the state’s tax regulations. The certificate should be used only for transactions involving goods intended for resale. Misuse can lead to penalties, including back taxes, fines, and interest. To comply legally, business owners must:

- Only present the certificate for goods that will be resold.

- Maintain accurate records of transactions involving the certificate.

- Adhere to state-specific rules and regulations regarding resale transactions.

Comprehending the legal boundaries ensures businesses avoid non-compliance penalties and audit issues.

Key Elements of the Texas Resale Certificate

The Texas Resale Certificate contains several critical sections that need to be completed accurately:

- Purchaser’s Information: Includes the name, address, and sales tax permit number.

- Seller’s Information: Requires the seller’s name and address.

- Description of Goods: Specifies the items being purchased for resale.

- Certification Statement: A declaration of intent to comply with state tax laws, requiring a signature and date.

These elements collectively ensure that the certificate meets regulatory standards and is legally valid.

Who Issues the Form

The Texas Resale Certificate is issued by the Texas Comptroller of Public Accounts. Businesses must first apply for a Texas Sales and Use Tax Permit before obtaining a resale certificate. The Comptroller's office facilitates this process, ensuring that businesses are legitimate and authorized to conduct tax-exempt transactions.

Eligibility Criteria

Eligibility to use a Texas Resale Certificate hinges on several factors. Primarily, the business must:

- Hold a valid Texas Sales and Use Tax Permit.

- Operate within industries that resell goods, such as retail or wholesale.

- Ensure all purchases with the certificate are solely for items intended for resale.

By meeting these criteria, businesses can effectively leverage the tax advantages provided by the resale certificate.

Important Terms Related to the Texas Resale Certificate

Understanding the terminology associated with the Texas Resale Certificate is crucial. Key terms include:

- Sales Tax Permit: A mandatory requirement for businesses to collect and remit sales tax.

- Resale: The act of purchasing items with the intention of selling them.

- Non-Taxable Purchase: Purchases that do not incur sales tax at the time of sale, under the condition of resale.

Familiarity with these terms aids in navigating and managing resale certificate transactions efficiently.