Definition and Purpose of the High-Performance Incentive Program (HPIP)

The High-Performance Incentive Program (HPIP) is a tax initiative designed to encourage businesses, particularly in the manufacturing sector, to make investments in employee training and facility improvements. The program is specifically aimed at fostering economic growth by incentivizing companies to enhance their operational infrastructure and workforce capabilities.

HPIP offers two primary types of tax credits: the Training and Education Credit and the Investment Tax Credit. These credits are leveraged by qualifying businesses to offset taxes, thereby reducing the overall financial burden associated with scaling operations and improving service delivery. The mandate is to create an economic environment conducive to innovation and skill development, therefore increasing the state's competitiveness in the manufacturing industry.

How to Utilize the High-Performance Incentive Program

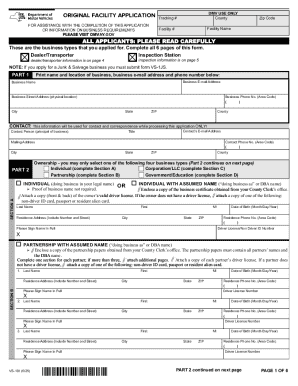

To effectively use the HPIP, businesses must undertake several preparatory steps to ensure compliance with program requirements. Initially, companies should familiarize themselves with the specific qualifications necessary for participation. This includes reviewing the type of investments that are eligible for credits, such as expenses related to employee training programs and facility upgrades.

It is essential for businesses to maintain comprehensive records of their investments and planned improvements. Detailed documentation will be necessary to justify claims for tax credits. Companies can then apply these credits against their tax liability, effectively reducing the taxes they owe. Participation in the HPIP not only provides financial relief but also demonstrates a commitment to fostering a skilled workforce and modernized facilities.

Steps to Complete the High-Performance Incentive Program Application

-

Verify Eligibility: Confirm that your business qualifies for HPIP based on state-specific eligibility criteria, which typically include industry type, investment amount, and employee qualifications.

-

Prepare Required Documentation: Collect all necessary documents, including records of investments and descriptions of training programs. This may include contracts, receipts, and reports detailing employee training curriculums.

-

Complete Application Form: Fill out the appropriate HPIP forms, ensuring that all sections are completed accurately. Double-check the entries for consistency and correctness.

-

Submit Application: Depending on state regulations, submit your application and supporting documents online, via mail, or in person. Ensure that submissions are made before or on the specified deadline to avoid penalties.

-

Await Approval: Once submitted, the application goes through a review process. Approval times may vary based on submission method and the volume of applications.

Important Terms Related to HPIP

Understanding key terms associated with HPIP can ease the application process:

- Training and Education Credit: A tax credit for businesses that invest in employee education programs, aimed at improving workforce skills.

- Investment Tax Credit: A tax credit available to businesses that undertake facility improvements, promoting innovative production methods and operational enhancements.

- Eligibility Criteria: Specific conditions that a business must meet to qualify for the HPIP, usually involving minimum investment thresholds and educational program requirements.

Application Process and Approval Time

The HPIP application process is straightforward but requires careful attention to detail. After verifying eligibility, businesses must prepare and submit a detailed application. The time taken for approval varies, often ranging from a few weeks to several months, depending on the completeness of the application and the state's review capacity.

State-specific guidelines may impact timelines, and businesses are encouraged to apply well before the deadline to account for potential delays. Once approved, businesses can apply the credits to their tax returns for immediate financial benefit.

Legal Use of the High-Performance Incentive Program

The legal framework governing HPIP is designed to ensure fair access and usage of tax credits. Businesses must adhere to guidelines regarding the appropriateness of claimed investments and the accuracy of submitted data. Misrepresentation or misuse of credits can result in penalties and disqualification from future participation.

It is crucial for businesses to stay updated with any legal changes and consult with legal advisors or tax professionals to ensure compliance with HPIP regulations.

State-Specific Rules for HPIP

Different states may have variations in HPIP implementation. For instance, states might impose unique eligibility criteria, different application forms, or varied credit scales. Businesses operating in multiple states should be aware of and comply with each state's specific requirements.

Understanding these differences helps in maximizing the benefits from HPIP and avoiding unintentional non-compliance. Engaging local experts familiar with state-specific rules is advisable for businesses seeking to leverage the program fully.

Examples of Using the High-Performance Incentive Program

Real-world applications of HPIP illustrate its efficacy:

- A manufacturing company invests in a new training program aimed at increasing worker efficiency. By qualifying for the HPIP Training and Education Credit, the company reduces its state tax liability, making it financially feasible to invest in further training initiatives.

- Another manufacturer undertakes a significant renovation project to modernize its production facilities. By participating in the HPIP, they secure substantial tax relief through the Investment Tax Credit, allowing for additional capital investment into cutting-edge technology.

These scenarios underscore HPIP as an effective tool for manufacturing businesses to enhance their operational framework while enjoying tax benefits.