Definition and Meaning of K-59 Kansas High Performance Incentive Program (HPIP) Credits

The K-59 Kansas High Performance Incentive Program (HPIP) credits are part of a state initiative designed to encourage businesses in Kansas to invest in their workforce and facilities. These credits are primarily targeted at businesses that enhance employee training, education, and capital investment in qualified business facilities. Companies can utilize these credits to offset their state income tax liabilities, effectively lowering the cost associated with these strategic business improvements.

Key Elements

- Training and Education Tax Credits: Provided for expenditures on employee training and educational activities.

- Investment Tax Credits: Given for investments in physical improvements to business facilities within Kansas.

- Carry Forward Provision: Allows unused credits to be carried forward for deduction in future tax years.

How to Use the K-59 HPIP Credits

Utilizing the K-59 HPIP credits involves several critical steps that businesses must undertake to maximize their benefits.

Eligibility Criteria

To qualify for the K-59 HPIP credits, businesses must meet specific requirements, including:

- Being located in Kansas.

- Demonstrating ongoing investment in employee training and physical plant improvements.

- Meeting or exceeding the wage and employee training thresholds set by the state.

Steps to Completion

-

General Information Section: Begin by filling out basic information about the business entity and identifying the reporting period for which the credits are being claimed.

-

Training and Education Credits: Calculate expenditures related to employee training and education programs. Document these expenses in the appropriate sections with required substantiating evidence.

-

Investment Credits: Detail investments made in eligible Kansas facilities. This could include new buildings, upgrades, or equipment purchases that align with eligibility requirements.

-

New Investment Information: Provide specifics for any new investments made during the tax year, ensuring all qualifying expenditures are reported accurately.

How to Obtain the K-59 HPIP Credits

Application Process

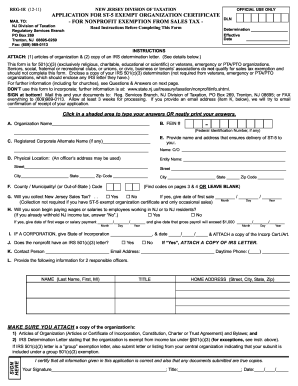

Businesses interested in claiming the K-59 HPIP credits must adhere to the following application and review processes:

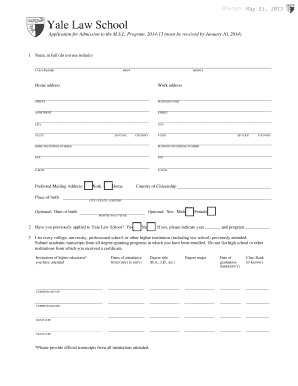

- Pre-Certification: Submit a pre-certification application to verify eligibility and set the groundwork for claiming future credits.

- Formal Application: Once pre-certified, businesses need to submit a formal application detailing all eligible expenditures during the tax year.

- Approval: After review by the Kansas Department of Revenue, eligible businesses receive confirmation of credits approved for use against tax liabilities.

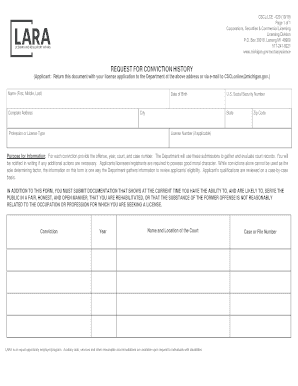

Required Documents

As part of the application, certain documents must be submitted, including:

- Proof of training costs and attendance.

- Documentation of eligible facility investments.

- Payroll records to confirm wage levels and compliance with state standards.

Examples of Using K-59 HPIP Credits

Real-World Scenarios

-

Manufacturing Firm: A Kansas-based manufacturing company invested in a new training program for its employees and renovated its production facility. They successfully applied for the HPIP credits, thus reducing their state income tax liability for the year.

-

Retail Chain: A retail business expanded its operations and engaged in significant staff training. By applying for K-59 HPIP credits, the company was able to offset the growing tax liability from their expanding operations.

Legal Use of the K-59 HPIP Credits

Compliance and Disclosure

Businesses must use the K-59 HPIP credits in compliance with state laws and ensure full disclosure of all claimed expenses and investments. Regular audits and progress reports may be required to verify ongoing eligibility and proper use of tax credits.

Penalties for Non-Compliance

Failure to comply with HPIP regulations can result in severe penalties, including:

- Repayment of claimed credits with interest.

- Additional fines for willful misrepresentation or fraud.

- Disqualification from future program benefits.

State-Specific Rules for K-59 HPIP Credits

Kansas has specific rules governing the use of HPIP credits to ensure the intended economic and workforce benefits are achieved.

Filing Deadlines and Important Dates

- Pre-Certification Deadline: Businesses must submit pre-certification applications by a designated date early in the tax year.

- Filing Deadline: The completed K-59 form should be filed by the annual state tax filing deadline.

- Amendments: Any amendments to a previously filed K-59 form must be made within the stipulated amendment window.

Software Compatibility

For businesses using software to complete their tax documentation, integration compatibility includes:

- TurboTax and QuickBooks: These platforms generally offer support for preparing and filing state-specific forms, including the K-59 form for HPIP credits.

- Professional Tax Services: For complex cases, engaging professional tax advisors familiar with Kansas taxation laws is advisable.

Business Types Benefiting Most from HPIP Credits

While the K-59 HPIP credits are applicable to all qualifying Kansas businesses, certain business types particularly benefit:

- Manufacturing Companies: High potential for capital investment and employee training for specialized skills.

- Technology Firms: Often investing in state-of-the-art facilities and robust employee development programs.

- Large Retailers: With constant facility upgrades and significant staff operational training needs.

In summary, the K-59 HPIP credits offer substantial tax relief opportunities for Kansas businesses committed to workforce improvement and facility enhancement. By understanding and utilizing the outlined steps, requirements, and legal considerations, businesses can significantly benefit from this state-directed incentive program.