Definition & Meaning

A Certificate of Authority is a formal document issued by a state government that authorizes a business entity to operate legally in a state other than where it was originally incorporated. This certificate is a vital document for foreign corporations, allowing them to transact business in new jurisdictions and ensuring compliance with state-specific regulations. Its primary purpose is to provide legal recognition to businesses that want to expand their commercial activities beyond their home state.

By obtaining this certificate, a business agrees to adhere to the laws and regulations of the foreign state, including tax obligations and reporting requirements. It is not merely a licensing document; it also serves as a means for states to keep track of foreign corporations operating within their borders. The certificate also often signifies that the business has met initial compliance requirements, such as appointing a registered agent within the state.

How to Use the Certificate of Authority

Using a Certificate of Authority involves integrating it into your business operations to legally transact in a new state. Once obtained, businesses must display the certificate prominently within their principal office, demonstrating compliance to potential auditors or inspectors. Additionally, having the certificate allows businesses to legally engage in signing contracts, hiring employees, and opening bank accounts in the new state, which are otherwise restricted without state authorization.

Owners should ensure that their registered agents in each state maintain an up-to-date copy of the certificate. This document must also be submitted when applying for state-specific permits or licenses. In practice, the Certificate of Authority plays a crucial role during legal proceedings and tax reporting, as it validates the business's right to operate in the foreign jurisdiction.

How to Obtain the Certificate of Authority

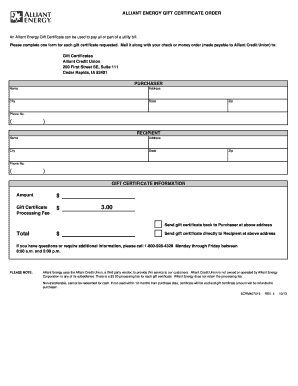

The process to obtain a Certificate of Authority typically involves submitting an application to the Secretary of State's office in the state where the business seeks to operate. This application often requires:

- Completion of a form provided by the state agency detailing the business's legal name, the assumed name if applicable, the type of business entity, and original jurisdiction.

- Submission of a recent certificate of good standing or existence from the business's home state, verifying that it is in compliance and authorized to conduct business there.

- Payment of a required filing fee, which varies by state.

- Possible submission of additional documentation, such as the company's Articles of Incorporation or Organization.

The application criteria differ from state to state, so businesses must refer to the specific requirements of the target state. Upon successful submission and approval, businesses receive their Certificate of Authority, allowing them to conduct legal operations in that state.

Steps to Complete the Certificate of Authority

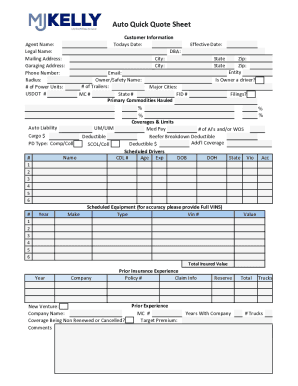

- Determine State Requirements: Research the specific rules and requirements for obtaining a Certificate of Authority in the desired state.

- Gather Required Documents: Compile necessary documents, including a certificate of good standing from the home state.

- Fill Out Application: Complete the application form with accurate business information, ensuring no section is left incomplete.

- Appoint a Registered Agent: Designate an individual or business entity within the target state to act as a registered agent.

- Submit Application and Fee: Submit the application along with the appropriate filing fee to the Secretary of State's office.

- Await Approval: Allow time for the state's review process, which could take several days to weeks.

- Receive and Verify: Once received, verify the details on the Certificate of Authority for accuracy.

State-Specific Rules for the Certificate of Authority

Each state in the U.S. has unique requirements and rules governing the issuance of a Certificate of Authority. For instance, some states may require businesses to publish a notice of their intent to operate in a local newspaper. Others might have additional registration requirements or require annual renewals of the certificate. Fees also vary, as do the penalties for non-compliance, which can include fines or the inability to continue operations within the state.

Businesses should consult the respective Secretary of State website or contact professional advisors familiar with local laws to ensure adherence to all state-specific guidelines. This proactive approach helps prevent potential legal issues and ensures smooth business operations.

Key Elements of the Certificate of Authority

A standard Certificate of Authority includes various crucial elements that officially recognize a business in the foreign state:

- Business Name and Address: Must match the registered name in the home state.

- State of Incorporation: Indicates the original state where the business was formed.

- Registered Agent: Details of the appointed registered agent responsible for receiving legal and official documents.

- Filing Date: The date on which the certificate was officially filed and approved.

- State Seal or Certification Mark: Official insignia from the issuing state's office confirming legitimacy.

Understanding these elements ensures businesses maintain up-to-date documentation and comply with legal requirements.

Examples of Using the Certificate of Authority

Consider a case where a New York-based corporation intends to open a new office in California. Prior to commencing operations, the corporation must secure a Certificate of Authority from California's Secretary of State. This certificate allows them to enter into contracts, hire local employees, and engage with clients legally. Without it, the corporation risks penalties and being prohibited from conducting business activities within the state.

Another example involves an LLC expanding from Texas to Florida. The LLC must obtain a Certificate of Authority from Florida to handle business activities like property acquisition, fulfilling government contracts, and paying state taxes. This shows that the certificate not only grants legality but also facilitates smooth business operations across state borders.