Definition & Meaning

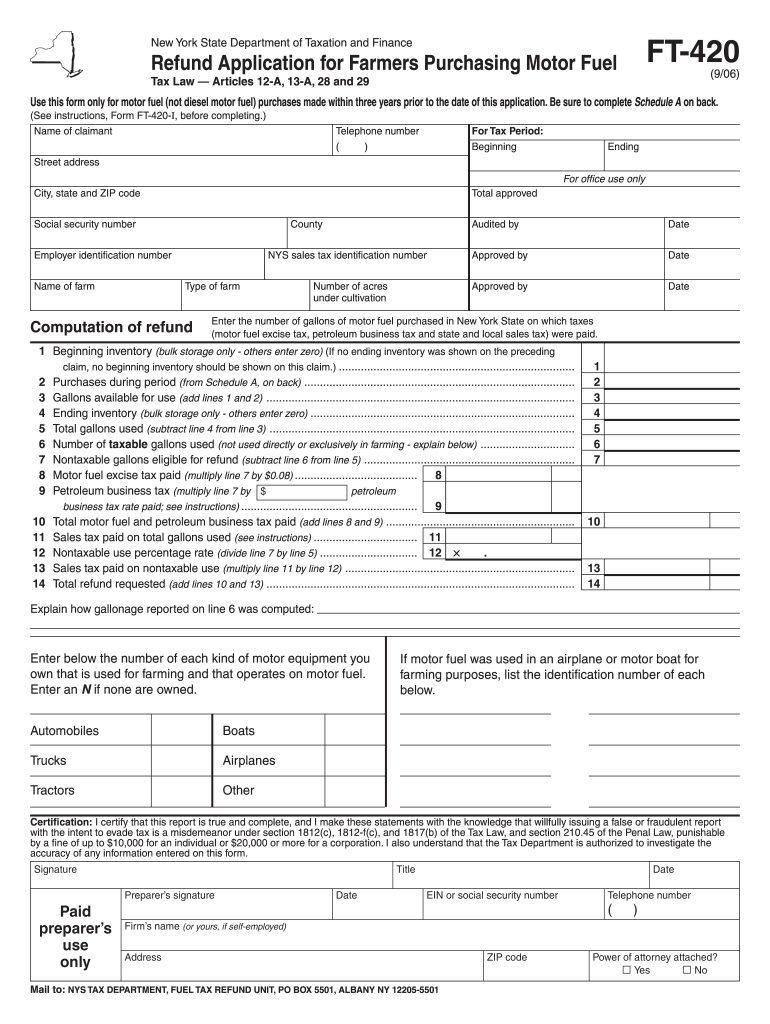

Form FT-420:9 06 is a refund application specifically designed for farmers in New York State who seek refunds on motor fuel purchases. This form is intended for non-diesel motor fuels purchased within the last three years. Its primary purpose is to facilitate reimbursement of taxes already paid on these fuel purchases, ensuring that agricultural businesses can manage expenses effectively. Understanding its application is crucial for farmers aiming to optimize financial management.

How to Use the Form FT-420:9 06

To use Form FT-420:9 06 effectively, farmers must gather detailed information on their motor fuel purchases. This includes documenting quantities, types of fuel, and tax amounts already paid. Filling out the form involves entering this data accurately to avoid discrepancies. It's essential to retain purchase receipts and transaction records as they serve as supporting documentation in case of audits or further inquiries.

Steps to Complete the Form FT-420:9 06

-

Gather Necessary Information: Collect details of all motor fuel transactions, including invoices, receipts, and tax records.

-

Fill Out Personal and Business Information: Ensure your name, address, and business details are clearly stated.

-

Detail Fuel Purchases: Accurately enter the quantity of fuel purchased and the respective tax amounts paid for each transaction.

-

Complete Certification Statement: Review the accuracy of the information provided and sign the certification statement to confirm the details are correct.

-

Attach Supporting Documents: Include copies of receipts and any relevant documents to support the refund claim.

-

Submit the Form: Send the completed form and attachments via mail or online if applicable.

Important Terms Related to Form FT-420:9 06

-

Motor Fuels: Refers to gasoline and other non-diesel fuels used in motor vehicles and agricultural equipment.

-

Refund Application: A request submitted to the tax authority seeking reimbursement for overpaid taxes.

-

Certification Statement: A declaration by the applicant affirming the truthfulness and accuracy of the information on the form.

-

Tax Exemption: A provision that allows certain tax relief under specific conditions for eligible farmers.

Eligibility Criteria

Farmers applying for a refund must meet specific eligibility requirements including:

-

Business Location: The farm must be located in New York State.

-

Fuel Usage: Fuel must be used exclusively for farming purposes.

-

Time Frame: Eligible purchases must have been made within the last three years.

Meeting these criteria ensures that the application is processed without delay.

Key Elements of the Form FT-420:9 06

-

Applicant Information Section: Captures personal and business identification.

-

Transaction Detail Tables: Sections to log each fuel purchase and corresponding tax paid.

-

Certification Statement: Requires a signature to validate the information provided.

-

Documentation Checklist: Lists necessary documents to attach for processing.

Required Documents

When submitting Form FT-420:9 06, ensure inclusion of:

-

Purchase Receipts: Proof of the fuel transactions.

-

Tax Payment Proofs: Documentation showing the taxes paid.

-

Business Registration Evidence: Confirmation of business legitimacy as a farm in New York State.

Form Submission Methods

Farmers can submit the completed form and supporting documents via:

-

Mail: Traditional postal methods to the New York State Department of Taxation and Finance.

-

Online Submission: If available, through the official tax department website for faster processing and confirmation.

Ensure all information is correct to minimize delays in processing and reimbursement.

Application Process & Approval Time

-

Submission: Once submitted, the form undergoes a verification process ensuring all information's accuracy and compliance with New York State's regulations.

-

Processing Time: Typically, processing could take several weeks. Farmers may check status updates via mail or online, depending on submission mode.

-

Notification: Applicants will be notified of the approval or rejection and any additional information required to complete the process.

Through these steps, farmers can efficiently claim a refund on motor fuel taxes, supporting their agricultural operations.