Definition and Purpose of the Personal Tax Credit Return BC

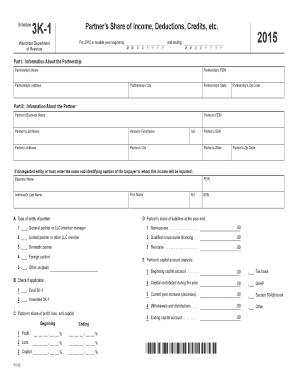

The Personal Tax Credit Return BC, also known as the TD1BC, is a crucial form utilized by employees and pensioners in British Columbia to claim eligible personal tax credits. This form outlines various credits such as the basic personal amount, age amount, tuition and education amounts, and caregiver amounts. It plays a vital role in determining the provincial tax deductions applicable to an individual, based on their unique circumstances. The TD1BC aids employers in withholding the correct amount of provincial tax from their employees' paychecks, ensuring compliance with British Columbia's tax regulations.

How to Use the Personal Tax Credit Return BC

Utilizing the TD1BC form involves a series of straightforward steps designed to ensure accurate tax credit claims. Employers and employees must collaborate to complete the form, with attention to several key areas:

-

Filling Out Personal Information: Begin by entering personal details, such as full name, social insurance number, and address.

-

Calculating Total Credits: Employees must enter amounts for which they are eligible, like the basic personal amount, tuition, or caregiver amounts. Each section provides guidance on how to determine the claimable amounts.

-

Submission to Employer: Once completed, the form is submitted to the employer, who uses the information to adjust tax deductions accordingly.

Notably, employees should update this form whenever there are changes in their tax credit circumstances to maintain accurate tax withholding throughout the year.

Steps to Complete the Personal Tax Credit Return BC

Completing the TD1BC form can be broken down into a series of logical steps, ensuring thorough and precise reporting:

-

Read Instructions Carefully: Begin by reviewing all instructions provided on the form, which detail specific requirements for each section.

-

Section-by-Section Completion:

- Basic Personal Amount: Report this standard amount, which applies universally to eligible individuals.

- Age Amount: If applicable, calculate based on your age and income.

- Tuition and Education Amounts: Include eligible post-secondary education expenses here.

- Caregiver Amounts: For those providing care to a disabled family member, additional credits may be claimable.

-

Review and Sign: After filling in all relevant sections, review the form for accuracy, sign it, and provide it to your employer.

-

Employer Submission: Employers input this data into their payroll systems to adjust withholdings.

Eligibility Criteria

Determining eligibility for specific credits on the TD1BC form is essential for accurate completion and maximizing tax savings:

- Basic Personal Amount: Nearly all employees qualify for this deduction.

- Age and Tuition Amounts: Specific to individuals over a certain age or enrolled in qualified educational institutions.

- Caregiver Amounts: Available for those supporting dependents with disabilities.

Understanding these eligibility criteria ensures that employees accurately report amounts they're entitled to claim, avoiding under or overestimation of tax liabilities.

Who Typically Uses the Personal Tax Credit Return BC

The TD1BC form is primarily used by:

- Employees: Those working in British Columbia and subject to provincial tax withholding.

- Pensioners: Individuals receiving pensions who need to adjust their tax credits in retirement.

- Employers: Who are responsible for withholding the correct provincial taxes based on an employee's credited amounts.

The form serves various individuals who need to align their tax obligations with provincial guidelines by properly claiming applicable credits.

Important Terms Related to Personal Tax Credit Return BC

Several key terms are vital for comprehending the Personal Tax Credit Return BC:

- Basic Personal Amount: A standard deduction available to most taxpayers, reducing taxable income.

- Caregiver Credit: A tax reduction for individuals caring for dependents with disabilities.

- Provincial Tax Deduction: The portion of tax withheld from income to meet provincial obligations.

- Eligible Tuition: Education-related expenses that qualify for tax credits if they meet provincial criteria.

Understanding these terms aids in the accurate and comprehensive completion of the TD1BC form.

Required Documents

To fill out the TD1BC accurately, supporting documents are necessary:

- Identification: Such as a social insurance number, verifying personal details.

- Income Statements: Including T4s and other earnings-related documentation.

- Tuition Receipts: For eligible education deductions.

- Caregiving Documentation: If claiming caregiver credits, necessary proof may be required.

Organizing these documents simplifies the process of form completion and ensures precision in reported amounts.

Filing Deadlines and Important Dates

The TD1BC form should be completed and submitted to employers upon commencement of employment or when financial circumstances change:

- Initial Submission: Ideally at the start of employment or fiscal year.

- Updates: Required whenever there is a change in employment status or eligibility for different credits to prevent incorrect tax deductions.

Employers should ensure they incorporate the TD1BC form into their records as soon as it is submitted to facilitate accurate tax reporting.

Who Issues the Personal Tax Credit Return BC

The TD1BC form is issued by:

- Canada Revenue Agency (CRA): As part of the suite of forms designed to ensure provincial tax compliance.

Employers distribute the form to employees, who complete and return it, supporting a structured provincial tax withholding system.