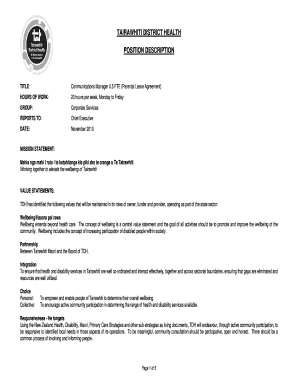

Understanding Refund Claims

Refund claims serve as a mechanism for individuals and entities to recover overpaid or unused funds. These forms are particularly common in scenarios such as tax overpayments, product returns, or service cancellations. A refund claim is essentially a formal request to regain money that has been paid out, and it requires specific details to be accurate and complete. Understanding the intricacies of refund claims is essential for preventing delays and ensuring the successful retrieval of funds.

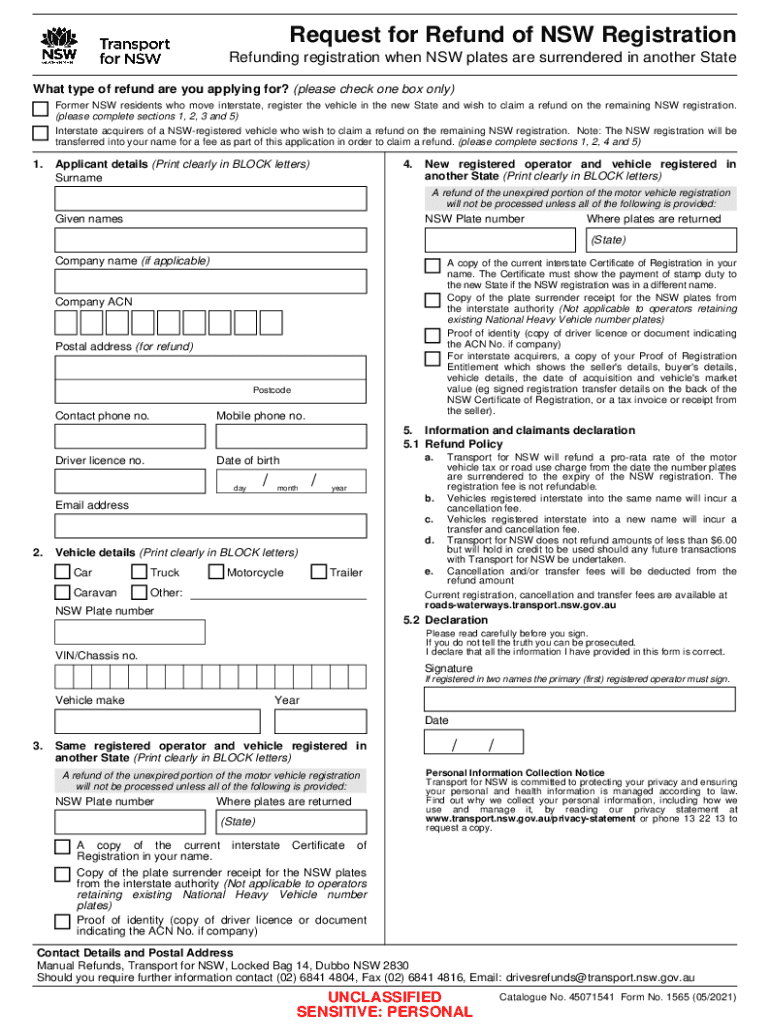

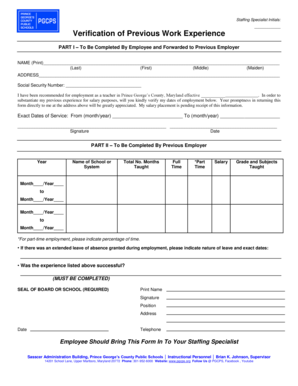

Key Elements of a Refund Claim

A refund claim typically includes a few critical elements. First, the claimant's personal or organizational details must be provided, which often involves name, address, and contact information. Second, the claim should detail the transaction or reason for the refund, including relevant dates and amounts. Third, supporting documentation is commonly required to validate the claim, such as receipts, invoices, or contracts. Fourth, a declaration of truthfulness or certification must be signed, confirming the honesty and accuracy of the information provided.

Steps to Complete a Refund Claim

Filling out a refund claim form correctly is crucial to ensure your claim is processed without unnecessary delay. Here is a structured step-by-step process:

-

Gather Necessary Information:

- Collect details about the original transaction, including date, amount, and receipt or invoice numbers.

- Obtain personal or business details relevant to the claim.

-

Prepare Supporting Documentation:

- Attach copies of receipts, invoices, or other evidence to substantiate your claim.

- Ensure all documents are legible and complete.

-

Fill Out the Form:

- Enter personal and transaction details accurately.

- Use clear handwriting if the form is being completed manually.

-

Sign and Date:

- Certify the information by signing the form where required.

- Include the current date to mark your submission.

-

Review and Submit:

- Double-check all entries for accuracy.

- Submit the form via the specified method—either online, by mail, or in-person.

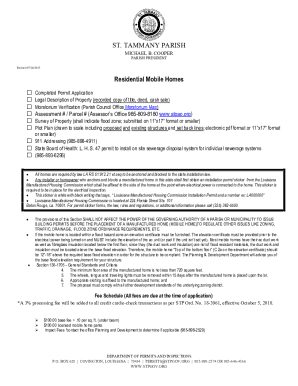

Supporting Documentation for Refund Claims

To bolster your refund claim, specific documentation is usually required. This may differ depending on the nature of the refund:

- Purchase Receipts: Essential for proving the amount paid.

- Invoices: Necessary for business transactions or service-based claims.

- Contractual Agreements: Useful in service cancellations.

- Official Correspondence: Emails or letters serving as evidence of agreements or transactions.

Obtaining a Refund Claim Form

Acquiring a refund claim form depends largely on the entity to which the claim will be submitted. Here's how you can generally obtain these forms:

- Online Portals: Most entities offer downloadable forms on their websites. Look under sections labeled "Customer Service" or "Support Documents."

- Physical Locations: Some organizations allow claim forms to be picked up at their offices or branches.

- Mail Requests: You can often request a form be sent to you via postal service, though this may take additional time.

Submission Methods for Refund Claims

Once completed, refund claims can typically be submitted through various channels:

- Online Submission: Upload the form and supplemental documents via the entity's website.

- Mail: Send the completed form and copies of relevant documents through postal mail. Include a return envelope if necessary.

- In-person: Deliver the form directly to the issuing office for immediate processing.

Legal Use and Compliance

Refund claims must adhere to specific legal standards to be processed successfully. For example, certain refund claims are subject to the ESIGN Act, ensuring electronic signatures are as legally binding as handwritten ones. Misrepresentation in a refund claim can lead to penalties, including fines or legal action, making it essential for claimants to provide truthful and accurate information.

Penalties for Non-Compliance

Failure to comply with refund claim requirements can result in several consequences:

- Rejection of Claim: Incorrect or incomplete information may lead to your claim being returned or denied.

- Financial Penalties: Providing false information can result in fines or further legal action.

- Delayed Processing: Missing documentation or misentry of details can significantly slow down the process.

Understanding and following the correct procedure ensures your refund claim is both effective and timely, helping to quickly resolve issues related to overpayments or unused services.